Pakistan’s Textile Sector Faces Pressure from US Tariffs

Pakistan’s textile sector maintained revenue stability in the third quarter of FY25 despite macroeconomic challenges and input cost pressures, but a looming threat from proposed US tariffs now casts a shadow over its future export prospects.

3QFY25 Performance

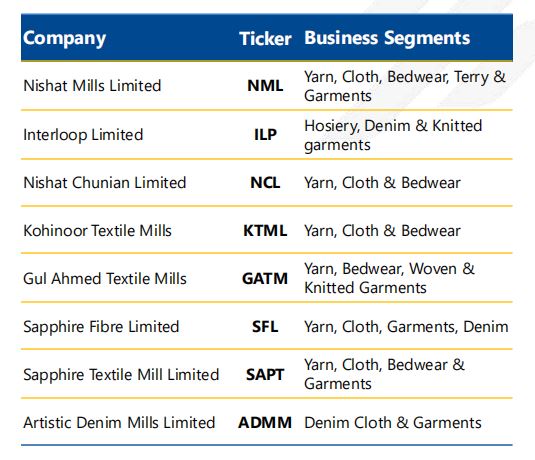

According to a JS Global report, based on a sample of eight leading textile companies representing 71% of the sector’s market capitalization, the industry recorded a 4% year-on-year (YoY) increase in revenue for 3QFY25. However, gross margins declined by 2% YoY, attributed primarily to the softening of global product prices.

Despite flat quarterly revenue, earnings rose 13% YoY, largely due to a 24% YoY decline in finance costs, thanks to lower effective borrowing rates and a shift to cheaper energy sources. Energy costs remained flat even as gas prices surged by 25% quarter-on-quarter, signaling increased reliance on alternatives like coal, furnace oil, or grid power.

Yet, the QoQ earnings dipped by 10%, pressured by higher taxes, reflecting ongoing fiscal tightening.

Textile Export Performance

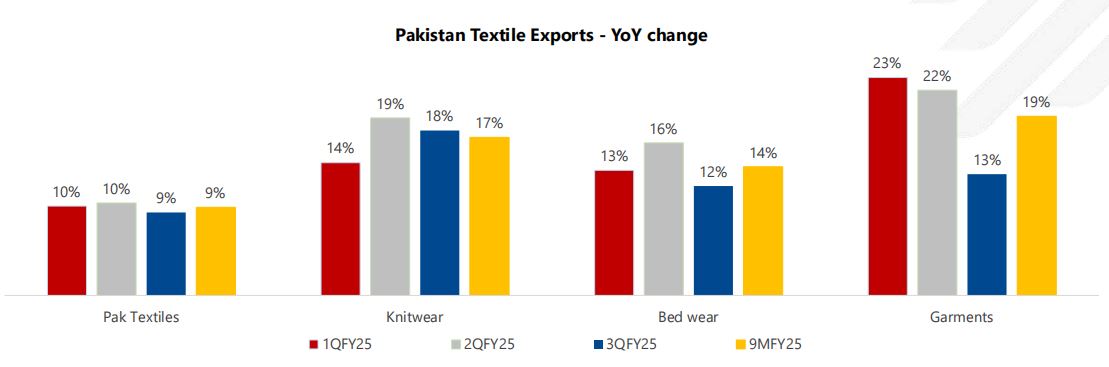

Pakistan’s textile exports rose by 9% YoY to US$4.53 billion in 3QFY25. This growth was spearheaded by:

- Knitwear exports: +18% YoY in value, +16% YoY in volume

- Readymade garments: +13% YoY in value, with prices up 15.5% YoY

- Bedwear: +12% YoY in value, with a 3% YoY price hike

However, a 34% drop in domestic cotton production, falling below 6 million bales, forced mills to import 3.2 million bales, costing over US$1 billion in 10MFY25, compared to US$314 million the previous year. Domestic cotton prices also declined by 15% YoY, in line with weaker global demand.

