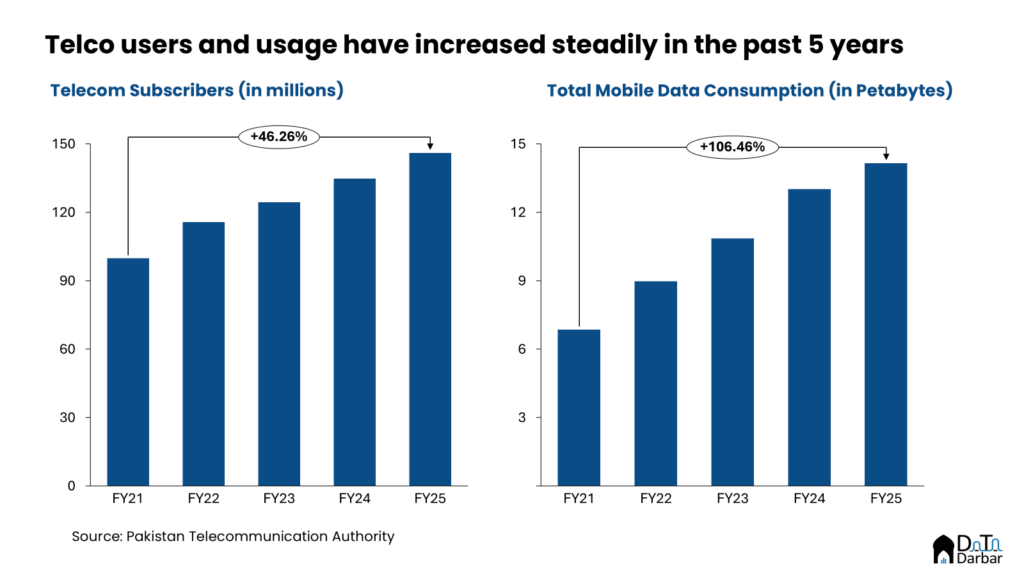

Between fiscal years 2022 and 2025, Pakistan’s mobile ecosystem recorded a substantial expansion with roughly 46 million new cellular subscribers and average monthly data consumption tripling from about 3 GB per user in 2019 to 8.8 GB by 2025, according to industry analysis by Data Darbar.

However, despite this surge in usage, telecom infrastructure and spectrum allocation have lagged significantly, creating bottlenecks in network performance and regionally lagging broadband speeds.

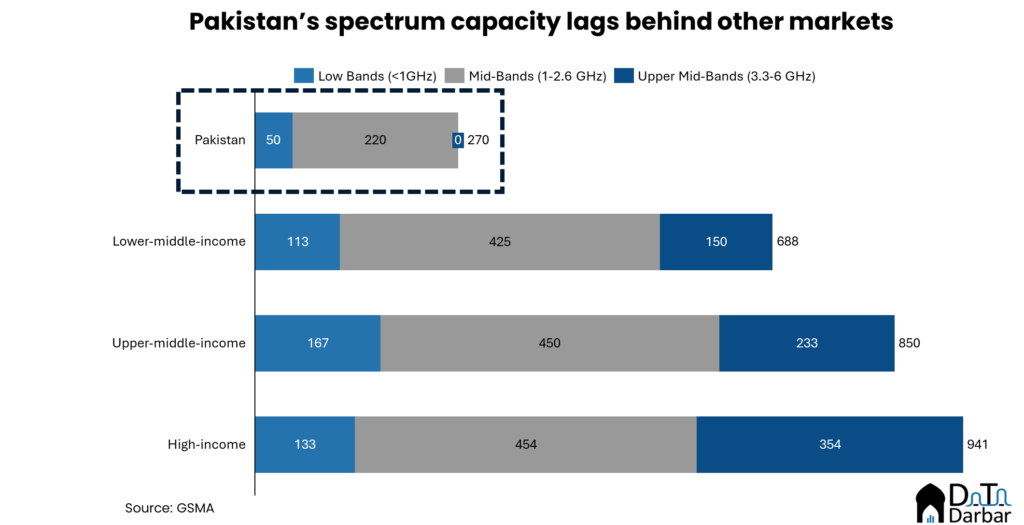

Part of the challenge stems from Pakistan’s limited spectrum holdings. For years, the country has operated with just 274 MHz of mobile spectrum, one of the lowest allocations in Asia and roughly one-third of neighboring Bangladesh’s roughly 600 MHz, despite serving a population of nearly 240 million. This shortage has frustrated network expansion and has been linked by the GSMA to economic losses of approximately $1.8 billion in GDP for each year of delayed spectrum release.

Spectrum auctions (the process by which operators gain licensed access to radio frequency bands) have historically suffered from high reserve prices that deterred full participation, leaving chunks of available spectrum unsold in previous auctions. Awareness of these structural weaknesses has helped shape the government’s planned largest auction yet, unveiled in January 2026, which proposes to make nearly 597.2 MHz of new spectrum available across six key bands, including low, mid and high frequencies suited for both 4G and next-generation 5G services.

The auction’s design includes competitive safeguards and deployment obligations requiring operators to build out extensive network infrastructure, i.e., mandates meant to ensure broader coverage but also increasing financial and operational commitments for bidders. These include requirements for fiber-to-the-site connections and minimum rollout timelines that stretch into the early 2030s.

Telecom analysts argue that if Pakistan’s auction framework balances reserve pricing, infrastructure conditions and market realities effectively, it could unlock significant network investment and improve broadband quality nationwide. However, the sector’s long-term health hinges not just on releasing more spectrum but on aligning auction policy with sustainable deployment models that address both urban data demand and rural connectivity gaps.