The Employees’ Old-Age Benefits Institution (EOBI) is a social insurance program in Pakistan that provides financial support to employees upon retirement, disability, or their survivors in case of death. Understanding the process of claiming your EOBI pension is essential to ensure a smooth transition into retirement. This comprehensive guide will walk you through the steps to claim your pension, ensuring you receive the benefits you’ve earned.

Understanding EOBI and Its Benefits

EOBI offers four primary types of benefits:

- 1. Old-Age Pension – For insured persons who have reached retirement age.

- 2. Invalidity Pension – For those who become permanently incapacitated and unable to work.

- 3. Survivors’ Pension – For the dependents of a deceased insured person.

- 4. Old-Age Grant – A one-time lump sum payment for those who have reached retirement age but do not meet the minimum contribution requirements for a monthly pension.

These benefits provide financial security to employees and their families after their working years.

Eligibility Criteria for EOBI Pension

To qualify for an EOBI pension, you must meet the following criteria:

- Registration: You must be registered with EOBI through your employer. Employers with 10 or more employees are required to register with EOBI. Those with fewer than 10 employees can voluntarily register.

- Contribution Period: A minimum of 15 years of contributions is required. However, there are provisions for reduced eligibility with at least 7 years of contributions under certain conditions.

- Retirement Age: The retirement age is 60 years for men and 55 years for women.

Step-by-Step Guide to Claiming Your EOBI Pension

1. Verify Your Registration and Contribution Details

- Visit the official EOBI website: www.eobi.gov.pk

- Navigate to the “Individual Information” section.

- Enter your Computerized National Identity Card (CNIC) number to check your registration status and contribution history.

2. Gather Required Documents

For Old-Age Pension:

- EOBI Registration Card (if available).

- Certificate of Employment or proof of employment.

- Copy of your CNIC.

For Survivors’ Pension:

- All documents mentioned above.

- NADRA-issued death certificate of the deceased.

- Nikah-Nama (for spouse) or NADRA Family Registration Certificate (FRC) is used to establish a relationship with the deceased.

3. Submit Your Application

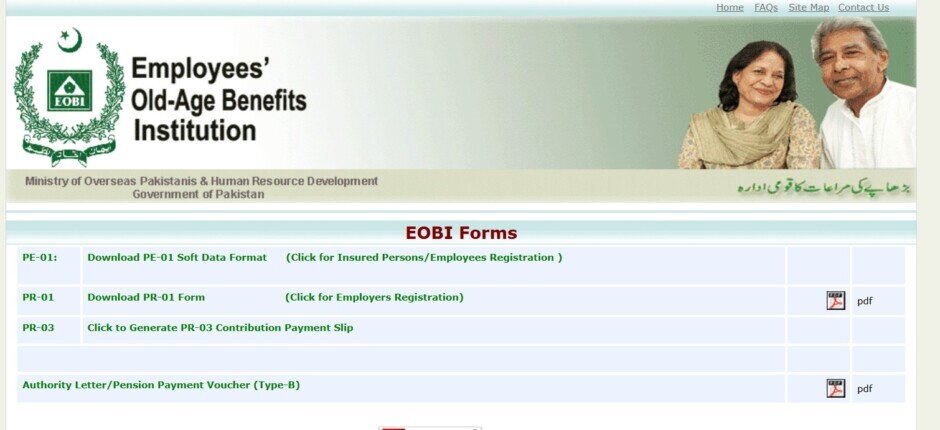

- Download the Pension Claim Form (PE-02) from the EOBI website or obtain it from the nearest EOBI regional office.

- Fill out the form accurately and attach all required documents.

- Submit the completed form and documents to your nearest EOBI regional office.

4. Application Processing

- After submission, EOBI will verify your documents and contributions.

- Upon successful verification, you will be issued a Pension Claim Form to complete and return.

- EOBI aims to process pension claims and issue a Pension Book or Pension Card within 30 days of receiving the completed claim form.

5. Receiving Your Pension

- Pension payments are disbursed through designated bank branches.

- You can withdraw your pension using the EOBI Pension Card at ATMs or bank counters.

Checking Your Pension Claim Status

To monitor the status of your pension claim:

- Visit the EOBI website and navigate to the “Pension Claim Status” section.

- Enter your Claim Form Number or CNIC to view the current status of your application.

Important Considerations

- Contribution Accuracy – Regularly ensure that your employer is accurately contributing to EOBI on your behalf.

- Document Safety – Keep copies of all submitted documents and correspondence with EOBI for future reference.

- Timely Application – Initiate your pension claim process shortly before reaching the retirement age to avoid delays in receiving benefits.

Conclusion

Claiming your pension with EOBI is a structured process designed to provide financial support during retirement. By understanding the eligibility criteria, preparing the necessary documentation, and following the outlined steps, you can ensure a seamless transition into this new phase of life. Regularly consulting the official EOBI website or contacting their helpline can provide additional assistance and up-to-date information.