The BTC to PKR rate showed clear strength, with bitcoin trading around PKR 25 million, as fresh institutional money returned to the crypto market. The move comes alongside a strong recovery in global sentiment, led by heavy inflows into U.S. spot bitcoin exchange-traded funds (ETFs).

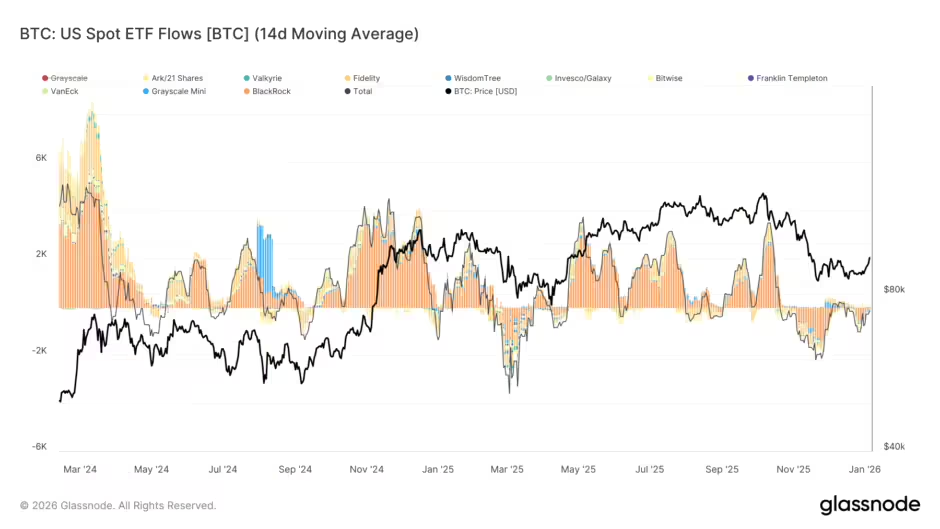

U.S. spot bitcoin ETFs recorded $697.2 million in net inflows in a single day, marking the largest daily inflow since October. In just the first two trading days of 2026, total ETF inflows have crossed $1.2 billion, reflecting renewed confidence from large investors. During the same period, bitcoin prices climbed nearly 7%, helping stabilize the market after recent weakness.

Market data shows that extended ETF outflows in the past have often coincided with local price bottoms. Similar situations were seen in mid-2024 and early-2025, when heavy selling was followed by strong recoveries. Recent ETF flows turning positive, along with an improving Coinbase premium, suggest selling pressure is easing and capitulation conditions are fading.

With institutional demand returning and global markets supportive, analysts believe bitcoin could maintain positive momentum in the near term. For Pakistani investors, movements in BTC to PKR are likely to remain closely tied to ETF flows and overall international market trends.