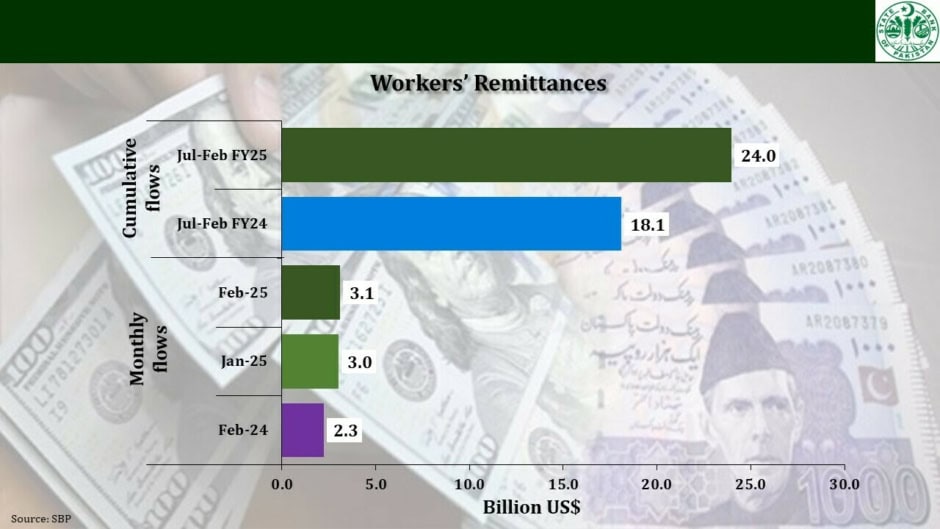

Pakistan recorded a significant increase in remittance inflows, reaching $3.1 billion in February 2025, reflecting a 3.8% month-on-month (MoM) increase from January’s $3 billion, according to data released by the State Bank of Pakistan (SBP) on Monday.

Remittances rose 38.6% when comparing February 2025 to February 2024 totals reaching $2.25 billion. This substantial increase demonstrates overseas Pakistanis play a vital economic role for the country.

Cumulative Growth in FY25

Total money sent from abroad during July 2024 through February 2025 reached $24.0 billion representing a 32.5% increase from the $18.1 billion recorded during the same period in the previous fiscal year.

Remittances play an essential role in providing foreign exchange stability for Pakistan while fueling economic growth and financial improvement for local households.

During February 2025 the greatest amount of foreign monies arrived from three specific nations.

- Saudi Arabia: Remittances from Saudi Arabia reached $744.4 million in February 2025 which demonstrated a 2.21% month-over-month growth and a 37.88% annual growth since February 2024 when they were at $539.9 million.

- United Arab Emirates : The United Arab Emirates sent $652.2 million in remittances which increased by 4.94% Month-on-month and 69.49% Year-over-year (from $384.8 million during February 2024).

- United Kingdom: The United Kingdom transferred $501.8 million to Pakistan during the Month-on-Month period recording a 13.12% growth and Year-over-Year showing a 45.03% spike.

- United States: $309.4 million, growing 3.41% MoM.

The rising figures demonstrate Pakistani diaspora trust in national financial infrastructure and demonstrate successful government initiatives to establish secure and fast international payment methods.

Experts anticipate that Pakistan’s economic stability will remain robust in the coming months as a result of robust foreign remittance flows. Government programs are designed to simplify remittances by utilizing digital payment systems and blockchain technology to reduce transaction fees in remittance transfers.

2 min read

2 min read