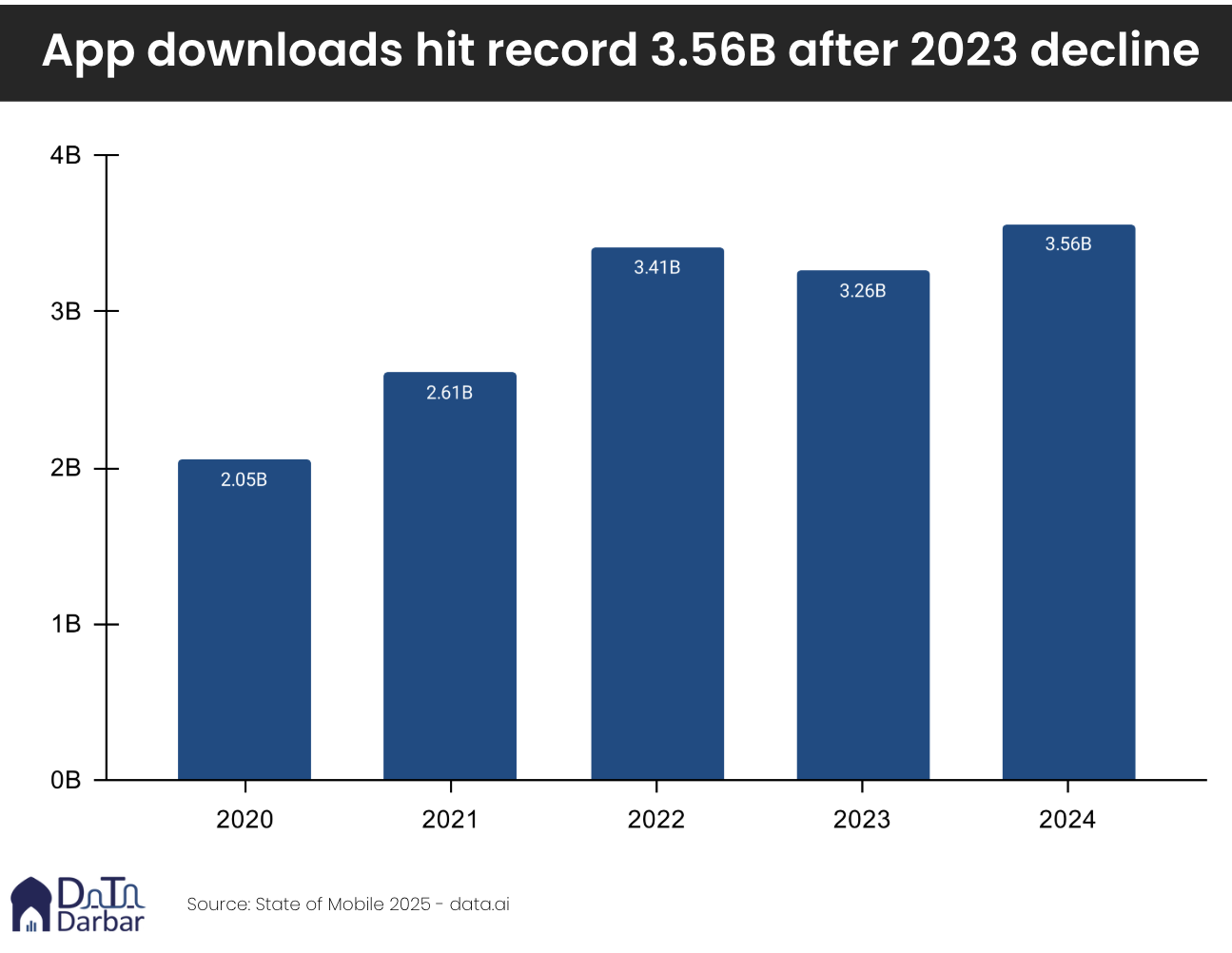

Pakistan saw its mobile app market grow significantly in 2024, with 3.56 billion downloads. Globally, the mobile app industry continue expanding with 136bn downloads and $150bn in consumer spending. Which means Pakistan is taking up 2.62% of the global pie share.

This revelation comes from Pakistan State of Apps 2024 report from Data Darbar. 3+ billion downloads is a number which is 9.2% increase over the previous year in terms of usage, propelling the country into the top 10 global markets by download volume.

But alongside rising consumption lies a dark reality not many talk about. The local app development has declined sharply in the meantime. According to the report, Android app releases dropped 55% to just 1,700 new titles, while the active local developer community shrank 26% to approximately 1,400 developers.

