In an era where every second counts in humanitarian relief, Ripple Labs is rolling out its dollar-pegged stablecoin RLUSD to help nonprofits deliver much-needed aid faster and more effectively.

American-based analysts report that RLUSD is powering real-time emergency fund transfers for organizations responding to crises around the globe.

What’s Changing in Aid Delivery

Ripple says its platform enables immediate, verifiable payouts, replacing slow-moving traditional banking rails. In pilot programs with nonprofits such as Mercy Corps, World Central Kitchen and Water.org, RLUSD-based transfers have moved from hours or days to minutes, with full recording of each transaction for audit and transparency purposes. These efforts underscore blockchain’s potential to slash friction in global aid delivery.

RLUSD is issued on both the XRP Ledger and Ethereum network, enabling interoperability across multiple blockchain protocols and widening its use for nonprofits, payment providers and corporate treasuries. Ripple emphasises regulatory compliance, transparency and cross-chain portability as key differentiators.

Why This Matters for Humanitarian Impact

For crisis-affected regions, delayed transfers can mean the difference between timely food, shelter or clean water and heightened suffering. In Kenya, for instance, Mercy Corps notes that RLUSD-powered pilots are enabling payouts to vulnerable families in near-real-time. Ripple says reduced settlement time, lower fees and direct mobile access help reach underserved communities without bank accounts.

Beyond timing, RLUSD adds a layer of accountability. Every transaction is placed on-chain, offering traceability and visibility, features many aid organisations highlight when dealing with remote or high-risk regions where oversight is difficult.

The Broader Financial Implications

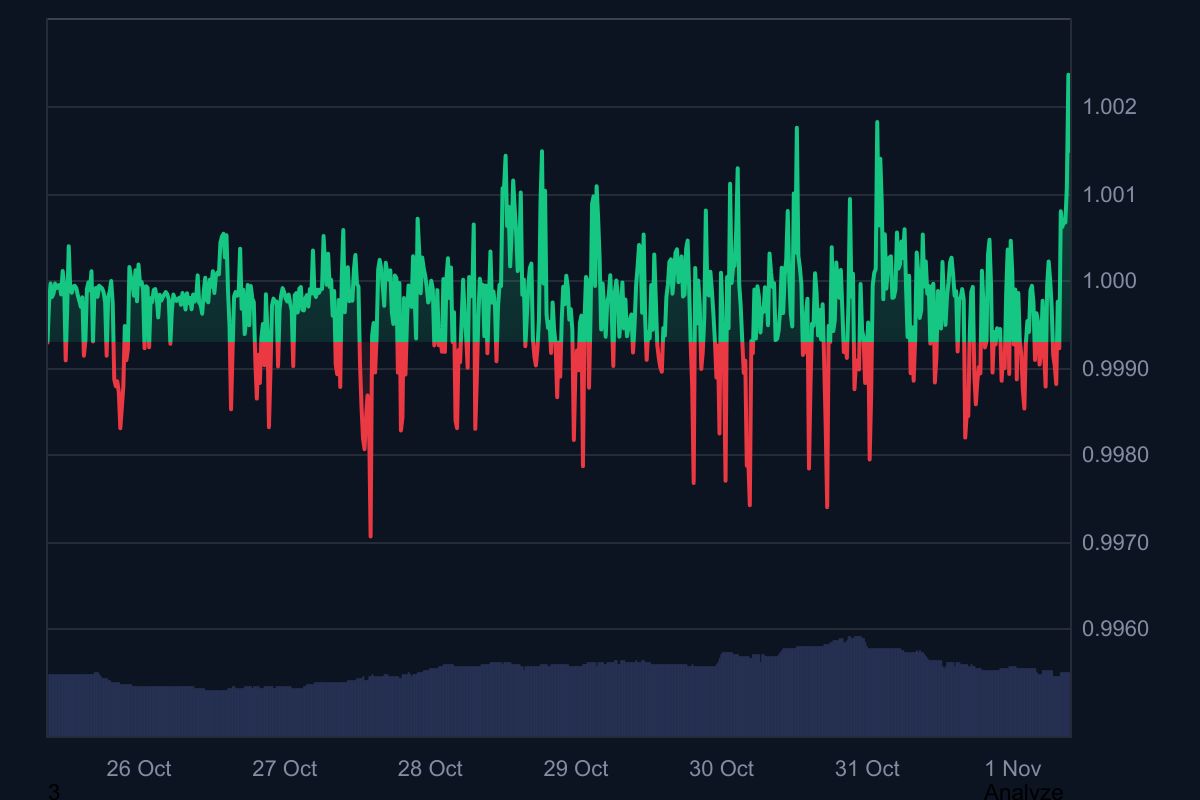

RLUSD is stepping into a crowded stablecoin field, yet Ripple’s emphasis on real-world utility and institutional rails positions it differently.

Analysts note RLUSD and Ripple’s token-repo partnerships with institutions such as DBS Bank and Franklin Templeton are bolstering its credibility. The stablecoin may thus serve as a bridge between crypto innovation and traditional finance in payments, remittances and aid.

Challenges and What to Watch

Despite the momentum, RLUSD faces structural headwinds: stablecoin shelf-space is still dominated by USDT and USDC, and regulatory scrutiny remains intense worldwide. Ripple will need to scale its infrastructure, demonstrate sustainable volumes and maintain regulatory clarity to build trust.

If these pilots scale effectively, they could redefine how aid is delivered and broaden blockchain’s role in global finance.

2 min read

2 min read