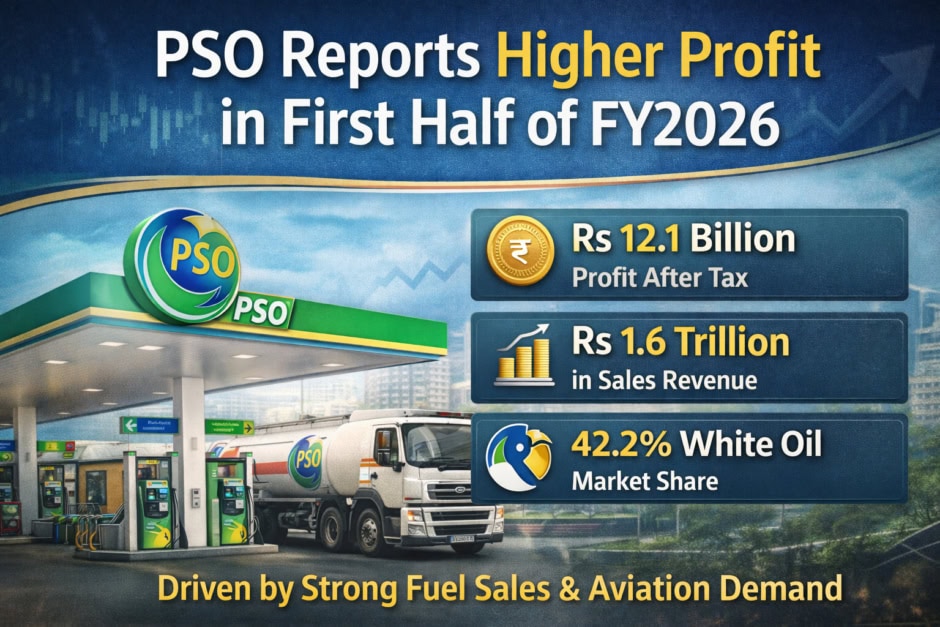

Pakistan State Oil (PSO) reported a profit after tax of Rs12.1 billion for the half year ended December 31, 2025, up from Rs11.2 billion in the same period last year, driven by strong white oil sales and stable aviation demand.

Sales, Market Share and Segment Performance

The company posted earnings per share of Rs25.82, while gross sales surged to Rs1.6 trillion during the period. On a consolidated basis, profit rose to Rs14.7 billion with EPS of Rs31.34.

PSO maintained a 42.2% share in the white oil segment, selling 3,418 KMT of products. However, black oil volumes declined due to reduced demand from the power sector. In aviation fuel, the company retained a dominant 99% market share, while LPG sales grew 3.6% year-on-year to 28.5 KMT.

During the half year, Pakistan State Oil rehabilitated 39 KMT storage capacity and expanded its retail network to 3,638 outlets nationwide. The company also continued rollout of VIBE convenience stores and its in-house VIBE Café concept.

The White Oil Pipeline Project advanced after federal cabinet ratification of its summary and provisional tariff, moving toward implementation.

Renewables, EV Charging and Digital Push

PSO accelerated its energy transition strategy through PSO Renewable Energy (PSORE), solarizing terminals and targeting 2.2 MWp solar capacity by mid-2026. The company also established Pakistan’s largest EV charging network with nine stations along highways and major cities.

Digital initiatives included the Payvay mobile app and Raast payment integration via its fintech arm Cerisma.

Circular Debt Challenge Persists

Despite improved profitability, PSO’s receivables linked to circular debt remained elevated at Rs412 billion, continuing to strain cash flows. The company said it is working with the government to resolve the issue sustainably.