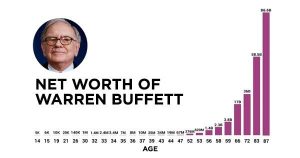

Indeed, you might have heard about Warren Buffett as he is highly regarded as a successful investor and wealthy businessman. Moreover, his net worth is $113 Billion, and he is among the topmost wealthiest people across the globe.

Warren established his company, Berkshire Hathaway, from scratch. Currently, he is the owner and manager of some of the largest corporations in the world, like Helzberg Diamonds, FlightSafety, International, and NetJets. So why are you refraining from learning a few lessons about doing business and making wealth?

When you have high dreams and aim to achieve all of your dreams then, it’s usually wise to follow in the footsteps of those who have successfully built their goals before you.

Buffet’s Investment Strategy

Buffett is a person who has earned a lot in his life, as he follows the strategies of Benjamin Graham’s school of value investing. However, value financiers seek securities with excessively low prices based on their intrinsic values. There is no generally accepted way to determine their intrinsic value, but utmost it is projected by considering a company’s fundamentals. Buffett owns a different approach to business and he took this value investing approach to the next level. Buffett has his own mindset and he doesn’t even think about the activities of the stock market. He believes in long-term investments and profits no matter what market worth a company has. He only believes in how well a company can make money as a business.

By keeping in mind the pieces of advice given by Warren, investors can avoid some of the common mistakes that can affect profits and threaten financial goals.

Lessons from Warren Buffett’s Life

When the billionaire continuously advises his writings or talks and how he leads his life. Then why not take advantage of this opportunity to learn and grow to become successful? This write-up will discuss 11 important pieces of advice you need to take from Warren Buffett.

1. Choosing The Work You Love

Success is guaranteed if you are choosing the work you love. Warren Buffett himself followed this advice and is also urging us to follow. If you love your work, it doesn’t seem like work to you because you are passionate about it; you relish it.

Moreover, you do not ever feel low or depressed. Then, you do not need money to make you happy, because working brings you happiness. You wake up in the morning with an aim and eagerness to rush off to work to have a good time. Being busy and having an aim in your mind helps you to achieve what you desire in your life. Having a clear mindset of your goals may lead you to success.

2. Keep Your Eyes And Ears Open And Invest

Warren Buffett kept his eyes and ears open and invested in high-quality investments for some time. He dislikes profit booking and market timing, but he stays attentive so he can grab the upcoming opportunities.

Looking at Warren Buffett’s investments over time, you may notice that his most preferred stock, American Express and Coca-Cola, have been since the start if you have a long-term strategy that will give you an advantage in all equity markets across the globe. As it never can be about the short term with equities.

3. Investing In What You Know About

In 1990, when the entire investment world was thinking of investing in the IT and Telecom industry, the Oracle of Omaha chose not to do what everyone was doing. The reason was that he considered technology very complex and challenging to understand.

Likewise, during the subprime mortgage crisis, Oracle of Omaha restrained from investing in banks and financials. Because Buffett followed this advice, his portfolio was not affected by the worst meltdowns in US history. So the lesson is to stick to your investment, no matter how hard or dull.

4. If You Did What Everyone Else Is Doing, You Will would Never Make Money.

The advice is to be unique and not change your mind just because the market is moving in the opposite direction. When you make up your mind, stick to it and remember when you are alone, you can make good money in the stock market.

Believing in yourself will allow you to remain firm. Do not invest in stocks or any other thing just because your friends or someone from your relatives is doing it and has told you to do it. After succeeding in the start, investors think that they have learned everything about products and investments. But it would be best if you keep updating your knowledge with time.

Learn from your experiences and make decisions based on your knowledge if you are unsure about something. Every person has different experiences in his life, never look at what others have done. You need to remain targeted and focused on your goals by keeping a fixed mindset that will help you to earn money. No matter how much time it will take but if you have a clear vision then for sure you will win the race.

5. Make Books Your Best Friends

Buffett reads books regularly and advises everyone, even his fund managers and investors, to read daily. By reading, you can get new ideas and understand recent trends. Otherwise, you will not be able to progress as an investor, as an investor needs to be innovative.

Books are those best friends who give you the best advice and guide you properly, so you need to consider them your best friends. Warren Buffett learned about the stock market by visiting his father’s workplace and reviewing some finance books from his collection. Onwards, he developed his investment library and market knowledge. Warren suggests reading books and keeping yourself updated by having a grasp on financial markets. According to Warren Buffett “Invest in yourself as much as you can, you are your own biggest asset by far”. So, it is for your own benefit to read and have in-depth knowledge about what you are going to establish.

6. Spend Some Time In Market Instead Of Just Timing The Market

No one knows exactly about the market trends, and no person can ever do it in the future! The goal should be only to invest money when you are sure about its worth. It is enough to become wealthy over a while if you can purchase good equities at fair valuations and attractive pricing.

However, if we observe the practical world, we will notice that the perfect market timing is insignificant because of its risks. The only way to earn money is to be consistent and passionate about your work.

7. Evaluate The Expected Risk

Before making decisions, think about what better or worse can happen. Buffett gave this advice to his son Howie when he was accused of price-fixing in 1995 by the FBI. Hence, he made Howie realize that the risks of staying in his problematic company would not lead to any gains, so he resigned the next day. By evaluating the expected risks, you can understand where you are struggling and make better decisions.

8. Invest In Stocks In The Start

The earlier you invest in stocks, you extend the time limit of reaping your benefits. Your return will be much greater than your investment as the time is longer. This technique is called compounding power, and it is advantageous in the case of stocks. Warren Buffett also used this investment strategy while investing in equities.

9. You Need To Be Fearful Regarding Losing Money

To be a prominent investor, you need to fear losing your money. Buffett himself has suffered losses like his performance with IBM was poor. Though, if you lose money, think about when you went wrong and refrain from making those mistakes in the future. But if you are losing money and you are also not learning a lesson, that is not okay!

10. Reinvest With The Profit You Gain

Warren Buffett and his friend bought a pinball machine in high school. Both put that machine to work in a barbershop. They earned money with it, bought more machines totaling the number of eight, and put them in different shops. Later, his friends sold the devices, and Buffett bought stocks with his share of money and started a business.

When Buffett was 26, he had $174,000, which nowadays equals 1.4 million. Search for vast investment opportunities and reinvest even if the chance is slight. As anything can happen, even a tiny investment opportunity can make you a wealthy person if it works in your favor.

11. Know The Exact Time To Step In And Step Out

Warren Buffett kept his stocks for years to get good profits from them. On the other hand, if we look at the investments made by Warren Buffett, we will notice that sometimes he sold off his stocks to save himself from falling. The lesson is that you need to know the exact time to step in and step out and refrain from investing to avoid a more significant fall.

It only happens when you have in-depth knowledge of the market about when to enter and when to exit in order to avoid a larger fall. Being consistent and patient can also help you to achieve your desired results.

Warren Buffett is a person with an iconic personality, and the world knows him for his knowledge of investments and the stock market. The decisions he has taken regarding investments are fantastic, so walking in his footsteps will benefit you. So why not follow in his footsteps and note down the essential pieces of advice he gives? If you are here till the end, you want to grow and make a mark, so be practical and follow Warren Buffett’s advice.

Read more:

How This 30-Year-Old Pakistani Landed a Job at Amazon

Amazon- Jeff Bezos Made This Company A Success

Amazon Has Suspended Over 13,000 Pakistani Seller Accounts Due To Fraud

Popular Chrome Extensions with 1.4 Million Users Discovered Stealing User Data

Popular Chrome Extensions with 1.4 Million Users Discovered Stealing User Data