Bitcoin suffered one of its sharpest monthly crashes in recent history, sliding more than 40% to briefly fall below $60,000 (around PKR 16.7 million) before rebounding near $68,700. The drop wiped out over half of Bitcoin’s value from its October 2025 all-time high of $126,200, raising serious concerns across global crypto markets. Analysts now point to leveraged hedge fund trades, bank-linked ETF products, and rising pressure on miners as the main triggers behind the sell-off.

Bitcoin entered 2026 on the back of strong institutional inflows and ETF-driven optimism. However, heavy leverage across global markets made the rally vulnerable. As macro conditions tightened and volatility returned, even small price declines began triggering forced selling, accelerating Bitcoin’s fall and dragging investor confidence down with it.

One major theory suggests the crash started in Asia. According to Parker White, CIO of DeFi Development Corp, several Hong Kong hedge funds had placed aggressive leveraged bets on Bitcoin-linked ETFs such as BlackRock’s IBIT. These positions were financed using cheap Japanese yen loans.

“When Bitcoin stopped rising and yen funding costs increased, margin calls forced funds to liquidate BTC rapidly,” White explained.

This sudden unwind added heavy selling pressure to already weak markets.

Former BitMEX CEO Arthur Hayes highlighted another key factor: U.S. banks hedging structured products tied to spot Bitcoin ETFs. As Bitcoin breached critical price levels, banks were forced to sell BTC and futures to hedge exposure.

This phenomenon, known as “negative gamma,” turns banks into forced sellers during downturns, worsening price declines instead of stabilizing them.

Bitcoin miners also played a role. With AI data centers offering higher returns, several mining firms began shifting infrastructure and selling Bitcoin reserves. Riot Platforms alone sold $161 million worth of BTC in late 2025.

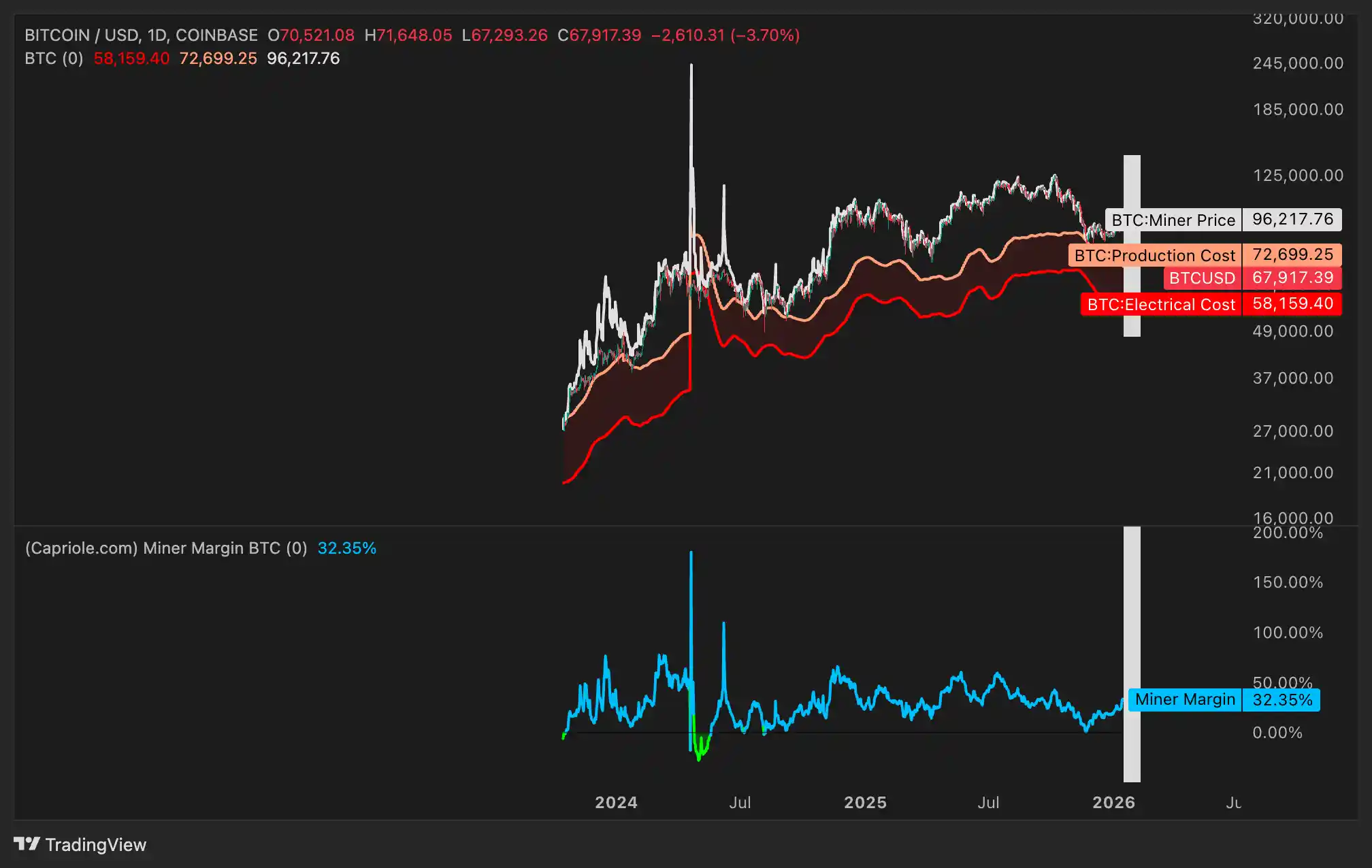

At the same time, mining costs surged. Electricity costs average near $58,000 per BTC, while full production costs exceed $72,000. A drop below $60,000 pushed many miners close to loss territory, raising fears of miner capitulation.

For Pakistani investors tracking BTC to PKR, Bitcoin’s dip below $60,000 translated into levels near PKR 16–17 million, increasing volatility in local crypto trading. While prices have recovered slightly, analysts warn that another drop below $60,000 could reignite selling pressure, especially if miners and institutions continue to de-risk.

2 min read

2 min read