Bitcoin and the broader cryptocurrency market are experiencing their highest levels of fear since March, even as BTC trades above $100,000. Investor sentiment has sharply turned negative, signaling potential shifts in market momentum. Meanwhile, gold and silver have surged, benefiting from post-shutdown market dynamics in the United States.

Crypto traders are now deeply entrenched in “extreme fear,” according to the Crypto Fear & Greed Index data released Wednesday. Bitcoin and altcoins have dropped to the lowest sentiment levels seen in over six months, reflecting growing caution among investors. Analytics platforms like BitQuant and Santiment highlight a notable absence of small investors, a trend that has defined much of the current bull run.

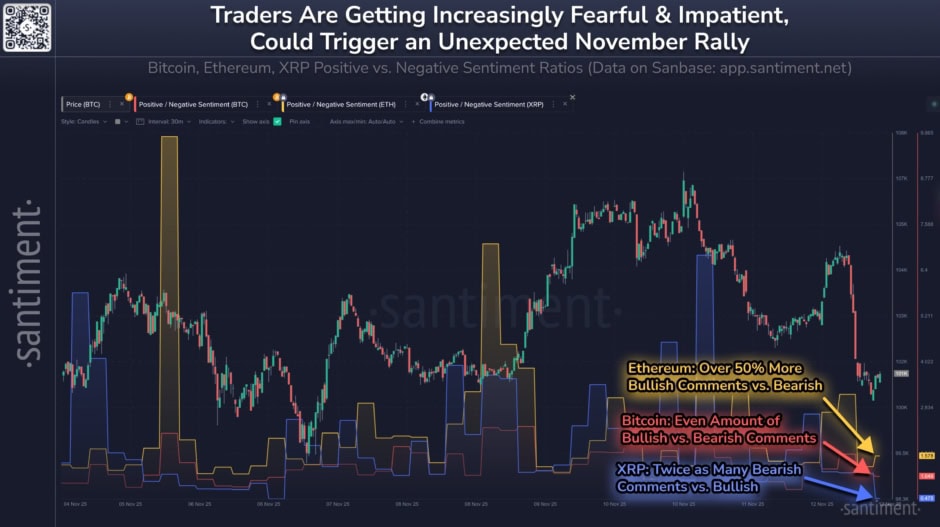

Santiment suggested that such negative sentiment may precede a market turnaround. “When the crowd turns negative on assets, especially the top market caps in crypto, it signals the point of capitulation,” the platform noted. Retail sell-offs often allow major stakeholders to buy discounted coins and eventually drive prices higher. The platform also reported that social media activity around Bitcoin shows an unusually balanced bullish/bearish ratio, underscoring limited enthusiasm.

Gold Gains Momentum as US Government Reopens

While crypto sentiment remains subdued, traditional markets have responded differently. The US government’s reopening after its longest-ever shutdown had little immediate effect, as the event was already priced into markets. Instead, gold and silver emerged as the strongest performers. Gold surpassed $4,200 per ounce, approaching previous all-time highs. Analysts point to President Donald Trump’s proposed $2,000 stimulus checks as a key factor behind renewed investor interest.

At the time of reporting, BTC/XAU is hovering near its lowest point in more than a year, indicating a divergence between crypto and traditional safe-haven assets. Market observers suggest that the current extreme fear may create conditions for a potential rebound once retail investors exit.

2 min read

2 min read