Leading financial analysts have identified three artificial intelligence (AI) stocks that may deliver significant returns in 2026, citing strong market positioning, revenue momentum, and expanding adoption of AI applications across industries, according to a report from The Motley Fool.

As enthusiasm around cryptocurrencies cools following repeated boom-and-bust cycles, a growing number of risk-tolerant investors are redirecting capital toward speculative artificial intelligence stocks, viewing them as a potentially more sustainable path to outsized returns.

While flagship digital assets such as Bitcoin and Ether delivered sharp gains during earlier rallies, many smaller altcoins and meme tokens failed to recover after the last crypto winter, reinforcing concerns about volatility driven largely by sentiment rather than fundamentals.

Against that backdrop, market attention has increasingly shifted toward AI-focused companies with tangible products, recurring revenue models, and exposure to long-term technological adoption. Among the names drawing interest are SoundHound AI, Lemonade, and CoreWeave, each operating in distinct segments of the AI economy but sharing high-growth profiles and elevated risk.

SoundHound AI

SoundHound AI (NASDAQ: SOUN) specializes in voice and audio recognition technology, offering tools that enable businesses to build customized conversational AI systems without handing sensitive data to large platform providers. While its consumer-facing music recognition app remains widely known, the company’s primary growth engine is its developer platform, which is used across industries ranging from automotive to food service and financial services.

The company has expanded through acquisitions and partnerships with major brands, positioning itself as an independent alternative in the rapidly growing voice AI market. Analysts project revenue growth of roughly 30 percent annually through 2027, with profitability expected to improve as scale increases.

Lemonade

Lemonade (NYSE: LMND) represents a different AI application altogether, using automation and machine learning to streamline insurance underwriting, onboarding, and claims processing. By replacing traditional agents with AI-driven systems, the company has built a reputation among younger customers for simplicity and speed. Its customer base has nearly tripled since 2020, supported by expansion into pet, auto, and international insurance markets. Analysts expect Lemonade’s revenue growth to accelerate through 2027 as its newer product lines mature and operational efficiency improves.

CoreWeave

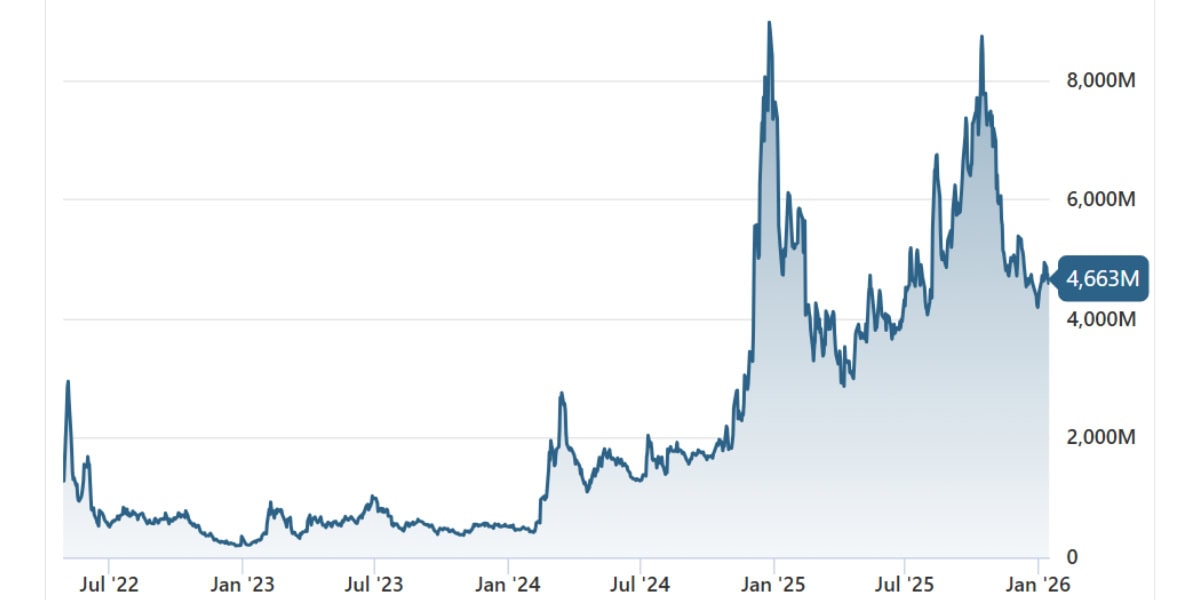

CoreWeave, meanwhile, has emerged as one of the most aggressive infrastructure plays in the AI sector. Originally a cryptocurrency mining operation, the company pivoted after the 2018 crypto downturn and repurposed its GPU assets to support machine learning workloads. Since then, it has scaled rapidly, expanding from a handful of data centers to dozens and securing major enterprise customers seeking high-performance AI computing without building their own infrastructure. With demand for GPU capacity surging, analysts forecast extremely high revenue growth over the next two years, albeit alongside significant capital expenditures.

While each of these companies carries elevated risk and premium valuations, investors increasingly view them as alternatives to speculative crypto assets that lack clear cash flows or business models. The broader shift underscores a changing appetite among growth investors, who appear more willing to tolerate volatility when it is anchored to expanding AI adoption rather than purely market-driven token cycles.

As AI continues to reshape industries from cloud computing to consumer services, these companies sit at the intersection of innovation and risk, offering exposure to the sector’s upside while testing investors’ conviction in the long-term economics of artificial intelligence.

3 min read

3 min read