Pakistan’s hybrid and plug-in hybrid SUV market is entering a more competitive phase as new, lower-priced models disrupt the price structure that once favored a few dominant brands. The shift has been triggered mainly by Jaecoo’s recent launches, which have reset entry prices in a segment previously dominated by vehicles priced well above PKR 9 million.

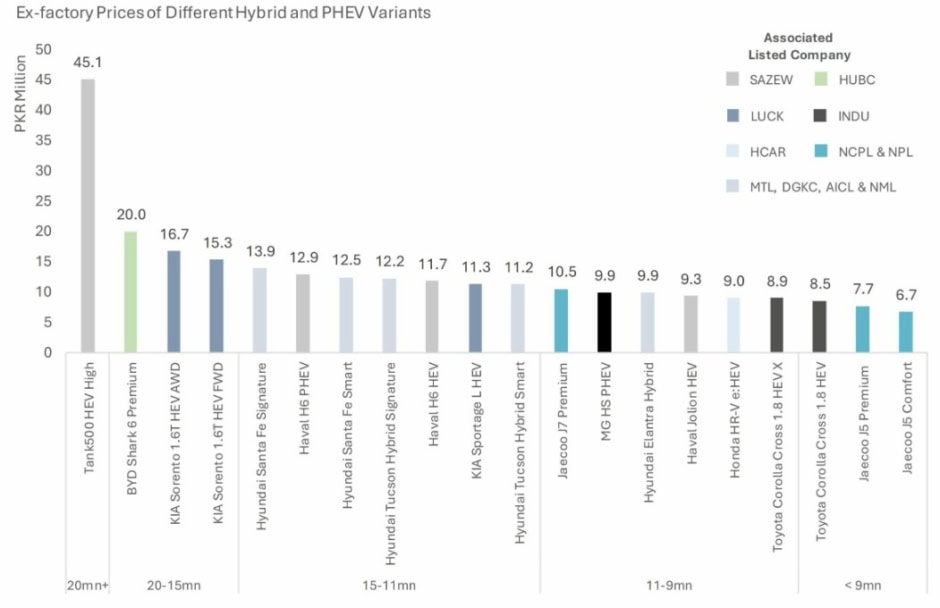

Jaecoo has introduced the J5 Comfort at PKR 6.7 million and the J5 Premium at PKR 7.7 million. The J7 Premium has also been launched at PKR 7.7 million. These prices place Jaecoo directly below almost every established hybrid and PHEV SUV in Pakistan. In contrast, popular models such as the Toyota Corolla Cross 1.8 HEV and HEVX are priced at PKR 9.9 million, while the Honda HR V e HEV stands at PKR 9.3 million. The Haval Jolion HEV costs PKR 12.2 million, and the Hyundai Elantra Hybrid is priced at PKR 12.9 million.

In the higher part of the segment, pricing moves even further up. The Hyundai Tucson Hybrid Smart sells for PKR 15.3 million, while the Kia Sportage L HEV is priced at PKR 20 million. The Kia Sorento 1.6T HEV comes in both AWD and FWD variants, which sit well above PKR 15 million. At the top end, models such as the Hyundai Santa Fe, the BYD Shark 6 Premium, and the Tank 500 HEV High push prices close to PKR 50 million.

This wide price gap shows how sharply Jaecoo’s entry has shifted the competitive balance. Analysts at Ismail Iqbal Securities say Jaecoo’s pricing directly targets the PKR 9 million to PKR 11 million range, which is where Haval, Kia, Hyundai, and Toyota currently generate most of their hybrid volumes. With Jaecoo now offering hybrid SUVs several million rupees cheaper, buyers are expected to become far more price sensitive.

As a result, the market is likely to see heavier discounting and tighter margins for existing brands. Hybrid and PHEV vehicles already carry higher costs than petrol models, so price cuts could squeeze profitability. However, the same pressure may also increase overall demand, as more consumers gain access to hybrid technology at lower prices.

The rising competition could also speed up the shift away from traditional petrol SUVs. With fuel prices remaining high, the appeal of hybrid and plug-in hybrid vehicles continues to grow. Jaecoo’s lower pricing now removes one of the biggest barriers to adoption, which was the high upfront cost.

From an industry and investment angle, the changes matter for several listed companies. Firms such as SAZEW, HUBC, LUCK, INDU, HCAR, and NCPL have exposure to auto manufacturing, energy, and related sectors. A faster move toward hybrids could boost unit sales, but it may also reshape profit pools as price wars take hold.