MCB’s full-year earnings came under pressure as rising operating costs and weaker interest income weighed on profitability, according to a review of the results by market data.

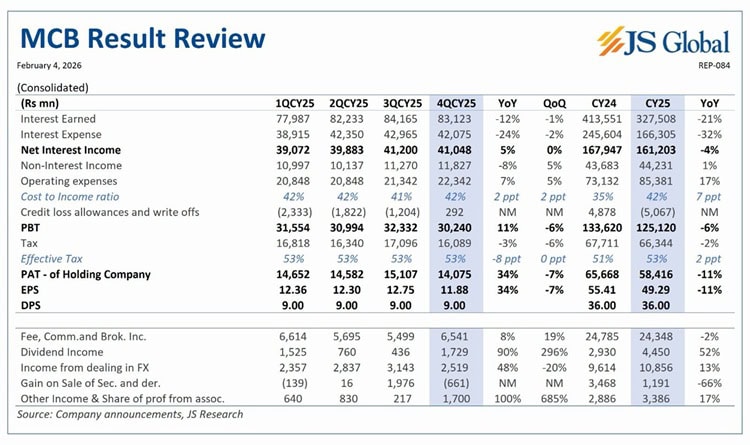

The bank posted a consolidated profit after tax of Rs 58.4 billion for calendar year 2025, down 11% compared to the previous year. Earnings per share also fell to Rs 49.29, reflecting a softer overall performance.

In its review, research shows that interest income declined sharply during the year, falling by 21% as lower interest rates and easing yields reduced returns on earning assets. Although interest expenses also came down, the impact was not enough to prevent a 4% drop in net interest income.

Cost pressures remained a key concern. Operating expenses increased by 17 % over the year, pushing the cost-to-income ratio up to 42% from 35% previously. JS Global pointed out that expenses grew faster than income, limiting the bank’s ability to protect margins.

Non-interest income showed little growth, rising just 1% during the year. While income from dividends and foreign exchange improved, this was partly offset by a sharp decline in gains from the sale of securities.

Pre-tax profit slipped by 6%, while a higher effective tax rate of 53% further weighed on net earnings, the review added.

On a quarterly basis, the bank’s performance remained broadly stable, but JS Global said this was not enough to offset the pressure seen over the full year.

2 min read

2 min read