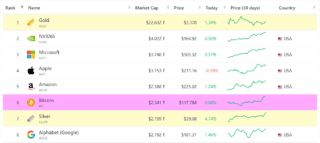

The Bitcoin market cap has soared to new heights, overtaking silver to become the sixth largest asset in the world. Following Bitcoin’s remarkable rally past $118,000, its market capitalization now stands at $2.34 trillion, according to Companies Market Cap data. In comparison, silver holds a $2.199 trillion market cap, dropping to the seventh spot.

This surge puts the Bitcoin market cap ahead of major tech giants. Google and Meta trail behind with valuations of $1.15 trillion and $1.79 trillion, respectively. Bitcoin is now within striking distance of Amazon’s $2.37 trillion market cap, setting the stage for a potential leap into the top five global assets. Gold remains unchallenged at the top with a staggering $22.6 trillion valuation, while NVIDIA follows at $4 trillion, and Microsoft and Apple hover around the $3 trillion mark.

Analysts highlight how the Bitcoin market cap reflects the cryptocurrency’s growing maturity, even during times of global economic and geopolitical uncertainty. The asset consolidated above $100,000 before hitting this record high, underlining strong institutional support. Petr Kozyakov, CEO at Mercuryo, attributes Bitcoin’s climb to “sustained institutional demand that continues to drive this market cycle.” Meanwhile, Ethereum and other altcoins are also in the green, but Bitcoin remains the dominant store of value attracting big players.

At the time of writing, Bitcoin trades at $117,884 after reaching a new all-time high of $117,784. It’s up 9.1% over the past week, 7.5% in a month, and an impressive 101% in a year. Analysts like Bitpanda’s Lukas Enzersdorfer-Konrad believe Bitcoin could soon break the $120,000 barrier, with eyes on $130,000. This growth is bolstered by record ETF inflows, supportive macro trends, and renewed confidence in digital assets.

However, experts also point out that the current rally isn’t driven solely by macroeconomic factors. Nicolai Sondergaard of Nansen notes that while U.S. fiscal expansion and potential monetary easing create a favorable backdrop, Bitcoin’s rally is largely fueled by robust institutional inflows into BTC and ETH spot ETFs. Zondacrypto CEO Przemysław Kral adds that Bitcoin’s latest all-time high underscores its expanding role in the global financial system, supported by clearer regulations like the EU’s MiCA and increased utility in payments.

Yet, with all the excitement around the rising Bitcoin market cap, Kral cautions that unpredictability remains. Tesseract’s James Harris also points out that while Bitcoin’s new highs are significant in USD, they still lag behind gains measured in EUR, GBP, or gold—but momentum suggests it’s catching up. As Bitcoin cements its place as the sixth largest asset worldwide, the market watches closely to see if it will soon eclipse Amazon.

3 min read

3 min read