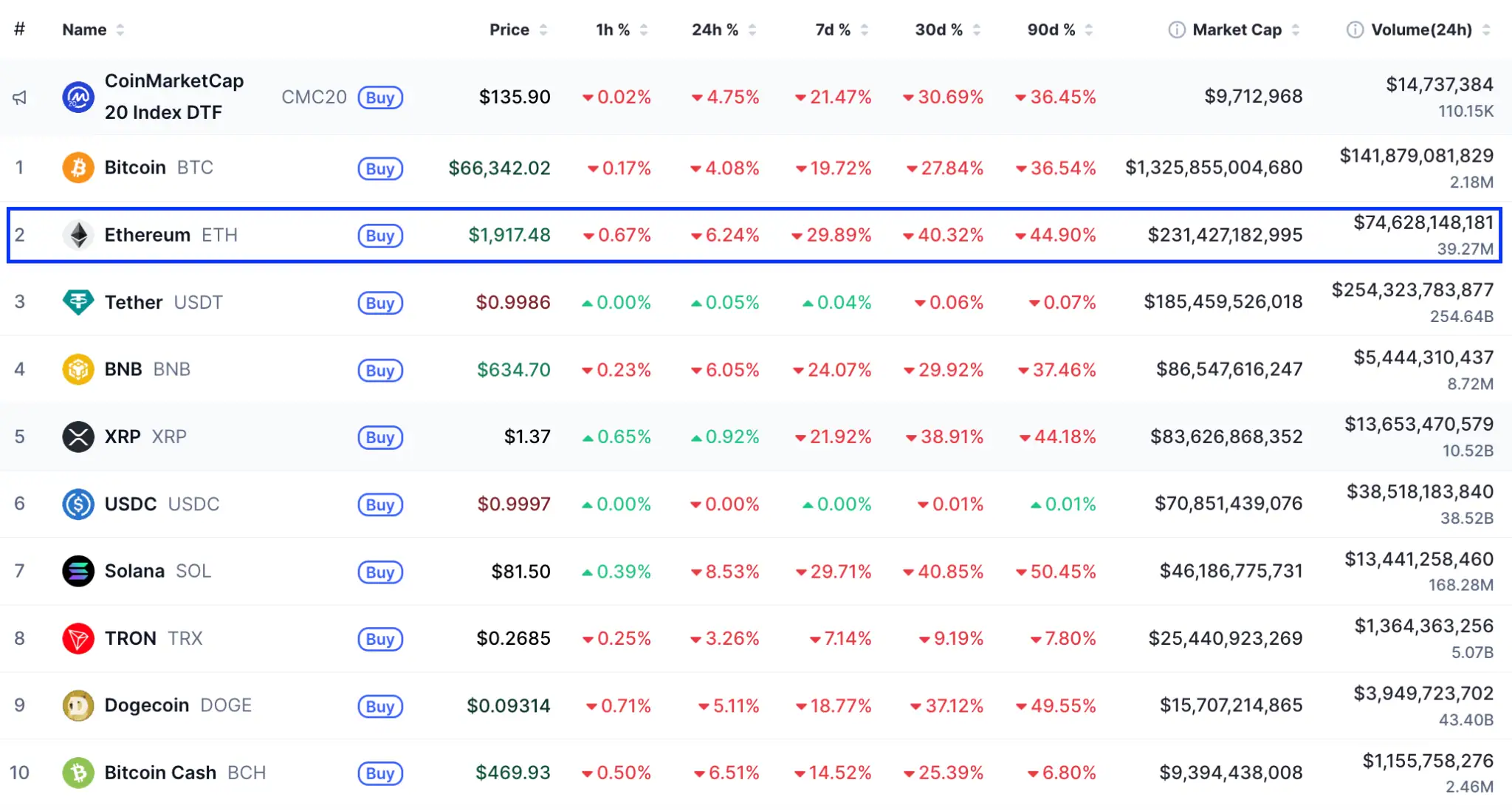

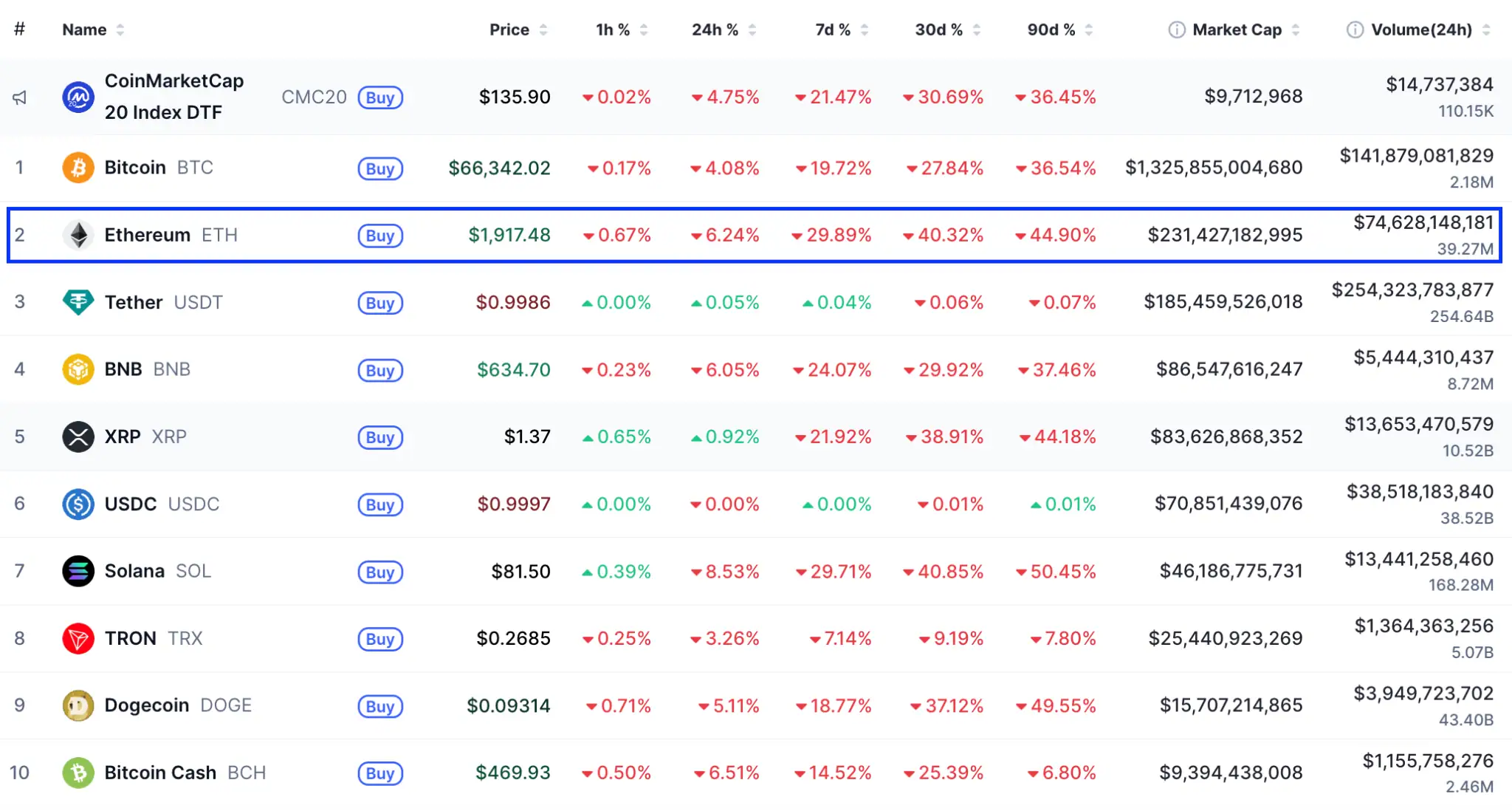

Ether has led losses across the crypto market after suffering a sharp 30% weekly crash, raising fresh concerns about how low ETH prices could fall. Despite a modest rebound toward $1,900, analysts say bearish technical and onchain signals suggest the downside is not over, with the $1,000–$1,400 range now in focus.

Ether dropped below the $2,000 psychological level for the first time since May 2025, hitting a nine-month low near $1,740 before stabilizing. The decline was accompanied by a sharp fall in futures activity, as Ether’s open interest dropped by more than $15 billion in seven days, pointing to reduced trader confidence.

At the same time, long liquidations surged, with nearly $400 million wiped out in 24 hours, highlighting aggressive selling pressure.

Spot Ether ETFs in the United States have played a major role in the downturn, recording around $1.1 billion in net outflows over the past two weeks. Additional selling by large holders, including crypto funds and early Ethereum stakeholders, has added to overhead pressure in the market.

Analysts note that Ether has lost critical long-term support levels, including the 200-week simple moving average. Historically, similar breakdowns have led to deeper declines.

Onchain data points to potential price “magnets” around $1,500, $1,300, and $1,000, where liquidation clusters and past buying activity could attract price action. A stronger support zone is seen near $1,200, where a large amount of ETH previously changed hands.

Still, analysts caution that while comparisons with past bear markets are useful, price action may not repeat perfectly.

“The reality is that no one knows what happens next,”

an analyst noted, highlighting ongoing uncertainty.

Ether’s sharp sell-off has placed the broader altcoin market under pressure, with traders now watching key technical and onchain levels closely. While short-term rebounds are possible, analysts warn that ETH may need to test lower zones before forming a sustainable bottom.

2 min read

2 min read