In today’s fast-paced financial world, managing your money should be simple, secure, and tailored to your needs. Whether you’re shopping online, dining out, or handling business expenses, The Bank of Punjab (BOP) offers reliable debit card solutions that blend modern digital convenience with Shariah-compliant values. Through its digiBOP platform, users can instantly access versatile debit cards designed for everyday use, without the burden of credit, interest, or hidden charges.

About the Bank of Punjab

Established in 1989 and publicly traded since 1991, the Bank of Punjab has grown into a digital-first institution, blending regional strength with cutting-edge technology. Its digiBOP platform offers a seamless mobile app experience, making banking accessible and efficient for all Pakistanis.

Eligibility Requirements

To apply for a BOP debit card, you must meet these criteria:

- Age: 18 years or older

- Residency: Pakistani citizen with a valid CNIC

- Account Requirement: Active BOP bank account (savings or current, conventional or Islamic)

- Note: These cards are debit-based, meaning transactions deduct directly from your account balance, helping you avoid debt.

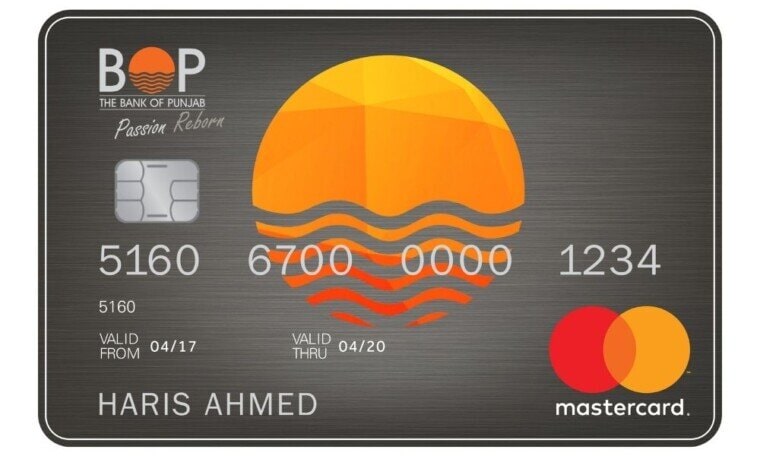

Types of BOP Debit Cards

BOP offers tiered debit cards to suit various needs:

- Classic: Standard features for everyday use

- Gold: Enhanced benefits and higher transaction limits

- Platinum: Premium features for high spenders and travelers

Each card type comes with customizable daily limits, allowing you to manage your spending effectively.

Application Methods

Applying for a BOP debit card is straightforward:

- Mobile App: Use the digiBOP app to request a new card under “Debit/Credit Card Management.”

- Internet Banking: Log into digiBOP online and navigate to the card request section.

- Branch Visit: Visit any BOP branch with your CNIC for in-person assistance.

Required Documents

Prepare these documents for your application:

- CNIC (original and photocopy)

- Verified mobile number linked to your account

- For business or freelancer accounts, additional documents like business registration may be required.

Approval, Delivery, and Activation

- Approval: Instant for digital cards via the app or internet banking.

- Delivery: Physical cards are delivered within 5–7 business days.

- Activation: Activate through the digiBOP app or at any BOP ATM.

Benefits of BOP Debit Cards

BOP’s debit cards offer a range of modern features:

- Contactless Transactions: NFC-enabled for quick payments.

- Global Acceptance: Use at millions of locations worldwide with Mastercard.

- Secure Payments: EMV chip, 3D Secure, and real-time block/unblock features.

- Custom Limits: Set daily spend caps via the app for Gold and Platinum tiers.

- Convenient App: Manage cards, pay bills, and transfer funds with digiBOP.

Frequently Asked Questions (FAQs)

Can I apply without visiting a branch?

Yes, use the digiBOP app or internet banking for instant issuance.

Are these cards accepted worldwide?

Yes, BOP’s Mastercard debit cards work globally at POS and ATMs.

Can I disable e-commerce capabilities?

Yes, toggle online payments via the app for added security.

What are the daily spend limits?

Limits vary by tier: Classic (basic), Gold (higher), Platinum (highest). Customize via the app.

Final Thoughts

The digiBOP debit cards from the Bank of Punjab (BOP) deliver a secure, convenient, and ethically sound solution for financial management in 2025. Equipped with advanced features such as contactless payments and global acceptance, these cards address the diverse requirements of users, including students, professionals, and small to medium enterprise (SME) owners. To access smarter, debt-free banking, individuals are encouraged to apply today through the digiBOP mobile application or by visiting their nearest BOP branch.