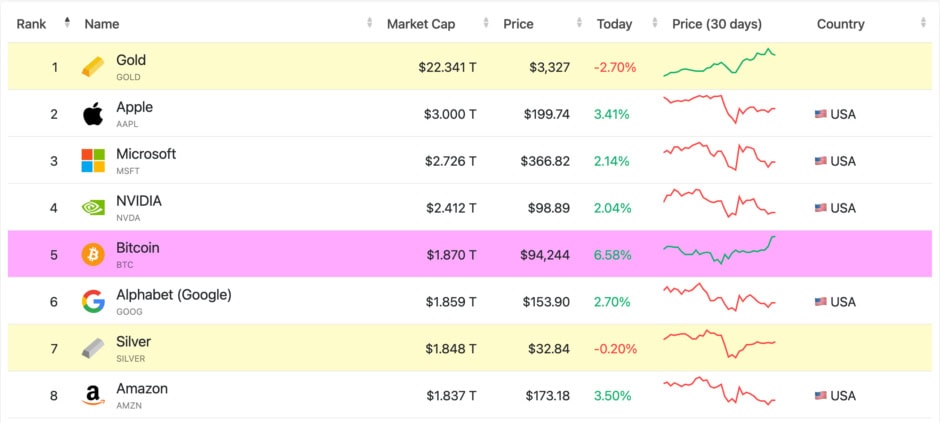

Bitcoin (BTC) has boldly ascended into the top five global assets by market capitalization, surpassing giants like Alphabet Inc. (Google), silver, and Amazon. This remarkable achievement positions Bitcoin among the titans of global finance, with a market cap of $1.87 trillion, standing tall just behind Microsoft, Apple, and gold.

As of April 23, data from CompaniesMarketCap.com confirms Bitcoin’s new rank as the fifth-largest asset in the world, edging past Google’s $1.859 trillion valuation. BTC now trails only Gold ($14.4T), Apple ($2.85T), Microsoft ($2.75T), and Saudi Aramco ($2.07T).

Bitcoin’s price has climbed over 15% in April, outpacing traditional tech equities, which have faced mounting pressure. The Nasdaq 100 fell 4.5%, but Bitcoin exceeded $94,000, demonstrating potential independence from US tech stocks while establishing itself as a worldwide macro asset class.

Market experts see this excellent performance as proof that Bitcoin is becoming a global hedging instrument that profits from global political turbulence, monetary policy changes, and international economic disputes.

Trump Policies Fuel Crypto Optimism

President Donald Trump’s monetary policies are currently generating investor confidence. His executive order to establish a Strategic Bitcoin Reserve (SBR) approaches its obligatory 60-day review period, while also encouraging institutional entities to embrace Bitcoin. The “risk-on” rise emerges in response to Trump’s comments targeting Fed Chair Jerome Powell, as well as his promise to reduce Chinese import tariffs, which will boost Bitcoin and other global financial assets.

“Chatter questioning Fed independence is having positive spillover effects on BTC,” said Vetle Lunde, head of research at K33. Analyst Fejau added that capital outflows from U.S. assets are likely to benefit Bitcoin, which offers “high beta to a portfolio without the tail risks of U.S. tech.”

Bitcoin’s $1.87 trillion market cap now doubles that of Tesla, a company that famously added Bitcoin to its balance sheet in 2021. Tesla’s early crypto investment made when BTC was around $33,500 has since grown over 180%, reportedly netting the automaker more than $1 billion in unrealized gains.

Global Repricing

Beyond the headlines, this surge represents a deeper transformation in how global markets perceive Bitcoin. Analysts emphasize its role as a macro benchmark, increasingly viewed as a store of value and hedge against economic instability.

“This market regime is what Bitcoin was built for,” Fejau noted. “Once the degrossing dust settles, it will be the fastest horse out of the gate.”

With institutional inflows accelerating and technical indicators confirming a breakout, Bitcoin appears poised for sustained momentum — and potentially, further climbs in the global asset rankings.

3 min read

3 min read