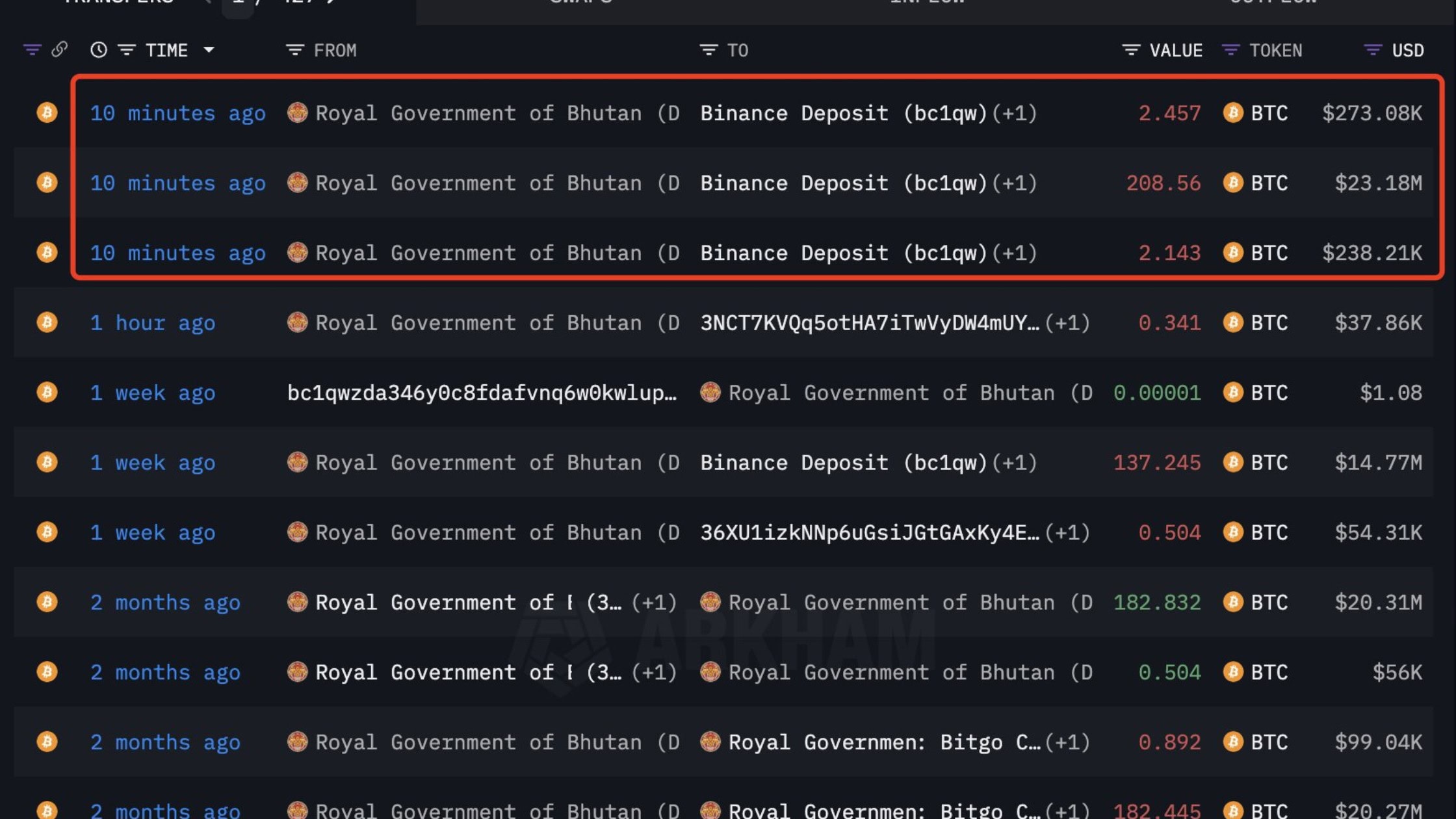

As Bitcoin rockets to a surprising all‑time high of $112,000, the tiny land-locked country of Bhutan has raised eyebrows. They managed to do so by moving 213.5 BTC (roughly $23.7 million, or a mind-boggling PKR 6 billion) into Binance for the second week running.

The transfers coincided exactly with the Bitcoin peak, sparking speculation that the Himalayan kingdom may be preparing to sell into strength and lock in huge gains. Bhutan now holds an estimated 11,900 BTC (worth over $1.3 billion, nearly 40 percent of its GDP), which is mostly mined via hydropowered operations overseen by Druk Holding & Investments in partnership with Bitdeer Technologies.

Bhutan Bitcoin: Timing Is Everything!

On-chain researchers saw 137 BTC (roughly $14.8 million) in transfer activity on June 30th, leading to suspicions of strategic treasury manoeuvres. This week’s additional 213 BTC swipe to Binance indicates a pattern. Analysts believe Bhutan is selling Bitcoin at a premium price to support development, stabilise its economy, or diversify its cryptocurrency assets, rather than panic selling.

Although long-term Bitcoin holders often start to cash out at approximately 300 percent ROI, Bhutan’s situation is much more apparent: the government is sitting on returns approaching 215 percent, meaning there’s still an opportunity to end the fiscal chapter while Bitcoin remains above its profit zone.

Why the World Should Watch This Himalayan Move?

Bhutan has carefully crafted itself as one of the biggest holders of BTC at the state level in the world. It is not the only country following similar paths; Countries like El Salvador and big companies like Tesla are doing the same. Thanks to sustainable hydropower mining during the previous five years, Bhutanese reserves have grown from $750 million to more than $1.3 billion.

Can Bhutan Influence The Next Bitcoin Trend?

While Wall Street celebrates Bitcoin’s sprint past $110,000, Bhutan is holding a crypto chest so large, it’s nearly half the size of its national economy.

It’s not the usual suspect stirring Bitcoin’s waters this time. However, when a sovereign player with that much digital gold starts unloading, the shockwaves don’t stay local. Traders eyeing liquidity flows and sudden dips may want to turn their attention east. Because if Bhutan blinks, the whole market might flinch.

2 min read

2 min read