Bitcoin has entered a rare statistical extreme after crashing below its 200-day moving average for the deepest drop in its history, even surpassing the COVID-19 and FTX collapses. Despite the sharp sell-off, analysts say a rebound is now highly probable as BTC to PKR volatility increases and long-term fundamentals remain intact.

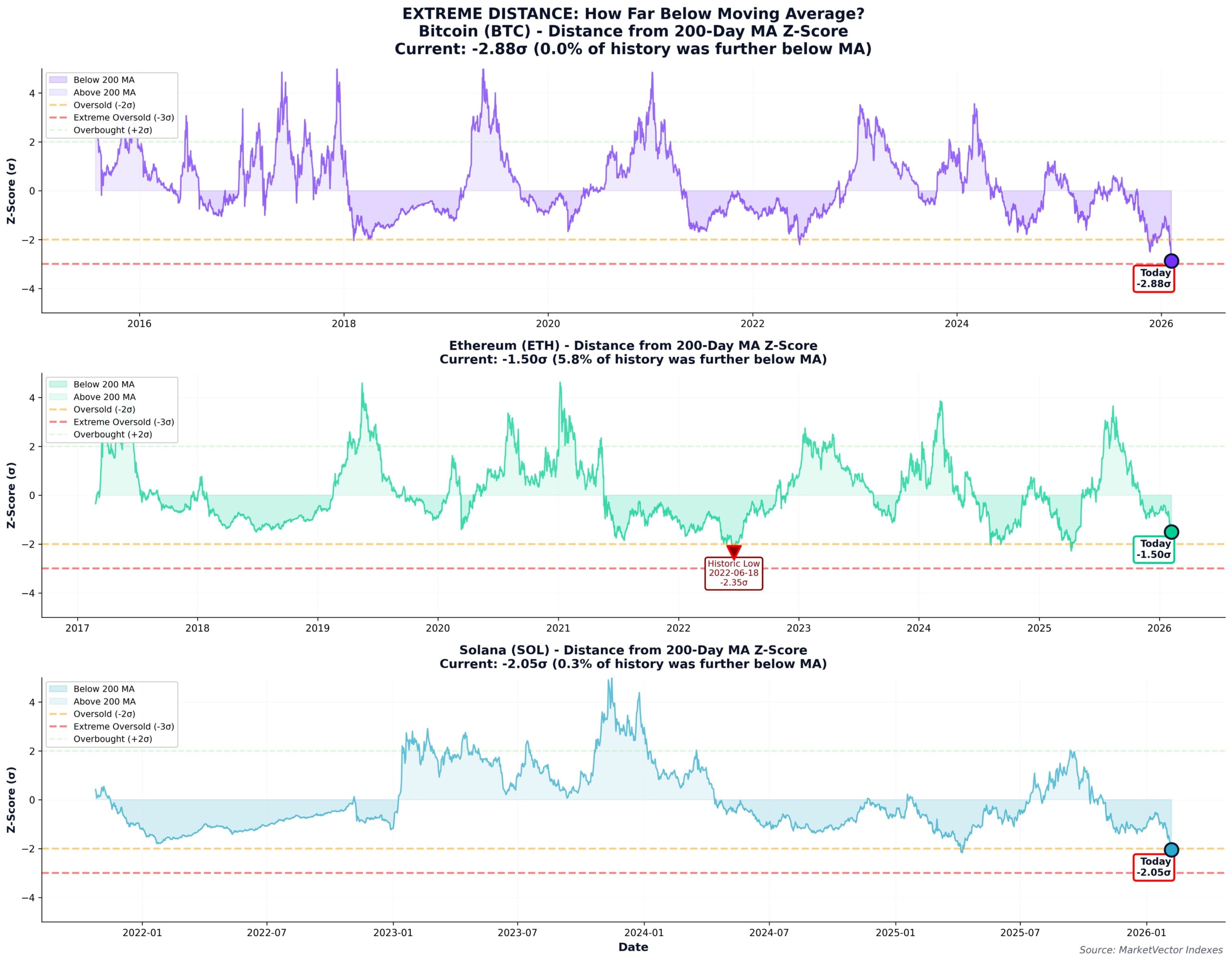

Bitcoin briefly fell below $60,000 before rebounding to around $70,592, marking a decline of more than 22% in a single week. According to MarketVector Indexes’ digital asset research director Martin Leinweber, Bitcoin is now 2.88 standard deviations below its 200-day simple moving average, a level never seen before in over ten years of data.

“Bitcoin has literally never traded this far below its 200-day average not during COVID, not during FTX,” Leinweber said in an X post.

