Streamline Your Tax Process: How to Verify Your NTN Online Today

In Pakistan, if you want to be on top of your financial game, you need to verify your National Tax Number (NTN) online. NTN streamlines the tax process and opens doors to you as a taxpayer in the country, not limited to bank loans alone.

Imagine this: with only a few short minutes of validating your NTN, you can create a reliable financial profile, simplify loan acceptance, and get tax savings. This comprehensive guide will walk you through how to authenticate your NTN online, address common problems, and pick up professional tax management techniques.

What is an NTN and Why is It Essential?

You might already be familiar that the Federal Board of Revenue (FBR) controls the taxation process in Pakistan, with SRB (Sindh Revenue Authority), PRA (Punjab Revenue Authority), BRA (Balochistan Revenue Authority), and KPRA (Khyber Pakhtunkhwa Revenue Authority) handling the provincial affairs.

These revenue boards take control of tax flow by giving people and businesses in Pakistan a unique identification known as the National Tax Number (NTN). You should see it as a tax passport because it verifies your identification to banks and the government.

The NTN has seven digits and occasionally a dash and extra digit (the check number) at the end. e.g., 4174941-3. This number is unique to everyone, which makes it an identifier. Not only that, but this number can help you with your tax filing process, business registration, import/export, and even government procurement processes, should you go for that business. In short, NTN is required by individuals and businesses to be legally transparent in Pakistani economic hub.

Online NTN Verification

In the digital age, traditional paperwork is a thing of the past, but many people belivel that is not the case in Pakistan. It is true to some extent, but not when it comes to NTN verification.

Luckily, online NTN verification is very much a thing that provides a fast, efficient, and secure way to confirm your tax identity. without the hassle of physical visits to government offices. Now you can rest easy as you do not have to visit government offices and stand in long queues just to get the NTN.

Benefits of Verifying Your NTN Online

- Speed: Complete the verification process online in minutes and rest easy for the future.

- Convenience: Your computer or smartphone will let you confirm your NTN from anywhere with just a tap and SMS.

- Accuracy: Simplified digital procedures help to lower human error possibilities.

- Security: Strong security systems used on modern internet platforms secure your important data, so you do not have to worry about data leaks.

Using online tools guarantees that your data is current and saves time; so, dealings with financial institutions become more flexible.

A Guide to Verifying Your NTN Online

Step 1: Visit the FBR Website (https://e.fbr.gov.pk/)

Go to the Federal Board of Revenue (FBR) official website on a browser, preferably using a computer.

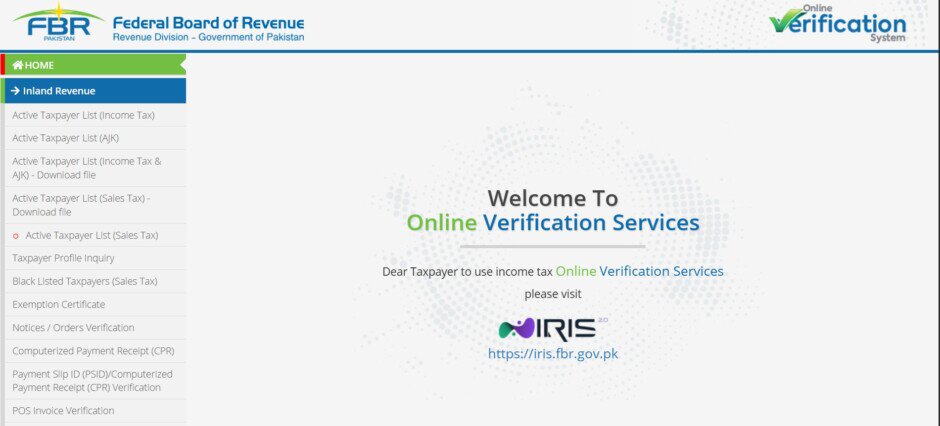

Step 2: Go to the ‘Taxpayer Profile Inquiry’ Page

Once here, choose “Taxpayer Profile Inquiry” from the menu on the left.

Step 3: Select Your Search Option

Next, you will be given three choices for inquiry:

- By NTN number

- By CNIC number

- By Registration number for businesses

Step 4: Enter Your Details

Enter the following credentials based on your case:

- If verifying via CNIC, enter your 13-digit CNIC number (without dashes).

- If you are using NTN for verification, enter your seven-digit NTN number.

- If you are a foreign national. enter your “Passport No.” in the field.

By choosing the “Comp/Reg No” option from the “Parameter type” column, you can verify the NTN of a firm or incorporation.

Step 5: Fill out the Captcha

Input the code in the Captcha box.

Step 6: Double-check Your Information and Verify

After carefully reviewing every detail you entered, click the Verify button.

How to Optimize Your Tax Process Beyond NTN Verification

Verifying your NTN online is just one piece of the puzzle. To truly streamline your tax process, consider these additional steps:

A. Regularly Update Your Tax Information

Keeping your personal and business tax information current is vital. Set a reminder to periodically verify and update your details on the FBR portal.

B. Leverage Digital Tax Tools

Utilize digital platforms and tools to monitor and manage your tax obligations. Apps like TaxSavy and FBR Mobile App can help you stay on top of deadlines and updates.

C. Keep a Digital Record of All Tax Documents

Save your tax returns, NTN verification data, and other pertinent records in an orderly digital order or file. This simplifies tax reporting and increases information access.

D. Stay Informed About Tax Regulations

Tax laws in Pakistan can evolve rapidly. Follow reliable news sources and subscribe to FBR newsletters to stay updated on any changes that might affect your NTN or tax process.

E. Consult with Tax Professionals

If your financial situation is complex, consider consulting with a tax advisor or professional. They can offer personalized advice and help you navigate any challenges in your tax process.

Final Thoughts: Empower Your Financial Journey

One of the most important things you can do as an entrepreneur or working professional is simplify your tax process. Verifying your NTN online is about assuming control of your financial future, not only about completing a process.

A verified NTN is not just a number; it reflects your dedication to openness, effectiveness, and expansion rather than only a number. By fulfilling your national duty, you can stand tall against the competition or the general disregard about tax returns in the Pakistani society. You can now embrace a future free of hassle and empower your financial operations to fully realize their potential by means of legal procedures.

Frequently Asked Questions (FAQs)

How long does it typically take to verify an NTN online?

What information do I need to verify my NTN?

Can I verify my NTN online without visiting an FBR office?

What if my NTN verification fails?

Do I need to update my NTN regularly?

Are there any third-party tools that can help me verify my NTN?

Sharing clear, practical insights on tech, lifestyle, and business. Always curious and eager to connect with readers.