US Tariffs: A Rising Concern

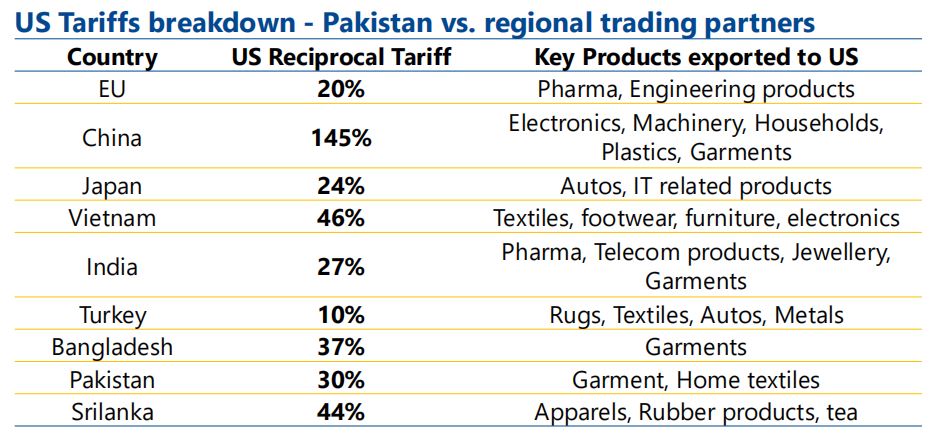

On April 4, US President Donald Trump announced reciprocal tariffs on over 60 trading partners, including Pakistan. Under the proposal:

- Pakistan faces a 30% tariff on garments and home textiles, up from existing MFN rates.

- China (145%), Vietnam (46%), and Bangladesh (37%) also face significant hikes.

- Tariffs have been temporarily paused for 90 days, with final rates expected post-July 2025.

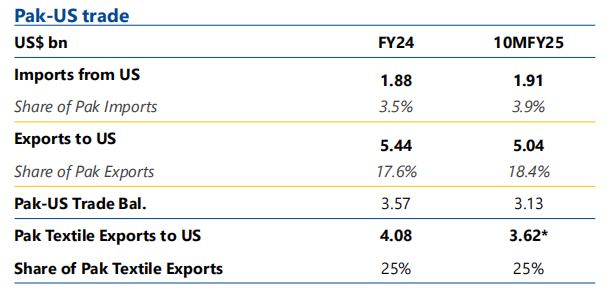

The United States remains Pakistan’s largest single export market, accounting for:

- 18.4% of total exports (US$5.04 billion in 10MFY25)

- 25% of all textile exports (US$3.62 billion estimated)

While Pakistan has proposed a zero-tariff bilateral agreement on select industries, including textiles, progress remains uncertain.

Impact and Outlook

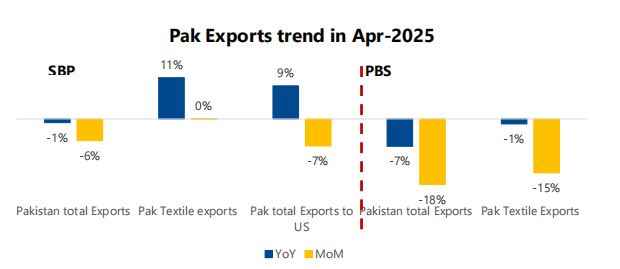

Industry analysts predict near-term pressure on export volumes and margins, particularly as US buyers seek price discounts to offset increased tariffs. April 2025 already saw a 7% month-on-month drop in Pakistan’s exports to the US.

The broader impact could ripple through the textile value chain from cotton growers to spinners and exporters, at a time when global container shipments to the US are down 11% YoY, and China’s exports to the US have dropped 38%.

However, long-term opportunities exist if Pakistan can:

- Capture market share from countries hit with higher tariffs (e.g., China and Vietnam)

- Expand into new regions like Europe, Africa, and Japan

- Invest in vertical integration, labor productivity, and sustainable practices

While 3QFY25 shows encouraging signs of resilience, the proposed US tariffs could redefine the trajectory of Pakistan’s textile sector. With 25% of its textile exports at stake, strategic policy negotiation, export diversification, and cost optimization are now more crucial than ever.

Sharing clear, practical insights on tech, lifestyle, and business. Always curious and eager to connect with readers.

3 min read

3 min read