Bitcoin’s price climbed above $97,000 this week, driven by fresh inflows into US spot Bitcoin exchange-traded funds (ETFs), signaling renewed institutional demand and a potential reshaping of Bitcoin’s market cycle. Analysts suggest this surge could reignite the path toward the $100K milestone as larger investors step back into the market.

Since the start of 2026, US spot Bitcoin ETFs have seen nearly $1.5 billion in net inflows, according to Bloomberg ETF analyst Eric Balchunas.

“The pattern of ETF demand suggests that maybe the buyers have exhausted the sellers,” Balchunas noted, referring to Bitcoin breaking out of its prolonged consolidation near $88,000. On a single day, ETF buyers contributed $843.6 million in net inflows, highlighting steady institutional interest.

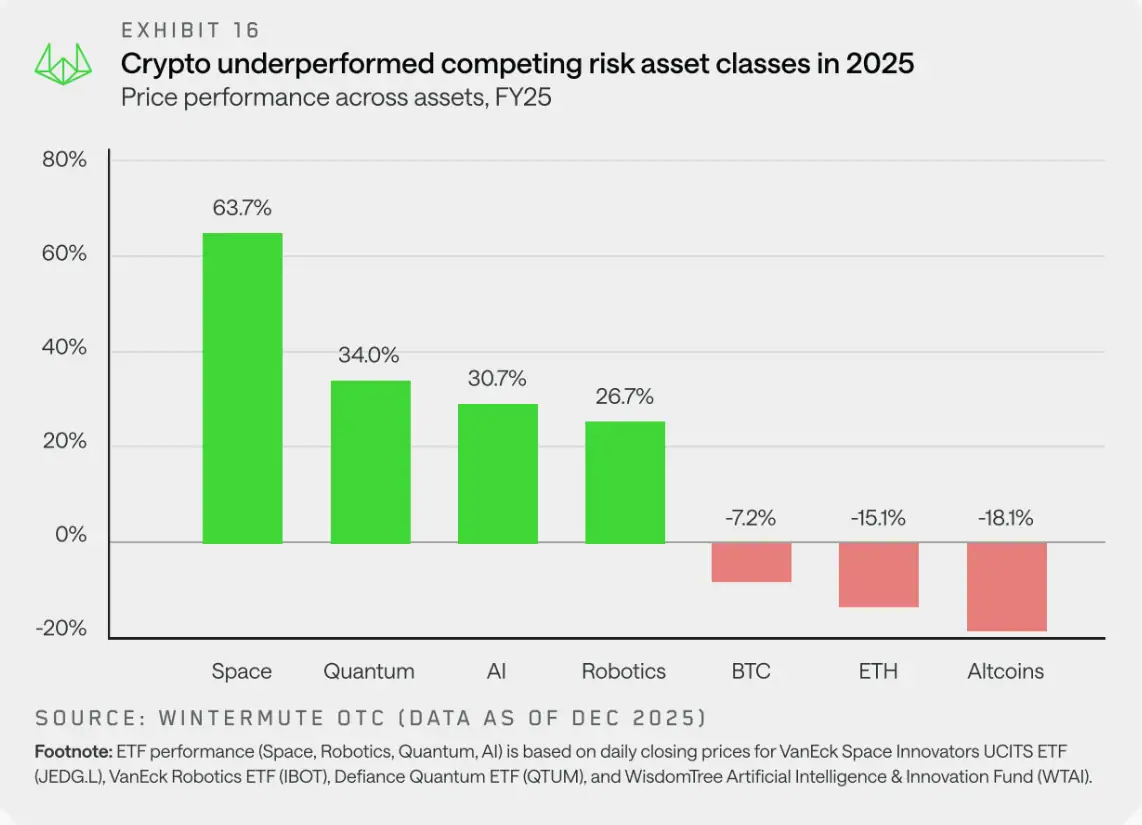

Bitcoin experienced a mixed performance in 2025, reaching new all-time highs but failing to trigger a broad altcoin rally. Retail inflows were limited as investors turned toward sectors like AI, robotics, and space stocks. Experts, including Wintermute, argue that a structural shift in Bitcoin markets through continued accumulation by ETFs and digital asset companies may be necessary to sustain a wider crypto market recovery in 2026.

Historically, Bitcoin’s four-year cycle peaks 12–18 months after halving events. While some analysts warn the market may already have passed its cyclical high, current ETF driven demand could reshape this narrative. Stronger, consistent performance across major cryptocurrencies may generate a broader wealth effect, driving sustained growth in 2026.