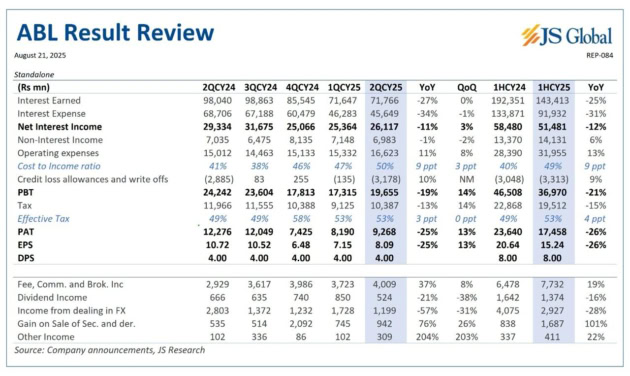

Allied Bank Limited (ABL) has reported a significant decline in profitability for the first half of 2025, as highlighted in the latest Allied Bank Result Review. The bank’s pre-tax profit (PBT) dropped 21% year-on-year (YoY) to Rs36,970 million in 1HCY25, compared to Rs46,508 million in the same period last year.

Interest income grew by 34% YoY, reaching Rs192,351 million, but this was offset by a sharper 45% rise in interest expenses to Rs133,871 million. As a result, net interest income (NII) fell 12% YoY to Rs51,481 million. Non-interest income provided limited support, rising only 6% YoY to Rs14,131 million.

Operating expenses increased by 13% YoY to Rs31,955 million, pushing the cost-to-income ratio up to 50% in 2QCY25 from 41% last year. The effective tax rate also rose to 53% from 49%, further reducing earnings. Consequently, earnings per share (EPS) slipped 26% YoY to Rs15.24 in the first half.

Fee, commission and brokerage income grew 19% YoY, while gains on securities more than doubled, increasing 101%. However, dividend income fell 16% and foreign exchange income plunged 28%.

Despite weaker profitability, ABL maintained its dividend payout at Rs4.00 per share for the half year, signaling confidence in long-term stability.

The Allied Bank Result Review underlines a challenging period for ABL, as profitability is being squeezed by higher funding costs, rising expenses, and increased taxation. While core income expanded, maintaining earnings growth will remain a key challenge in the coming quarters.

2 min read

2 min read