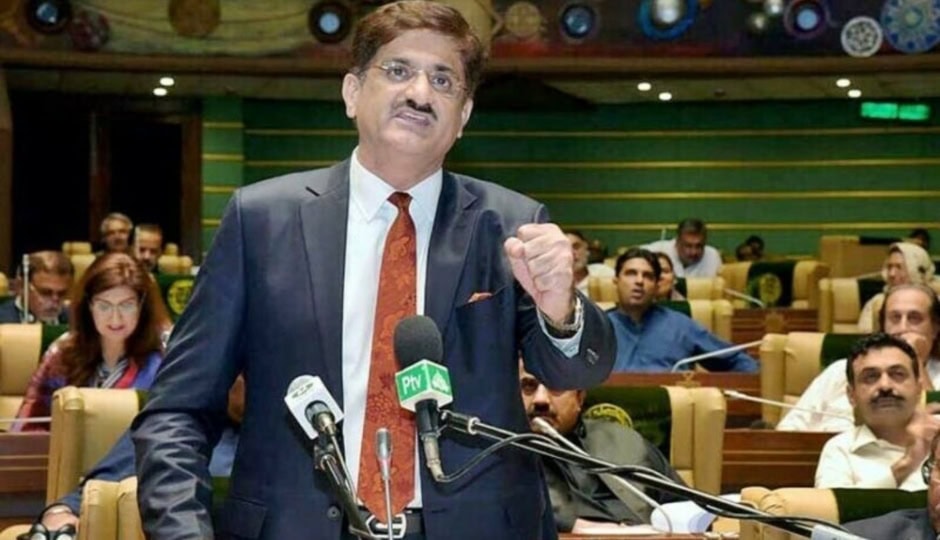

KARACHI: The Sindh government has announced a pro-growth provincial budget for FY 2025–26, totaling Rs3.45 trillion, with a focus on tax relief, development spending, and public welfare.

Chief Minister Syed Murad Ali Shah emphasized that “no new taxes” have been introduced, and several existing levies have either been eliminated or reduced to ease economic pressures.

Key Tax Relief Measures

At a post-budget press conference held at CM House, Shah revealed a series of tax relaxations:

- Export processing zones and special economic zones are now exempt from the services tax.

- The entertainment tax has been abolished, and restaurant taxes have been lowered.

- Stamp duty on third-party vehicle insurance is now Rs50, and the insurance tax has been slashed from 15% to 5%.

The Sindh Finance Bill 2025–26 outlines additional reliefs aligned with IMF recommendations, including the publishing of a comprehensive list of tax-exempted items.

Expanded Exemptions

Sales tax exemptions now apply to services rendered by:

- Parliamentarians, judges, tribunal members, and local government representatives.

- Construction of homes up to 10,000 square feet in private schemes.

- Health and life insurance policies up to Rs500,000.

- Government-approved universities and colleges are conducting research.

- Hajj and Umrah travel operators.

New and Adjusted Taxes

Despite the broad exemptions, selective taxation has been implemented in areas such as digital services and security:

- 19.5% tax on vehicle trackers, security systems, and internet/telecom services.

- 3% tax on vehicle transactions.

- 8% tax on online payments to restaurants, hotels, farmhouses, and beverage outlets.

- Cab services are taxed at 5%, rental vehicles and freight at 8%.

- Armed guard services, real estate, and foreign exchange now taxed at 8% and 3% respectively.

- Coaching centers, training institutes, and private schools/colleges charging over Rs500,000 annually will be taxed at 3%.

Public Sector Priorities: Salaries, Jobs, and Development

Out of the Rs3.45 trillion budget:

- Rs1 trillion is reserved for development.

- Rs2.15 trillion will cover current expenditures, including Rs1.1 trillion for salaries and pensions.

- Salaries will increase by 12% for lower-grade employees and 10% for higher grades.

The government also plans to fill 20,000–25,000 job vacancies in Grades 1 to 4, while recruitment for BPS-5 to 7 will follow an IBA-administered testing system.

Sectoral Boosts in Health, Education, and Agriculture

- Education funding sees an 18% increase, and health sector spending is raised by 11%.

- Additional allocations have been made for agriculture, irrigation, and local government projects.

- Rs590 billion has been set aside for development schemes, including infrastructure, sanitation, and transport.

Disputes with the Federal Government

CM Shah voiced serious concerns over the Rs105 billion withheld by the federal government, which Sindh was notified about just a day before the budget announcement. Of the Rs1,478.5 billion received from the divisible pool last year, Rs422.3 billion remains unpaid.

He criticized the exclusion of key projects from the Federal Public Sector Development Programme, notably the Sukkur-Hyderabad Motorway, where funding was cut in half from Rs30 billion to Rs15 billion.

Stance on Solar Tax and Climate Policy

Shah strongly opposed the federal government’s 18% tax on solar panels, warning that the Pakistan Peoples Party “would not support the federal budget” unless the issue is resolved.

The Sindh government, meanwhile, has allocated Rs25 billion for solar energy initiatives and is pushing forward with afforestation efforts to combat climate change. However, Shah admitted that “more work is needed.”

While the digitization of land records remains incomplete, pilot projects are underway in Matli and Sukkur. Shah also acknowledged delays in the operation of 150 buses in Karachi, citing resource limitations, but confirmed that infrastructure upgrades and sanitation projects continue across the province.

3 min read

3 min read