ISLAMABAD: A multi-pronged inquiry by TechJuice, corroborated by market sources and industry data, reveals that Sparx Smartphones, a brand under Deploy Group faces deepening operational challenges in Pakistan and may be scaling back or exiting the market altogether.

Stalled Product Pipeline

Sparx’s most recent flagship device launch was the Edge 20 in February 2025, introduced with significant fanfare and a high-profile endorsement by Mahira Khan. Despite aggressive marketing, industry feedback suggests the Edge 20 failed to achieve projected sales volumes. Subsequent absence of any newer model announcements implies R&D or supply-chain constraints hindering Sparx’s ability to refresh its portfolio.

Social Media Silence and Marketing Freeze

Analysis of Sparx’s official social media channels indicates no new posts since mid-May 2025, with the latest content only focused on older models. Such prolonged inactivity on platforms typically used for product launches and customer engagement signals a halt in marketing efforts, undermining brand visibility at a time when competitors maintain regular outreach and newer mobile launches.

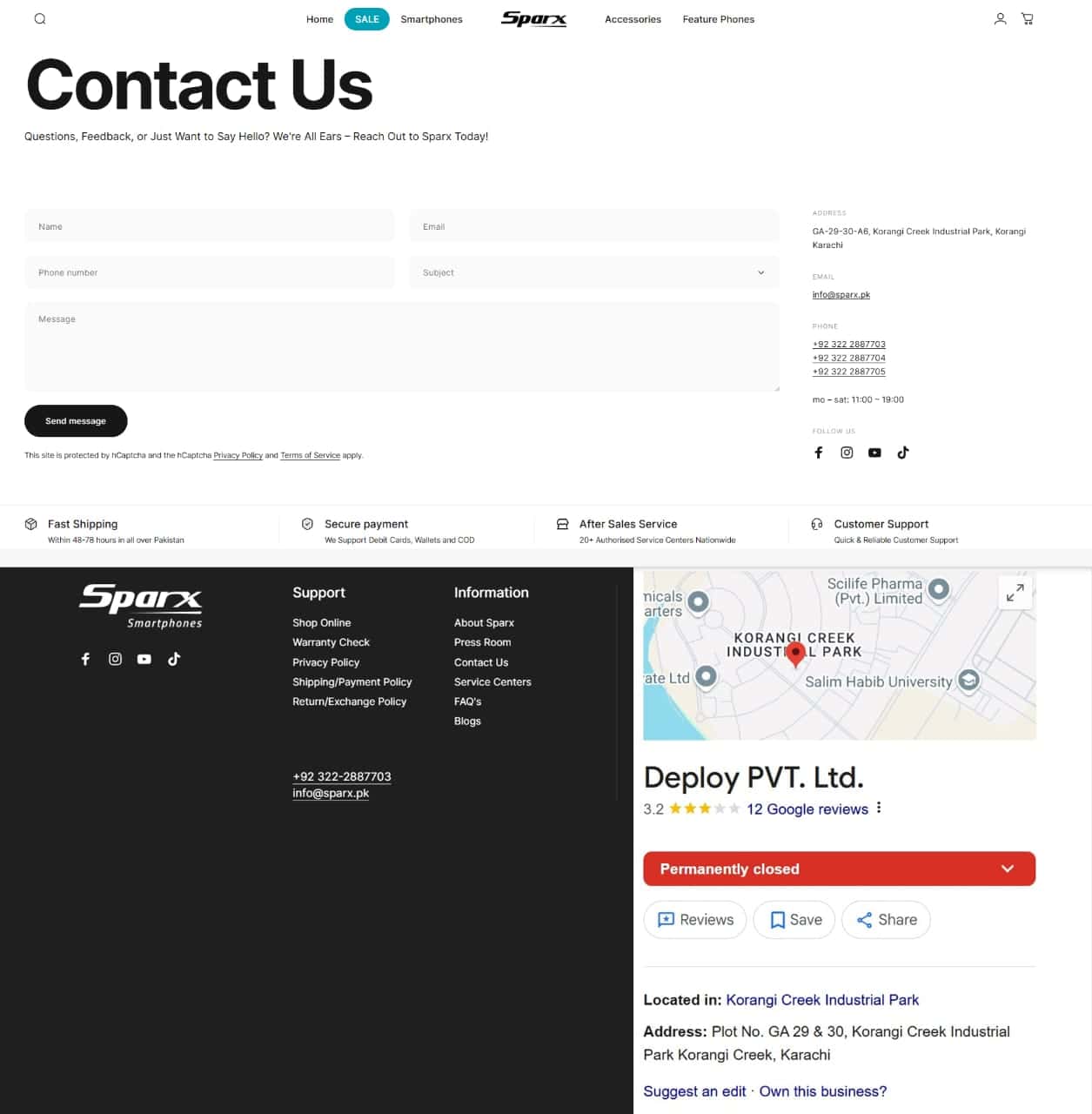

Physical Footprint and Office Status

Deploy Group’s listed Karachi office address for Sparx appears vacated. Independent inquiries at the location indicate the premises have been taken over by an unrelated smartphone assembler. While Deploy Group has not publicly confirmed a relocation or sale of property, the new owner of the compound, confirmed this development.

Import Data and Inventory Movements

According to proprietary import data accessed by TechJuice, Sparx (and associated entities such as Deploy or Brand X) recorded negligible imports of handset components for May and June 2025; April 2025 saw only approximately 4,000 units of components cleared, insufficient for large-scale production or replenishment of inventory. Dealers report bulk offloading of existing stock at steep discounts to minimize losses, consistent with pre-exit clearance behavior in consumer electronics.

Dealer Relations and Reputational Incidents

Earlier TechJuice reporting detailed serious reputational damage when two Sparx dealers “vanished” during a Europe trip organized by the company, prompting investigations and raising questions about corporate oversight and ethics. Separately, multiple dealers have complained of unresolved warranty claims, scarce spare parts, and lack of after-sales support issues that erode consumer trust and dealer confidence. Sources indicate some dealers have begun distancing themselves from Sparx, citing repeated failures in service delivery.

