Enjoy Tax Benefits: A Guide to Becoming a Filer in Pakistan

In a country like Pakistan, who wouldn’t want to know ways to reduce tax burden and gaining financial credibility? However, people in Pakistan prefer not to indulge in becoming a filer due to a general lack of knowledge or a preconceived notion about the political state of the country that prevents tax paying. Adding to the mess is a complex revenue system, which seems largely ungoverned, hence making it even more frustrating to become a filer.

Pakistan recorded a mere 3.35 million active taxpayers in the last update to FBR’s Active Taxpayer’s List, but experts believe the number might have fallen from 5.35 million in the previous years. A large reason for the fall can be attributed to tax reforms that happened after 2021, which further alienated the small section of population giving taxes.

In such a sorry situation, how can someone plan to be a filer? Turns out, the negative biasness of statistics should not be the only metric painting the overall painting. We bring to you a complete guide on how to become a filer in Pakistan (if you haven’t been one before) or if you are new to the tax bracket. Read till the end to find out how you can reap tax benefits from declaring yourself a filer.

Understanding Basics of Tax Filing in Pakistan

You must have heard other terms related to “filer” such as “late filer” or “non-filer.” Before we move on to the process, it is important to understand the basic terms of tax filing to make things clearer.

As should be apparent by now, a filer is defined as a taxpayer who has registered with the Federal Board of Revenue (FBR) and submits tax returns regularly.

A late filer is someone who enjoys the same perks as an active filer but had to pay slightly higher property taxes up until recently. This development happened because of The Federal Board of Revenue (FBR) introducing a new category of taxpayers, the Active (Late Filer), under the Income Tax Ordinance 2001, as amended by the Finance Act 2024. In this new light, a late filer is someone who comes to the fold after the government put deadline.

A non-filer is someone who has not paid or is not a part of the active taxpayers list with FBR.

Why Should You Be a Filer in Pakistan?

With the recent reforms, there is a chance that non-filers will get even more penalties, so it is high time to think about jumping ship now. Here’s why you should think about becoming a filer:

Legal Compliance

This goes without saying but paying tax is a legal compliance to the country you live in. In broader spectrum, it helps with the country’s economy, of which Pakistan needs a dire upgrade.

Access to Benefits

Filers get lower taxes on things like banking transactions, property deals and vehicle registrations. For instance, on a property worth PKR 9 million, a non-filer pays PKR 180,000 in tax, whereas a filer only pays PKR 90,000. They also get better access to financial services such as obtaining loans, credit cards, and mortgages.

Eligibility of Government Contracts

Contractors who are filers automatically become eligible for government contracts and tenders while non-filer ones cannot avail themselves of such opportunities.

How to Enjoy Tax Benefits if You Are a Non-Filer

In a straightforward answer, you cannot. In Pakistan, if you want to avail tax benefits, you must become a registered taxpayer. The following are some of the best tax benefits you get if you are a filer:

- You can claim deductions for various transactions, e.g., charitable donations, education expenses, and even certain business costs.

- Banks prioritize your cases because they can easily access your creditworthiness.

- Because you have declared yourself as a taxpayer, you can get more lucrative investment opportunities.

Complications of Being a Non-Filer in Pakistan

Some of the complications non-filers have to face in Pakistan include:

- They may have to face legal consequences and pay heavy fines

- In some cases, government has also mulled over imprisonment

- In association with a business entity, your reputation will take a hit if you are a non-filer

- There are financial complications if applying for loans and mortgages

By now, your mind must be made up of the decision you have to make at this point. Read on to find how you can be a filer just as easily to avail the benefits.

Step-by-step Guide to Becoming a Filer in Pakistan

Step 1: Organize your Documents

Before you got the FBR to become a filer, these are the documents that you must have gathered:

- Your CNIC as a primary identifier

- Proof of address i.e., a utility bill or rental agreements

- Bank account details

- Salary slips or business income records

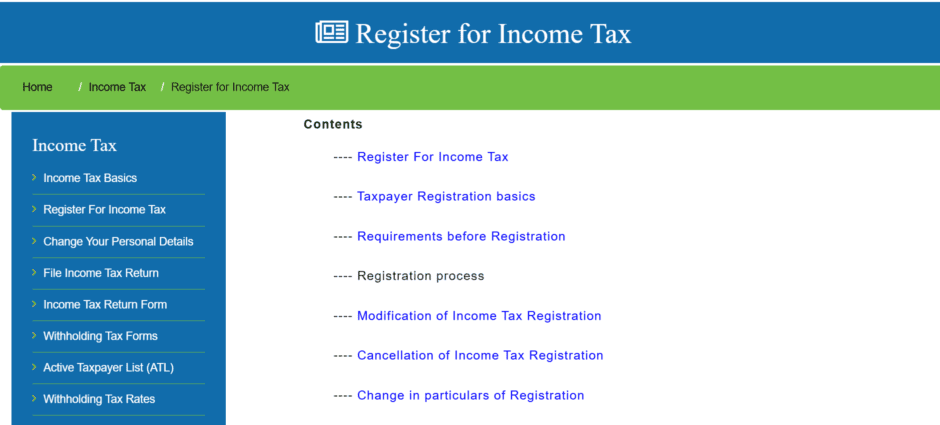

Step 2: Approach FBR

For this step, you can either visit the nearest FBR office or go to their website portal (https://iris.fbr.gov.pk). For the portal, you have to create an account with an NTN which you can get from FBR’s website. On the website, fill out the form and put in all the financial details. Where asked, upload necessary documents. You will get your NTN right away.

Only now can you log on to the FBR IRIS using your NTN and password. Fill in all the details in your profile. Add a verified email and phone number for added security.

NOTE: Do not share your personal details with anyone

Step 3: Maintain Filer Status

Once you are a confirmed filer, print out the confirmation record for safekeeping. It is a good practice to store receipts, bank statements and invoices for claiming later. Also, it is good to keep updated with the tax regulations to know any changes in FBR guidelines or new tax incentives.

You can also use FBR’s e-Services Portal to keep track of tax filing, deadlines and calculate deductions. There are online tools available too that can help you with calculations.

Step 4: Fill Your Tax Return

Now comes the most crucial step: filing your tax returns. On FBR’s website, you can access Tax Return Form, fill it in and add your income, deductions and tax payments. Review it thoroughly and hit the Submit button. Acknowledge the “Save Your Receipt” as these are important and must be saved. Based on what the tax calculators came up with, pay the payable tax using the FBR system. You will get a payment slip which will also be saved as proof of your filer status.

Step 5: Confirm Your Taxpayer Status

You can confirm if you are registered as a filer by comparing your name against Active Taxpayer List (ATL). You can also send an SMS to ‘9966’ with your CNIC to check your status. There is also Tax Asaan, an app by FBR to facilitate iOS taxpayers that can be accessed with the same username and password as the FBR portal.

Your journey to tax benefits starts with one simple commitment, but you can take the pressure off by acting on it today. Follow these steps and you will be a legally complying citizen of Pakistan, in addition to getting tax exemptions or reductions from various lifestyle transactions.

Sharing clear, practical insights on tech, lifestyle, and business. Always curious and eager to connect with readers.