The Pakistani rupee continued its steady recovery in the currency market, closing stronger against the US dollar for the 102nd straight session while posting broader gains against all major global currencies. The appreciation follows a sharp decline in gold prices, which eased pressure on Pakistan’s import bill and foreign exchange demand.

The Pakistani rupee (PKR) closed at 279.60 per US dollar on Tuesday, gaining one paisa in interbank trading. This marks the 102nd consecutive day of rupee stability against the greenback, reflecting improved supply demand balance in the currency market and easing external payment pressures.

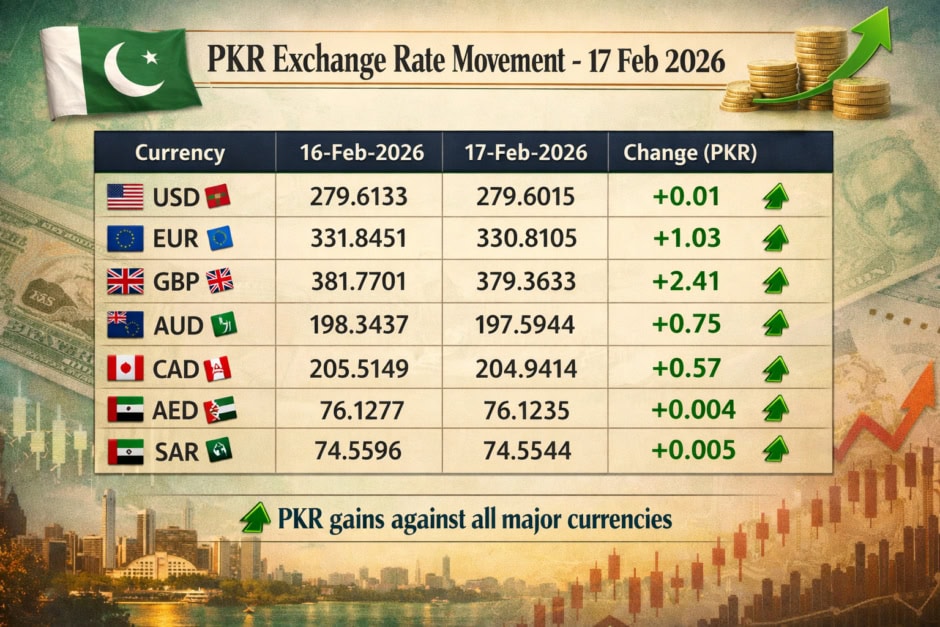

Broad-Based Gains Against Global Currencies

Beyond the US dollar, the rupee strengthened against all major traded currencies during the session. It posted the largest gains against European currencies, appreciating Rs2.40 versus the British pound and Rs1.03 against the euro.

The local currency also advanced against commodity-linked currencies, rising 75 paisas against the Australian dollar and 57 paisas against the Canadian dollar. Marginal gains were recorded versus regional currencies including the UAE dirham and Saudi riyal.

| Currency | 16-Feb-2026 | 17-Feb-2026 | Change (PKR) |

|---|---|---|---|

| USD | 279.6133 | 279.6015 | +0.0118 |

| EUR | 331.8451 | 330.8105 | +1.0346 |

| GBP | 381.7701 | 379.3633 | +2.4068 |

| AUD | 198.3437 | 197.5944 | +0.7493 |

| MYR | 71.7325 | 71.6927 | +0.0398 |

| CNY | 40.4729 | 40.4712 | +0.0017 |

| CAD | 205.5149 | 204.9414 | +0.5735 |

| AED | 76.1277 | 76.1235 | +0.0042 |

| SAR | 74.5596 | 74.5544 | +0.0052 |

The rupee’s recovery coincides with a notable fall in domestic gold prices following a downturn in global bullion markets. Lower gold prices typically reduce import demand and speculative dollar buying in Pakistan, supporting the local currency. Analysts note that gold and dollar demand often move together in the local market, meaning softer bullion prices can relieve pressure on foreign exchange reserves.

Currency dealers expect the rupee to remain relatively stable in the near term if import payments remain contained and remittance inflows continue. However, external financing needs and global commodity trends will remain key factors influencing the exchange rate trajectory in coming weeks.