Bitcoin (BTC) continues to stir concern among traders worldwide, and this has implications for BTC to PKR watchers as well, with price action fluctuating near the crucial $90,000 level. According to the latest analysis, US Bitcoin traders have flipped bearish, applying unusually strong selling pressure that could threaten Bitcoin’s ability to hold above $90K a key psychological and technical support zone.

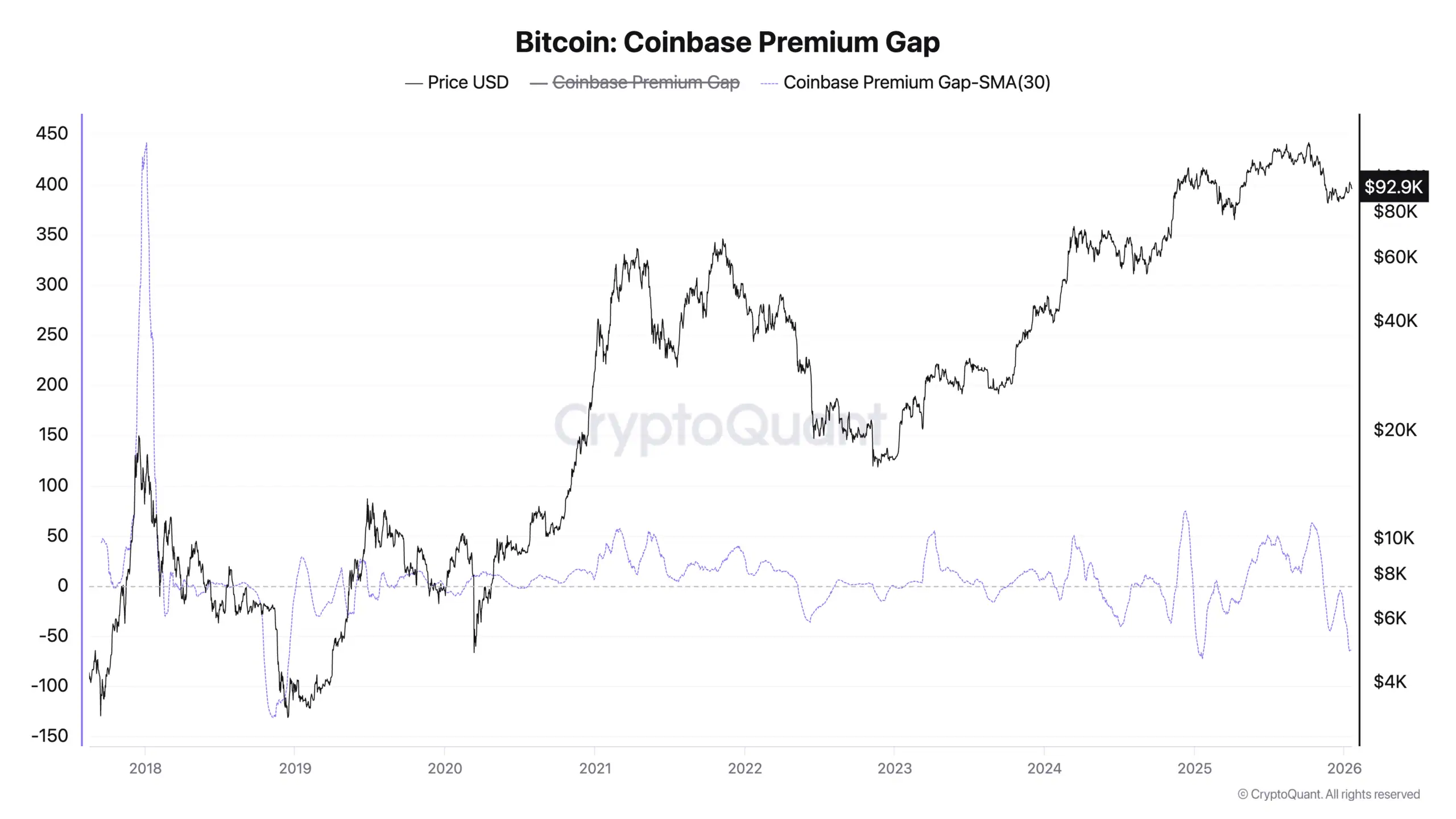

On Monday, Bitcoin’s Coinbase Premium Gap (CPG) the price difference between BTC on Coinbase and BTC on Binance fell to its lowest level in a year. This deep negative gap suggests US-based investors were selling more aggressively than global markets, not just through ETFs but directly via exchanges and OTC desks. Analysts point out that this type of pattern has preceded price drops in the past.

Added to this, Bitcoin’s daily chart shows a rising wedge pattern, a formation traders view as signaling weakening momentum. In such setups, price can break sharply downward if support fails, potentially exposing BTC to a deeper move toward $80,000–$78,000.

The bearish sentiment comes amid broader macro pressure and risk-off markets. Traditional safe havens like gold and silver have rallied, and US equity futures weakened recently. These shifts reflect capital rotating out of risk-oriented assets such as Bitcoin.

Analysts are watching key indicators closely, including ETF flows, derivatives positioning, and whether Bitcoin can maintain crucial support levels. A confirmed breakdown below the rising wedge’s lower trendline could accelerate selling and intensify volatility, impacting how BTC to PKR and other local currency pairs behave in the short term.

Looking Ahead: While Bitcoin remains above key technical levels for now, traders and investors should be alert to downside risks and manage exposure accordingly.

2 min read

2 min read