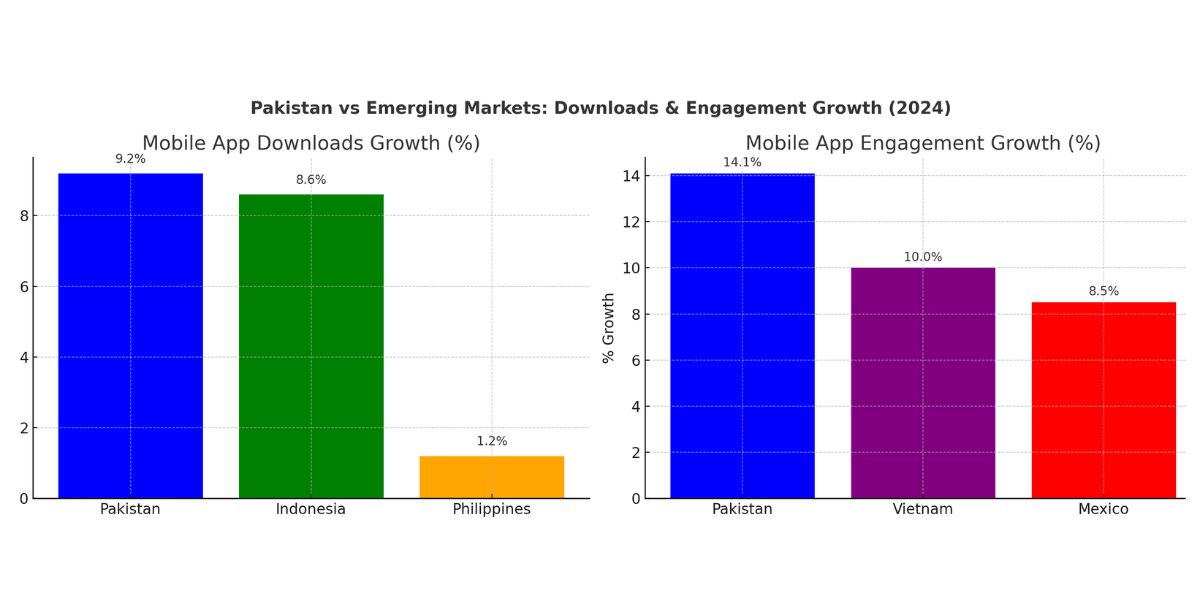

Pakistani users spent 79.1 billion hours in 2024 using mobile apps, up 14.1% year on year, the fastest engagement growth among emerging markets with similar scale. Meanwhile, mobile broadband subscriptions rose 8.4%, pushing total subscriptions to 134.8 million. Average data consumption per user climbed to 8.4 GB per month, nearly doubling levels from 2020.

On the hardware front, locally assembled smartphones surged 47%, reaching 31.38 million units and supplying 95% of the nation’s mobile demand, a clear sign that local manufacturing is catching pace with user growth.

In Pakistan, TikTok led with 32.4 million installs, followed by CapCut (27.1 million), Facebook (24.3 million), and WhatsApp (22.7 million).

Notably, Telegram nearly tripled in installs, from 4.4 million to 12 million, likely driven by increased VPN usage after the 2024 X (formerly Twitter) ban. The apps “Super VPN” and “Secure VPN” saw explosive growth of 149% and 158%, respectively.

In e-commerce, Temu emerged as a dark horse with 8 million installs in its debut year, just edging out Daraz (7.7 million). On fintech, JazzCash hit a record 19.67 million monthly active transacting users, while Easypaisa led in new installs with 12.1 million.

In the streaming sector, we see that Tamasha registered a 13.4% decline in new installs, but monthly active users climbed 61%, and its paid subscriber base surged 367%, reaching 1.35 million, a sign that monetization is catching up with reach.

Among peer nations, Pakistan’s 9.2% downloads growth outpaced Indonesia (8.6%) and the Philippines (1.2%). In engagement, its 14.1% increase led emerging markets like Vietnam and Mexico.

Yet compared to South Korea, India, and China, Pakistan remains far behind in local app origin, suggesting there is a massive gap to overcome for capacity building and ecosystem maturation.

Multiple structural and systemic factors are contributing to the sharp decline in domestic app creation in Pakistan. Stricter app store registration and approval requirements have discouraged many new entrants, while monetization challenges, particularly those tied to cross-border payments, taxation, and local regulatory friction, continue to stifle small developers.

To navigate these hurdles, many Pakistani developers are now registering their apps abroad, which reduces visibility within local app stores and skews market representation. Compounding the issue, venture funding and institutional support remain heavily concentrated, leaving most early-stage teams without the financial resources or guidance needed to sustain and scale their projects.

Interestingly, the report suggests that iOS development remained relatively stable at around 784 new apps, indicating that creators may still see better monetization pathways on Apple’s platform despite Android’s dominant market share.

3 min read

3 min read