In Pakistan, where inflation and low financial literacy remain constant challenges, finding lucrative investment opportunities can be difficult. One asset, however, stands out: Bitcoin.

This article examines how investing in Bitcoin has delivered exceptional returns and how it could shape the future of savings and investments in Pakistan.

The Rise of Bitcoin

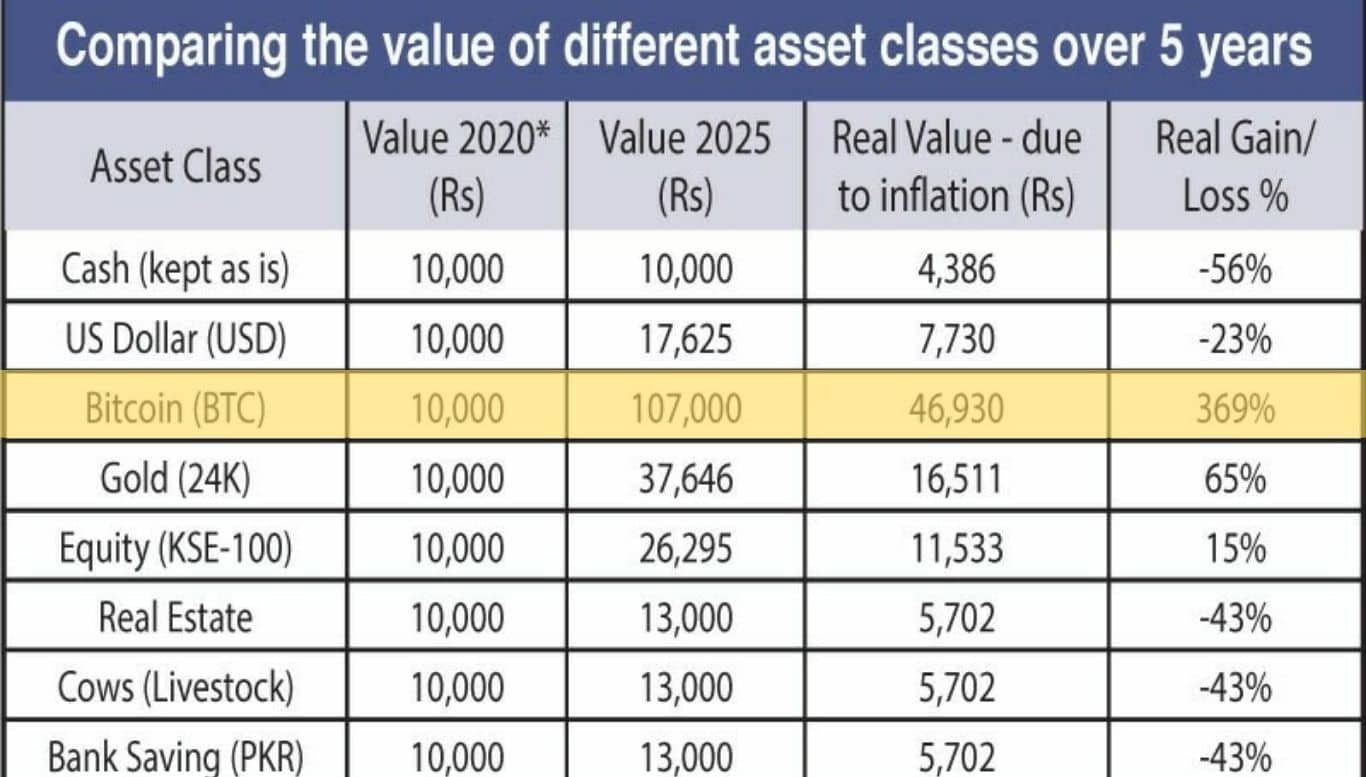

Bitcoin, the world’s first decentralized digital currency, has gained massive traction globally and in Pakistan. Despite being largely unregulated and speculative, it has provided impressive returns. For example, a 10,000 PKR investment in Bitcoin five years ago would have returned a staggering 369%. A profit that far outpaces traditional savings options like bank deposits and gold.

Bitcoin’s allure for Pakistani investors is its potential as a hedge against inflation. With the Pakistani rupee constantly losing value due to inflation, Bitcoin has proven itself as a store of value that can appreciate over time. This characteristic makes it especially attractive to people seeking to protect and grow their savings.

How Bitcoin Works for Pakistanis

In a country with a high reliance on cash savings and a weak financial system, Bitcoin provides a straightforward way to safeguard wealth. It offers a high rate of return without the constraints of the formal banking sector. The cryptocurrency market is growing rapidly in Pakistan, with estimates suggesting that as much as $10 billion to $30 billion worth of cryptocurrencies are held by Pakistanis, despite the lack of regulation.

The future for Bitcoin and other cryptocurrencies in Pakistan looks bright. Creating a secure, transparent, and regulated environment for these digital assets could attract billions of rupees from cash savings and elevate the national savings rate. This could not only help stabilize the economy but also open new avenues for growth.

Cryptocurrency, particularly Bitcoin and Ethereum, has seen a surge in popularity across Pakistan. Although exact numbers are hard to confirm through exchanges, analysts estimate that Pakistanis hold between $10 billion and $30 billion in crypto assets, with over 10 million individuals owning at least one crypto wallet on various platforms.

For comparison, it is assumed that in 2020, an equal investment of Rs 10,000 was made across various asset classes. Due to the absence of standardized market indices, the price of a three-bedroom apartment at Emaar in DHA has been used as a reference point for real estate, while the price of a cow has been used to represent livestock investment. All other asset values are based on officially published data available at the time of writing. These figures are derived from the author’s independent calculations.

Conclusion

Bitcoin has proven itself as a lucrative investment for Pakistanis, offering returns far superior to traditional savings methods. With its potential to help elevate savings rates and offer a store of value, Bitcoin could reshape Pakistan’s financial landscape. As regulations improve, cryptocurrencies like Bitcoin may become integral to Pakistan’s economic recovery and growth.

3 min read

3 min read