Digital fraud in Pakistan keeps evolving. Scammers do not sleep, and neither should your security protocols. As we wrap up 2025, reports of financial theft are surging. If you use banking apps, mobile wallets, or social media, you are a target.

Here is the definitive list of the top 5 scams operating in Pakistan today and exactly how to stop them.

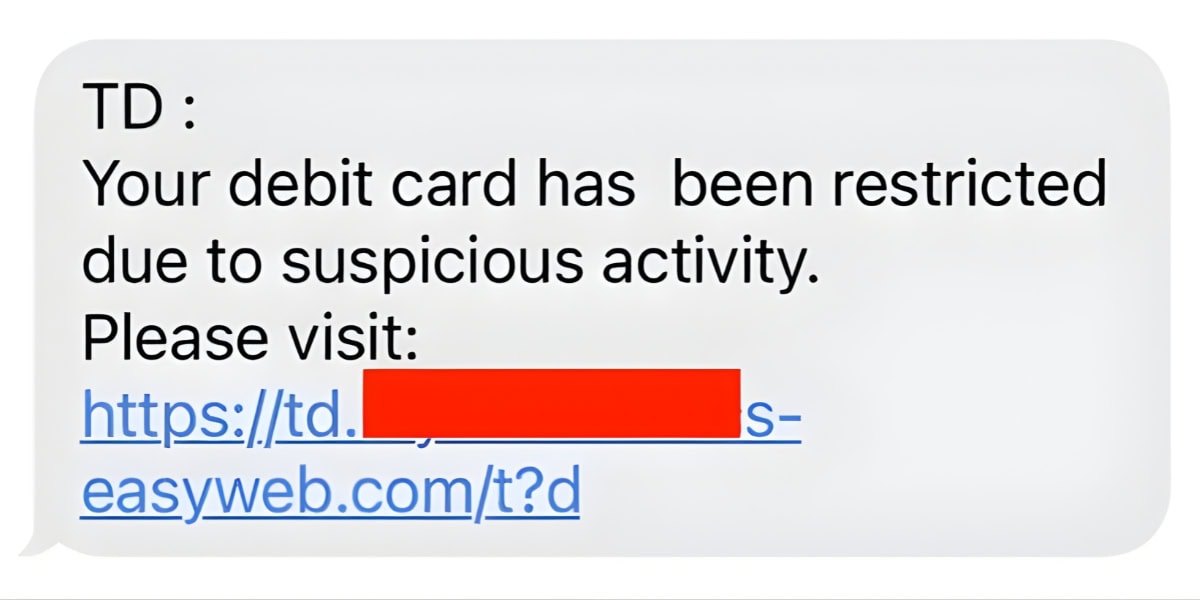

1. Fake Bank Messages from Scammers (Phishing)

Have you ever received a frantic SMS saying, “Your bank account will be blocked”? Trust me, we all have. It includes a link. You click it, and you lose everything. That link is a trap to steal your login credentials.

Your Defence:

- Banks NEVER ask for passwords or OTPs via SMS or call.

- Never click links in text messages.

- Always open your bank application directly.

2. ATM & Card Skimming

Thieves install hidden devices on ATMs to copy your card data. Alternatively, they call you pretending to be bank staff, demanding verification. If you share your details, they clone your card.

Your Defence:

- Cover the keypad with your hand when entering your PIN.

- Never share your full card number or CVV (the 3-digit code on the back).

- Remember: Banks do not call you to ask for card details.

3. Scammers Behind Online Stores

You see a product online. You pay in advance. The seller blocks you, or you receive a cheap, incorrect item. Fake stores with no physical address are unregulated and dangerous.

Your Defence:

- Check reviews religiously.

- Always prefer Cash on Delivery (COD).

- Avoid pages that lack a proper address or phone number.

4. Fake Job Offers by Scammers

You are offered a high-paying job, often abroad. The catch? You must pay a “registration” or “visa fee” first. After you pay, the “recruiter” vanishes.

Your Defence:

- Real jobs do NOT ask for money to hire you.

- Never provide copies of your CNIC blindly.

5. SIM Swap Fraud by Scammers

Your mobile signal suddenly dies. While you are confused, scammers have activated a new SIM card on your CNIC. They now receive your OTPs and access your bank accounts.

Warning Signs:

- Network signal disappears without reason.

- You receive OTPs for services you did not request.

Your Defence:

- Get your SIM blocked immediately.

Other Frequent Scams

- Mobile Wallet Theft: A caller claims to be an agent from JazzCash or EasyPaisa. They manufacture a crisis and demand your OTP or PIN to “fix” it. Once they have your OTP, they transfer your balance immediately.

- Crypto & Ponzi Schemes: “Double your money in 10 days”. “Guaranteed profit”. There is no such thing as a guaranteed return on investment. These are illegal Ponzi schemes that will collapse, taking your capital with them. If it sounds too good to be true, it is a scam.

The Golden Rule: NEVER share your OTP, PIN, or verification code with anyone. Real agents will never ask for this.

Important Helplines: Save These Numbers

If you are targeted, delay causes loss. Report immediately using these official channels.

| Authority | Purpose | Helpline Number |

| FIA Cyber Crime | Reporting all digital fraud | 1991 |

| State Bank (SBP) | Bank-related complaints | 021-111-727-273 |

| PTA Helpline | SIM/Network issues | 0800-55055 |

| SECP Helpline | Investment/Loan scams | 0800-88008 |

General Safety Protocol:

- Verify Everything: Confirm identities before making any payment.

- Don’t Panic: Scammers use urgency to make you act without thinking. Ignore the pressure.

- Keep Evidence: Save screenshots, call logs, and transaction receipts.

3 min read

3 min read