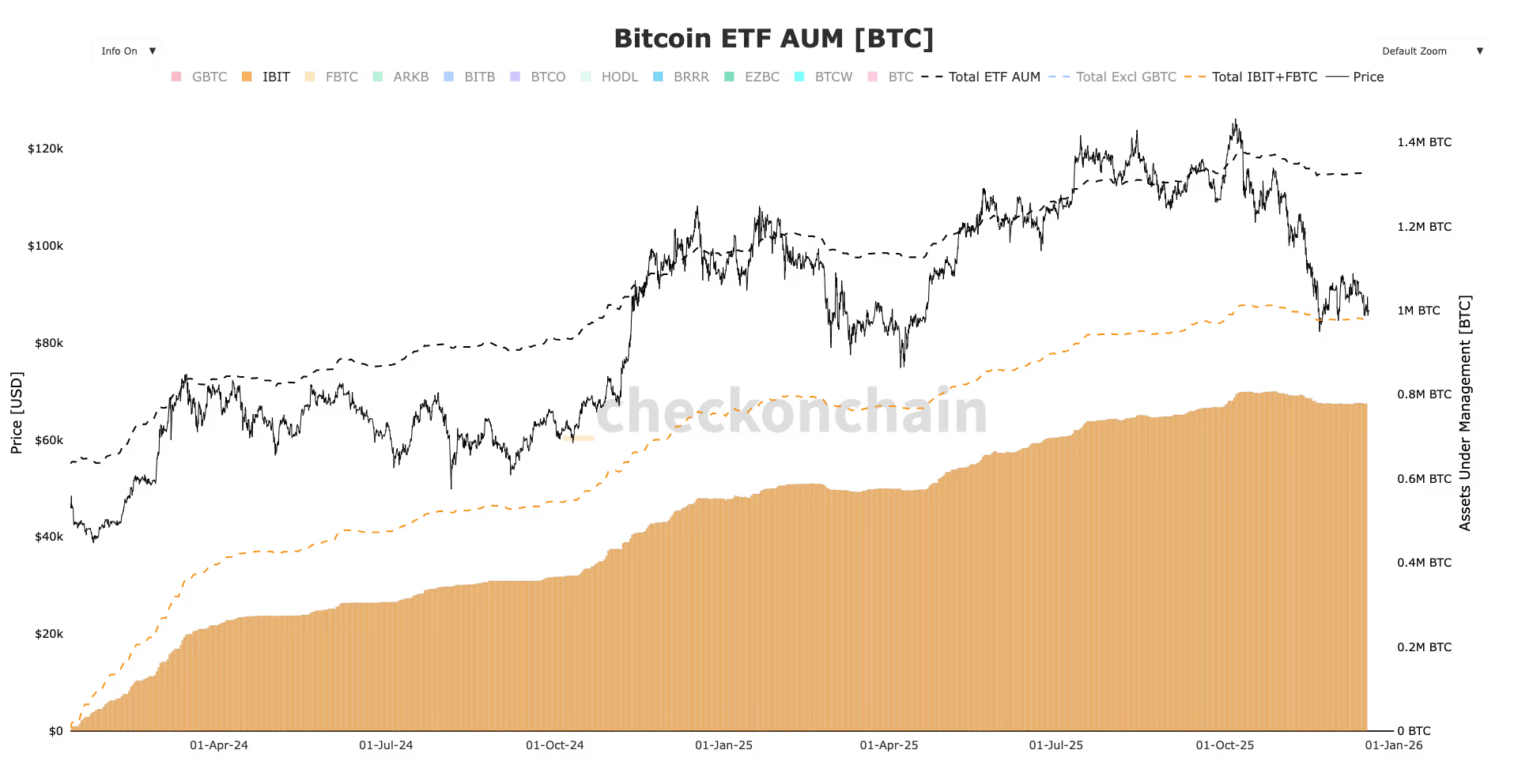

Bitcoin (BTC) remains under pressure after a sharp 36% correction from its October all-time high, trading around the $88,000 level, with the BTC to PKR rate hovering near PKR 24.6 million. Despite the price weakness, U.S. spot Bitcoin ETFs have shown strong resilience, as total assets under management declined by less than 4%, signaling continued institutional confidence even during the ongoing market correction.

In 2025, gold emerged as a dominant safe-haven asset, surging about 65% for one of its strongest yearly performances, while Bitcoin finished the year down approximately 7%. Both assets advanced by roughly 30% through August, but diverged sharply afterward, with gold continuing upward momentum and Bitcoin entering a notable correction phase.

Despite the price drop, U.S. Bitcoin ETF inflows remained robust. According to data from Checkonchain, spot Bitcoin ETF holdings dipped only slightly from 1.37 million BTC at the October peak to around 1.32 million BTC by December 19 a decline of just about 3.6%. “This suggests that the bulk of the BTC sell-off did not originate from institutional ETF holders,” analysts say, highlighting continued confidence among long-term investors through the downturn.

The introduction of U.S. spot Bitcoin ETFs in January 2024 marked a new era of institutional participation. Even in the face of recent price challenges, Bitcoin’s ETF landscape has shown strength, with BlackRock’s iShares Bitcoin Trust (IBIT) growing its market share to nearly 60%, holding roughly 780,000 BTC. Industry observers note this trend as a positive signal of growing institutional conviction in digital assets.

While Bitcoin’s price correction was sharp, the limited reduction in ETF AUM indicates that institutional holders may be viewing the dip as an opportunity rather than a reason to exit. Analysts believe that renewed investor confidence and broader adoption could support Bitcoin’s next recovery phase, although macro conditions and regulatory developments will continue to influence short-term price behavior.

2 min read

2 min read