A user out of many wrote on a social media platform, “Don’t buy a Sparx mobile. It’s been two months, my mobile has been at the Sparx warranty center for a fingerprint issue, but it still hasn’t been returned. They don’t even have the spare parts. Bad phone, bad service, not corporate.”

Company Response

TechJuice reached out to Zeeshan Qureshi, CEO of Sparx Smartphones/Deploy Group. Qureshi rejected claims of winding down operations, assured to address shared questions and referred queries to the Pakistan Mobile Phone Association (PMPA), implying Sparx remains active.

Interestingly, PMPA officials confirmed to TechJuice that Deploy Group or Sparx Phones are not registered members, and thus cannot claim endorsement or assistance from the association. Following these exchanges, TechJuice received a legal notice on probing the matter from Sparx leadership but no substantive evidence was provided to demonstrate ongoing production, shipment volumes, or membership in industry bodies.

Pakistan’s mobile device manufacturing/assembly sector has grown substantially, meeting an estimated 95% of domestic handset demand through local assembly in 2024. However, policy shifts, taxation pressures, and fierce competition from global brands assembled locally pose challenges.

Implications for Consumers and Dealers

Should Sparx indeed wind down its Pakistan operations, existing device owners may encounter difficulties obtaining warranty repairs, spare parts, or software updates. Dealers risk residual stock losses and erosion of consumer trust in smaller local brands.

Industry stakeholders suggest that PMPA and relevant authorities could institute mechanisms requiring clearer disclosures from local brands on membership status, operational health, and after-sales support guarantees. This could include mandatory notification periods or escrow-based warranties to protect consumers if a brand exits the market abruptly.

Converging indicators, product pipeline freeze post-March 2025, social media silence since mid-May, minimal import activity, vacated office premises, non-membership in industry association, dealer clearances at discounted rates, and prior reputational incidents, collectively point toward Sparx Smartphones retrenching or ceasing Pakistan operations.

While company leadership formally disputes these claims, absence of verifiable evidence and mounting market signals suggest significant operational contraction.

4 min read

4 min read