A recent change in tax policy effective post 1st July 2025 has raised alarm within Pakistan’s freelance and IT sectors. The introduction of a 5% “digital presence tax” on international digital transactions has caused confusion and worry among professionals who rely heavily on digital payment platforms like Sadapay.

Previously, many freelancers and digital business owners paid an 8% tax through platforms such as Sadapay, which simplified managing their payments. However, the new policy adds a 5% tax levy specifically targeting “digital presence”. This levy affects digital businesses, sellers, and buyers involved in international transactions, significantly increasing their tax burden.

Freelancers Concerned Over Increased Costs

The freelance community, which forms a large part of Pakistan’s growing digital economy, fears the rising taxes will cut into their earnings. Many professionals rely on overseas clients who pay through digital wallets and international payment systems. The sudden hike could make these transactions more expensive and complex.

One user shared their confusion on social media, highlighting the difficulty in understanding the new tax’s origins and implications:

“Maybe it’s due to Trump’s tariff hike, I have not found much reasons on the internet yet but do confirm me if you have paid it through your USD wallets or not yet?”

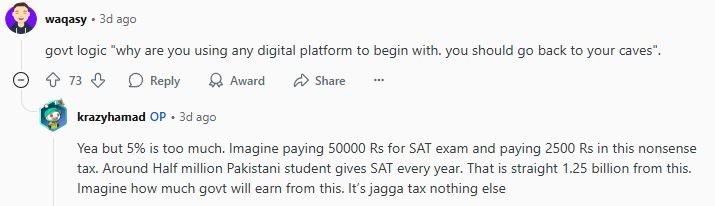

One user posted on Reddit,

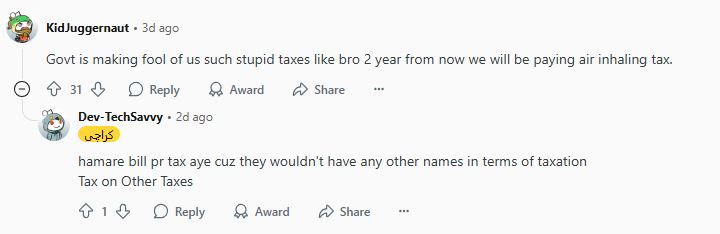

Another user posted,

This uncertainty adds to the frustration, as freelancers seek clarity on whether this tax applies only to certain payment methods or across all banks and cards.

There is speculation whether this “digital presence tax” is a standalone levy or part of a broader mix of taxes affecting cross-border digital payments. Some suggest this might reflect global trade tensions or local policy shifts targeting the booming digital economy.

The concern grows because, if this applies across the board, the effective tax rate could reach up to 7% on sales, rather than the previously expected 2% income tax, further squeezing freelancer incomes.

Why IT and Freelancers Are Worried

- Increased payment fees reduce net income for freelancers working with international clients.

- Uncertainty in financial planning arises because people are unclear about which transactions the tax affects.

- Additional tax layers might discourage digital entrepreneurship and slow down Pakistan’s emerging digital economy.

2 min read

2 min read