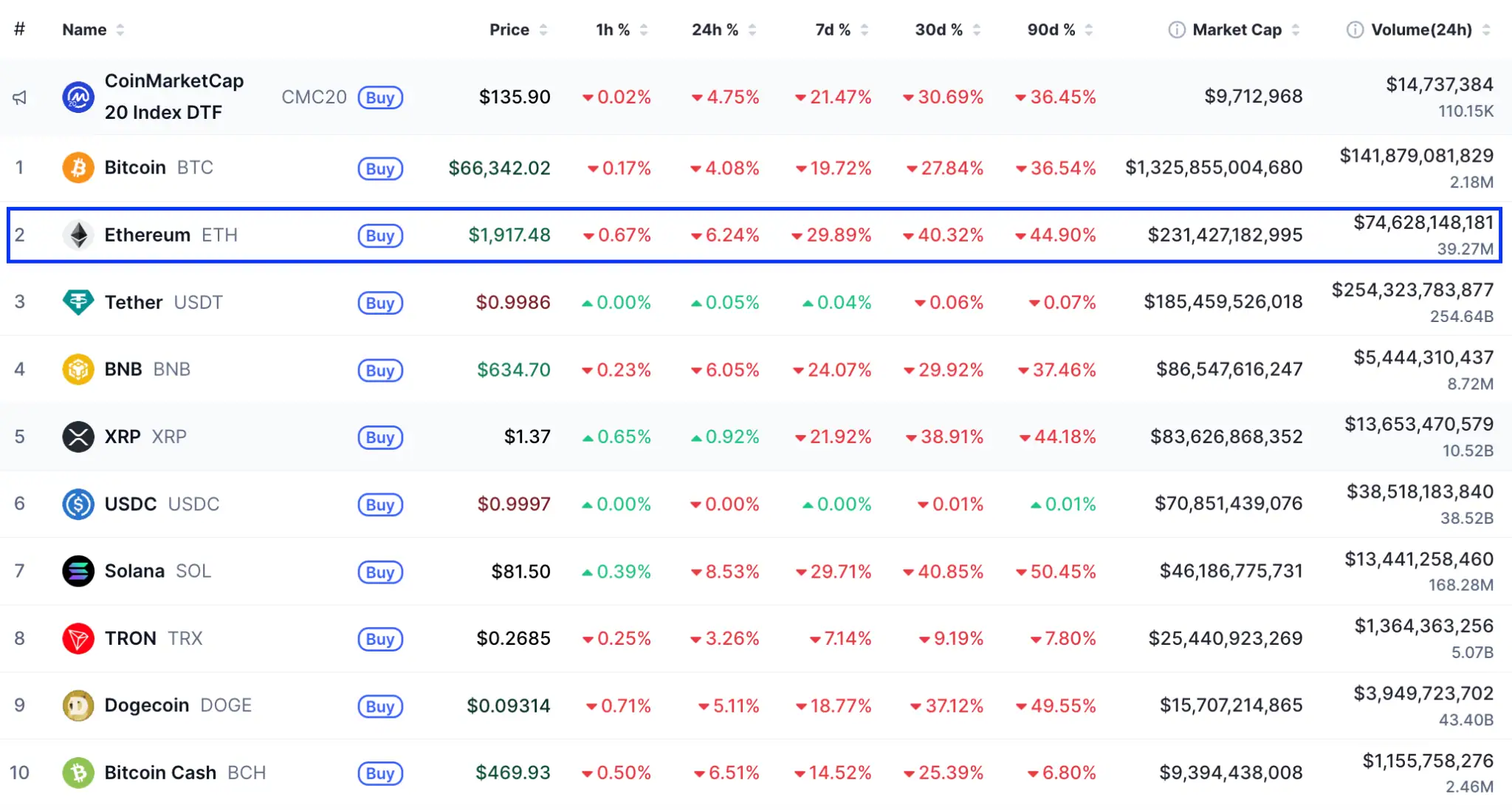

Ethereum’s native token Ether (ETH) has suffered its sharpest weekly decline since early 2025, crashing nearly 30% and slipping below the key $2,000 level. As selling pressure intensifies across the crypto market, analysts now warn that ETH could fall further toward the $1,000–$1,400 range before finding a durable bottom.

ETH dropped from around $2,800 to as low as $1,740 during the week, marking a nine-month low. Although prices briefly rebounded near $1,900, Ether still recorded the worst weekly performance among major cryptocurrencies. The decline came alongside a sharp reduction in futures activity, with Ether’s open interest falling by more than $15 billion, indicating traders are rapidly exiting leveraged positions.

The broader crypto market also weakened, with Bitcoin down over 20% on the week and total market capitalization shrinking to nearly $2.23 trillion.

On-chain data shows heavy long liquidations worth more than $400 million in just 24 hours, highlighting panic selling among traders. At the same time, US-based spot Ether ETFs have seen more than $1.1 billion in net outflows over the past two weeks, adding sustained downside pressure.

Large ETH holders, including institutional investors and prominent wallets, have also reduced exposure. According to analysts, this “relentless overhead supply” has made it difficult for ETH to reclaim lost support levels.

Ether has now broken below its 200-week simple moving average, a historically important support zone. The last time this happened, ETH fell another 45% before stabilizing. If that pattern repeats, analysts believe the next major downside targets lie between $1,400 and $1,200.

On-chain indicators reinforce this view. Data from Lookonchain and Glassnode shows limited historical buying activity below $1,900, suggesting buyers may wait for deeper discounts. Major liquidity and accumulation zones are visible near $1,500, $1,300, and $1,000, which could act as magnets before a long-term bottom forms.

While Ethereum’s long-term fundamentals remain intact, short-term sentiment is clearly bearish. Analysts caution that volatility may remain elevated until forced liquidations slow and ETF outflows stabilize.

As one analyst noted, “ETH is now trading in a zone where fear dominates, but historically, these levels have also marked areas of long-term opportunity.”

2 min read

2 min read