To protect citizens from rising digital scams, the Securities and Exchange Commission of Pakistan (SECP) has issued a public warning about fraudulent loan schemes on social media, which are tricking individuals through fake advertisements and deceptive practices.

The SECP has intensified its monitoring of digital platforms following a recent crackdown that led to the removal of 141 unauthorized digital lending apps. However, scammers behind such schemes have now shifted their focus to social media, using it as the primary channel to continue promoting fraudulent loan schemes on social media.

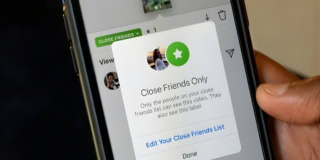

The Commission has detected misleading sponsored ads on platforms like Facebook that falsely promise quick, interest-free loans with little to no eligibility requirements. These ads often misuse the names of credible institutions to create a false sense of legitimacy and build public trust. Victims are lured into paying upfront charges under the pretense of processing, registration, or verification fees—or are manipulated into sharing sensitive personal data. Once the payment or data is received, the fraudsters vanish without providing any loans.

The SECP is actively coordinating with the Federal Investigation Agency (FIA) and the Pakistan Telecommunication Authority (PTA) to identify and take down such scams and remove associated ads from social platforms promptly.

Citizens are urged to remain alert, verify all financial offers, and avoid sharing personal or financial details with unverified sources. A complete list of SECP-licensed companies and approved personal loan apps can be found on the SECP’s official website for public guidance.

2 min read

2 min read