The Government has imposed 8% tax on the gross revenue earned by service providers in Pakistan. This applies to small scale, and large scale businesses alike such as cellular and landline service providers, courier companies, logistic companies, security companies, internet service providers, labour hiring companies and other service provider companies. This can be detrimental to business owners; including startups, entrepreneurs and other business entities in Pakistan.

Usually, a company pay taxes on the profit (revenue exceeds the cost) earned by it in a given year. But what if the company has not made any profit and is going in loss. In this situation, the company will have to pay an 8% tax from capital reserves since they did not earn any extra money after deducting the company costs. This is unfair and seems that the government of Pakistan wants to confiscate private capital from small businesses in Pakistan. According to PASHA, *“Such Minimum or even Revenue based taxes are not practiced in any of the leading marketplaces in the world and neither in any of the emerging investment destinations.”*

See also: Pakistan’s first income tax assistant app will save you time and a lot of money

How is it going to affect IT service companies and young startups?

This can have a great effect on IT service companies and rising startups. There are already huge expenses that these companies have to pay at their inception or for sustaining themselves to even reach break-even stage. The imposed tax will be a tremendous burden which could potentially lead to the early liquidation of a startup.

IT services in turn will have to raise their costs or prices to offset the new tax which will reflect negatively on the service providers and consumers alike. Both will probably have to pay the tax without any recourse or alternatives. These IT services already go through so much to get settled and started up that new tax can be a barrier in the survival or success of the company.

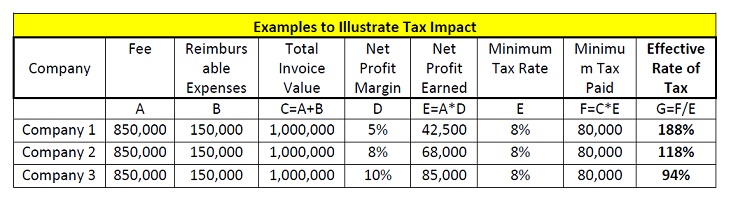

Here is an example of the Tax Impact on companies.

Reimbursable Expenses: The expenses which have to bore by the client

Invoice Value: Total/Final Amount which a service providing company will charge to its client.

Net Profit Margin: Sales divided by net profit

Net Profit Earned: Sales minus all the costs incurred by company

Minimum Tax Rate: A company has to pay 8% tax regardless of the amount of profit earned or loss made by the company

Effective Rate of Tax: How much percentage of profit is paid as tax. Tax Paid divided by Actual Profit Earned

Source: Pasha

Why the government shouldn’t impose this?

Instead of imposing the tax, the government should offer a subsidy to further boost the flourishing IT industry and help grow further, not shrink it. The IT sector has become one of the fastest growing industries of Pakistan and as such is the backbone of the economy. If this tax is imposed, then companies will have to increase their services price and, in turn, local consumers will be the one paying the price for this.

Various non-tangible products are at risk because of this tax imposition. Services that are essentials for Pakistani citizens will have to face an increased payment on these services. In a country, where there is already hidden costs present at the front and back end of products, this will only be a further nuisance to people who need these services.

TechJuice Giveaway: Bytes.pk VR Headset

TechJuice Giveaway: Bytes.pk VR Headset