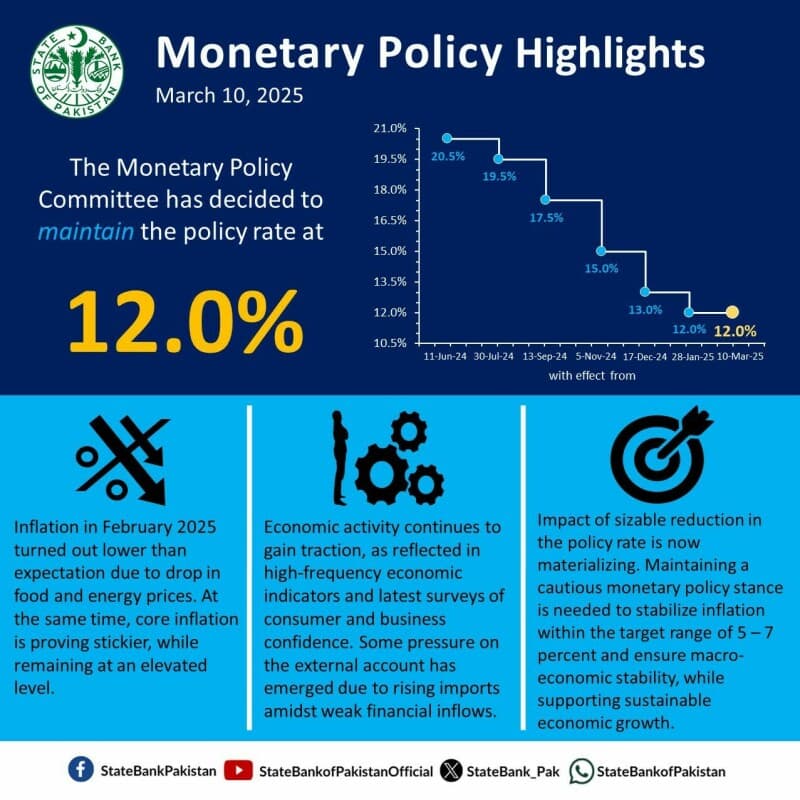

Defying market expectations, the Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) has opted to maintain the policy rate at 12%, citing the need for a cautious approach amid evolving economic conditions.

“At its meeting today, the MPC decided to keep the policy rate unchanged at 12 percent,” the committee said in a statement.

The decision comes despite a lower-than-expected inflation rate in February 2025, primarily due to a decline in food and energy prices. The committee recognised the potential risks associated with natural market price fluctuations, as their volatility could potentially impede the ongoing decline in inflation. Due to the propensity for inflation statistics to increase as a result of increasing food and energy prices, a stable core inflation pattern is of great concern.

Multiple economic data demonstrate that the economic stimulus impact becomes greater with each passing month. Foreign exchange dynamics are in distress as a result of low financial inflows and growing domestic imports. “On balance, the MPC assessed the current real interest rate to be adequately positive on a forward-looking basis to sustain the ongoing macroeconomic stability,” the statement added.

Economic Context and Market Expectations

The decision to maintain the policy rate follows the MPC’s previous move on January 27, when it reduced the key rate by 100 basis points (bps) to 12%. Market analysts anticipated that the SBP would prolong its monetary easing cycle due to the consistent indications of a decline in inflation.

Market consultants anticipated a 50 basis point decrease in interest rates, while others anticipated a total of 100 basis points in reductions. A small number of analysts predicted that the SBP would maintain its policy rate in light of the ongoing IMF review and rupee currency devaluation.

Key Economic Indicators

Numerous significant economic developments have transpired since the most recent MPC meeting:

- The current account balance experienced a shift in January 2025, from a surplus of $0.4 billion to a deficit, despite the fact that it had sustained a surplus for numerous previous months. The SBP’s foreign exchange reserves experienced a decline as a result of continuous debt repayments and weak financial inflows.

- Despite a significant month-over-month increase of 19.1% in December 2024, large-scale manufacturing output encountered a decline at the start of FY25.

- In both January and February, there was a substantial increase in tax revenue shortfalls from the previous month to the current month.

- Latest surveys indicate that consumer confidence has increased in tandem with business confidence.

The MPC emphasized that the impact of earlier monetary easing is now materializing. It reiterated the importance of a cautious monetary policy stance to keep inflation within the target range of 5-7% and emphasized the need for structural reforms to achieve sustainable economic growth.

Inflation Trends and Outlook

The positive supply-side factors contributed to the 1.5% year-over-year headline inflation rate in February 2025, which was lower than the 2.4% rate in January 2025. The prices of perishable food experienced a significant decline, while major non-perishable products were adequately stocked and energy prices remained stable as a result of the lower global oil prices.

However, core inflation remains elevated and stickier than expected. The target range will be achieved through gradual stabilisation, as inflation will exhibit a decreasing trend in the months ahead. Variations in food costs and changes in energy expenses, as well as new taxation policies and volatile world commodity prices, continue to be significant hazards.

External Account and Fiscal Position

Pakistan’s foreign exchange reserves, which reached $11.25 billion on February 28, experienced minimal growth, totalling $27 million, as the external financial situation continues to be a source of concern. Commercial banks maintained $4.62 billion of the total liquid foreign reserves in Pakistan, which amounted to $15.87 billion.

“While import volumes have been rising consistently in line with the pickup in economic activity, the uptick in some global commodity prices further pushed up import payments in January,” the statement noted. However, strong workers’ remittances and moderate export growth helped mitigate some of the pressure.

In the first half of FY25, the government achieved a moderate fiscal improvement as a result of the authorities’ effective management of their subsidy program and other expenditures, as well as an increase in non-tax revenue. The situation is still being impacted by a concerning increase in the tax collection deficiency of the Federal Board of Revenue (FBR).

Future Economic Prospects

The economic conditions are improving, as evidenced by high-frequency economic indicators such as automobile sales, import figures, private sector credit data, and Purchasing Managers’ Index assessments. The MPC anticipates that real GDP growth will accelerate in the latter half of FY25, while maintaining its current growth forecast. Economic growth recovery is anticipated by committee members due to enhanced financial stability, despite a 1.9% decline in large-scale manufacturing during the first half of FY25.

Experts disagree on the SBP’s future monetary policy decision, with some predicting a reduction in interest rates to 10.5-11% by mid-2025 and others cautioning against inflationary expectations.

5 min read

5 min read