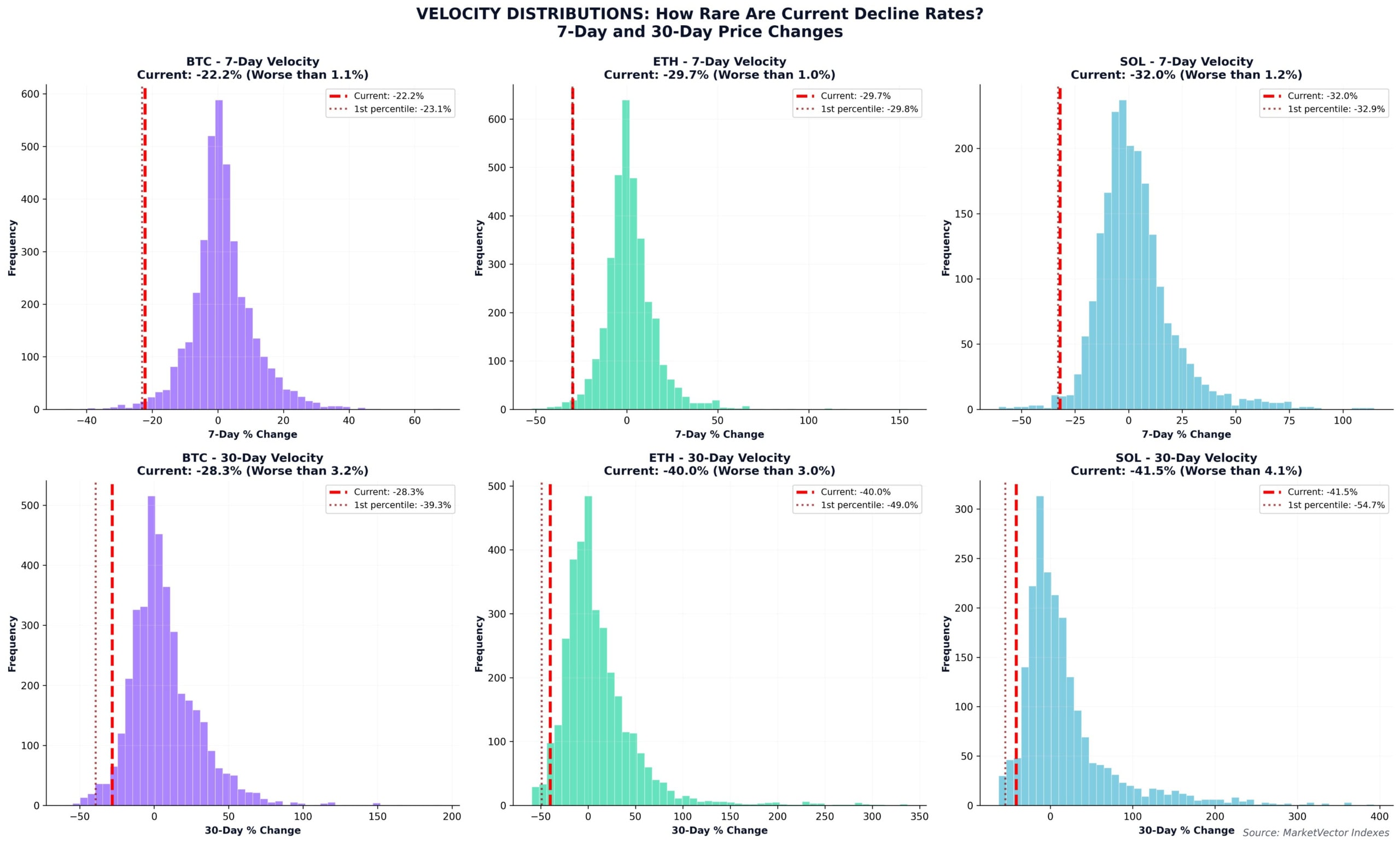

This makes the recent crash one of the fastest and most severe drawdowns in Bitcoin’s history, placing it in the 99th percentile of worst outcomes.

Historically, extreme deviations from long-term averages often lead to mean reversion, where price moves back toward its average. Analysts believe this increases the probability of a short-term rebound, though not necessarily a final market bottom.

Leinweber noted that while Bitcoin may not be at generational lows yet, the market is clearly at statistical extremes across multiple indicators.

Experts emphasize that the current downturn is driven by macro-economic pressure, not by any failure in Bitcoin’s technology or network.

“Bear market equals macro-driven, not a breakdown of Bitcoin’s core thesis,” the analysis concluded.

This distinction is important for long-term investors tracking BTC to PKR trends, as Pakistan-based traders remain highly sensitive to global market sentiment and dollar fluctuations.

Market fear reached extreme levels, with the Crypto Fear & Greed Index dropping to 9 out of 100. At the same time, large investors and hedge funds were seen buying the dip, particularly on Binance.

Trader Daan Crypto Trades described the situation as an opportunity for patient investors, saying the market had wiped out excessive leverage and reset risk.

Bitcoin’s record fall below its 200-day trend line marks a historic moment for the crypto market. While uncertainty remains, extreme data signals suggest a rebound is statistically likely. For traders watching BTC to PKR, the coming weeks may define whether this level becomes a temporary floor or part of a deeper macro-driven correction.

2 min read

2 min read