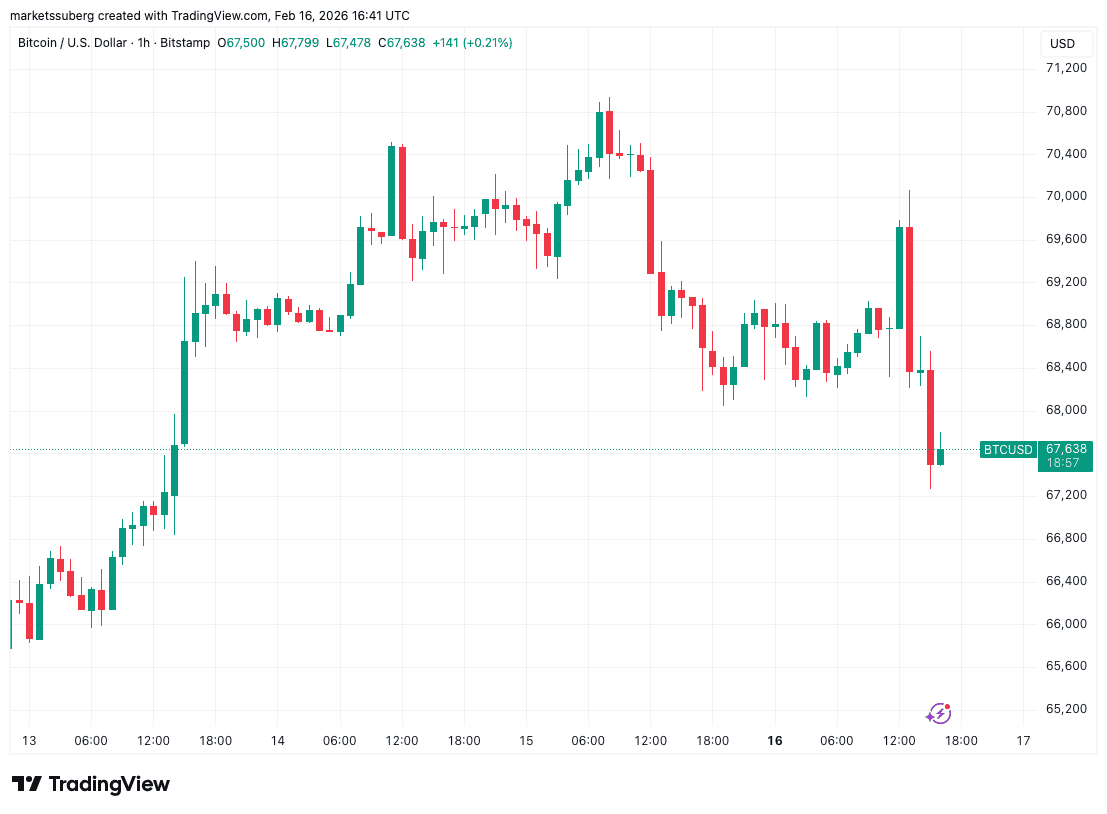

Bitcoin (BTC to PKR) volatility surged on Monday as thin holiday trading conditions triggered sharp price swings around $70,000, wiping out both long and short positions. Analysts say Bitcoin’s weekly RSI has dropped to levels last seen during the 2022 bear market bottoming phase, raising the possibility that BTC is entering another consolidation period before a larger move.

Bitcoin briefly touched $70,000 before reversing, as low liquidity during the US bank holiday allowed large traders to push prices in both directions. More than $120 million in crypto positions were liquidated within hours, reflecting aggressive market squeezes.

Analysts described the move as typical “breakouts and shakeouts,” where price clears both buyers and sellers in a tight range. Liquidity walls appeared above price as BTC fell, adding short-term selling pressure.

“Volatility is much higher… definitely not a calm period for markets,” market analyst Daan Crypto Trades said.

Market researchers noted that Bitcoin’s weekly Relative Strength Index (RSI) has dropped to 27.8 the lowest since June 2022. Historically, RSI below 30 signals oversold conditions and often appears near cycle bottoms.

“Weekly RSI is approaching once-per-cycle lows seen in 2015, 2018 and 2022,” said analyst Keith Alan. “In 2022 it led to five months of consolidation before the macro bottom.”

The comparison suggests BTC may remain range-bound before any sustained bullish breakout.

Bitcoin has traded sideways between roughly $60,000 and $70,000 in recent weeks as institutional flows weakened and macro uncertainty rose. Holiday liquidity gaps often amplify volatility because fewer orders exist to absorb large trades.

Despite short-term manipulation, some traders noted buying pressure remained stronger than previous sessions on most exchanges, indicating underlying demand near current levels.

If RSI behavior follows past cycles, Bitcoin could enter a multi-month accumulation phase before the next trend expansion.

At the time of writing, Bitcoin trades near $68,134, equivalent to approximately PKR 19.0–19.2 million per BTC depending on local exchange rates.