As cryptocurrency trading evolves, platforms continue to refine their offerings to meet the needs of seasoned traders. BYDFi (formerly known as BitYard) has gained attention for its advanced trading tools and features, but does it truly stand out as the best platform for experienced traders? This analysis takes a neutral approach to evaluate what BYDFi offers and where it stands in the competitive crypto exchange landscape.

What is BYDFi?

BYDFi is a one-stop social trading platform for individual investors. With its establishment in 2020, BYDFi has been providing global users with professional and convenient trading products and services such as spot trading, perpetual contracts, spot investment, martingale, and spot/future grid. Catering to the tagline “BUILD Your Dream Finance” goes a step further in trading cryptocurrencies. That is why BYDFi tries to ensure that the platform provides users with the opportunity to act independently and become an irreversible marker of the development of the sector.

BYDFi was founded in 2020 and introduced the cryptocurrency market under the brand BitYard. The organizational website has been developed for nearly three years. Due to shifts in the encryption market, it has been called as BYDFi since January 2023. Through enabling traders, copiers, project teams, media, and other communities to share their information with each other, BYDF has leveraged trading for both novices and experts.

A Platform for All Levels of Traders

Trading of the cryptocurrency is relatively complicated and seems to be designed for experienced traders while new entrants are disadvantaged. BYDFi covers this shortsightedness because it brings an environment that befits novices and the well-endowed too.

Spot Trading with Variety

Currently, BYDFi provides access to the assets of over 600 cryptocurrencies, traditional ones such as Bitcoin and Ethereum, as well as new-generation ones. This is because it caters to the farmer who wants to avoid losses yet other farmers are ready to take big risks to gain big returns.

High Leverage for Futures

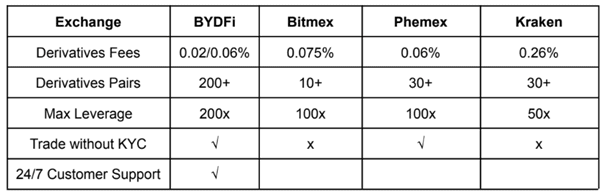

Advanced traders especially can navigate the perpetual contracts offered with up to a 200x leverage on BYDFi. This feature helps the users to put their trading positions many times their volume but with high risk which is suitable for traders who understand risk management.

Demo Trading for Learning

BYDFi gives client the ability to trade through a demo account with virtual balances of 100,000 USDT to enable clients practice on the strategies used when trading the actual virtual currencies without having to risk their real money. This feature is particularly great for practicing the identified pressures and experience in trading free of pressure.

BYDFi Features

Dual-Interface System for Novice and Professional Traders

BYDFi provides a dual-interface system designed to cater to both novice and professional traders. The Classic Spot Trading is straightforward with basic tools such as the real-time order book, price chart, and simple order options such as market, limit, and stop orders. This is especially perfect for those trader who only want to trade basic instruments and do not require other complex features. The Advanced Spot Trading interface for the more experienced traders adds such tools as live charting with features provided by TradingView. This comprises multiple timeframes, over 80 techincal indicators, specific and detailed customization for advanced analyzing. Despite these attributes as working, traders looking for specialty tools, such as for option trading, may be disappointed next to the likes of Binance or Deribit.

Perpetual Contract Trading with 200x Leverage

Perpetual contract trading is one of the most prominent products offered by BYDFi, where the leverage level goes up to 200 times. This high leverage again helps them to give a big push to their positions as traders so that they can benefit more than they think with very little capital outlay. For example, a hundred-dollar account can be scaled up to a twenty-thousand-dollar exposure at the max. However, this feature is a double-edged sword because high leverage is a double-edged sword since it increases both profit and loss. Positions with 200x leverage put BYDFi among industry leaders in the derivatives field; however, such speculative instruments are nevertheless rather risky and may not be suitable for all investors.

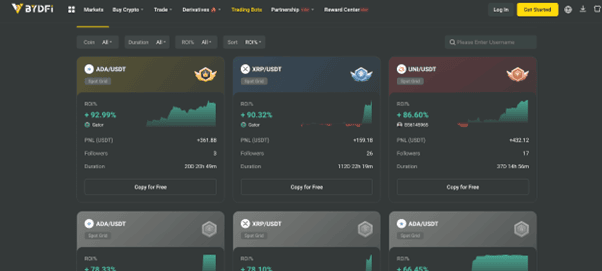

Copy Trading Feature for Perpetual Contracts

BYDFi has also launched copy trading on perpetual contracts where users can mimic the manner of trading by very successful traders. By competing on the ‘Leaderboard’ tab, where one can view ROI and historical win rates, users choose traders that suit their objectives. This feature makes trading more accessible by making the features of a complex trading strategy and information that can only benefit a professional trader available to those with little industry knowledge. But it also consists of certain disadvantages, as getting involved in another trader’s scheme leads to uncertainty. However, to those new in trading, this feature may be very useful, especially for those traders who like to have full control of their trades.

Sophisticated Charting Tools for Market Analysis

To support market analysis, BYDFi also supports the analysis of markets. More than 80 parameters, the possibility to design a trader’s operating panel, constant updates of prices and volumes in the market, all necessary tools for short-term and long-term planning of actions are given to the traders. However, I must admit that, for the most part, these tools are very sturdy and are not limited to BYDFi; They are equivalent to those found on other platforms. The traders who are in search of exclusive analytical tools may not find something special enough from BYDFi.

Transparent and Competitive Fee Structure

BYDFi’s transparent fee structure is one of its strengths, offering competitive rates that align with or surpass many industry leaders. The spot trading costs are further divided into makers which charge 0.10% while the takers charge 0.20% while the perpetual contracted costs begin at 0.05%. These rates imply make BYDFi convenient to use for constant traders. However, like some of the competitors, BYDFi securities lack some important tools, for instance, it does not provide special bonuses to the clients, for example, reduced fees for trading in large volume, or any kind of a loyalty program, the absence of which can largely affect the activity of big participants.

Security Measures and Regulatory Compliance

Security is a core focus for BYDFi. The platform is registered and regulated as a Money Services Business in both American and Canadian markets. To ensure that user’s money is safe over 95% of the company’s funds are kept in cold wallets so that they cannot be hacked. Other measures include two-factor authentication and withdrawal confirmation procedures that also possess high levels security. Fortunately, in the short period since its inception in 2019, BYDFi has been relatively secure with no pronounced hack attacks. However, there are no public audits of exchanges or proof-of-reserves reports to which traders might turn, which may be an issue in the eyes of those who like their transparent.

Global Presence and Accessibility

BYDFi has successfully created a worldwide presence with more than 500k registered users across 120+ countries it has daily trading volume of more than 2b$. It advisingly sustains multiple languages to provide comfort for the international traders and it operates its customer service all the time. Though, BYDFi is not as famous as Binance or Coinbase and therefore, the users of BYDFi might encounter rather low liquidity with not quite popular trading pairs.

Overall, BYDFi aims to establish itself as a credible and top-tier trading platform, particularly for professional traders. They provide competitive fees, a variety of advanced trading tools, and high-leverage options. This emphasis is a benefit, along with the additional advantage of an advanced feature like copy trading functionality. The lack of distinctive analytical tools, valuable incentives, and transparency initiatives could raise questions or remain underdeveloped in the future. The offerings of BYDFi as a trading platform ultimately hinge on the preferences of seasoned traders, particularly regarding leverage, fees, and specialized trading tools. This platform stands out as one of the top choices for trading cryptocurrencies, yet it does come with its own set of drawbacks.

7 min read

7 min read