China’s push to erode US dominance in advanced technology has moved from long-range ambition to concrete momentum, with Beijing accelerating investment across AI, robotics, and high-end semiconductor development.

Once heavily dependent on imported chips, China is now marshaling state capital, domestic champions, and a dense talent pool to narrow the gap, an effort that has already produced headline moments and serious technical progress, while exposing persistent limits and geopolitical constraints.

Big Names, Big Picture

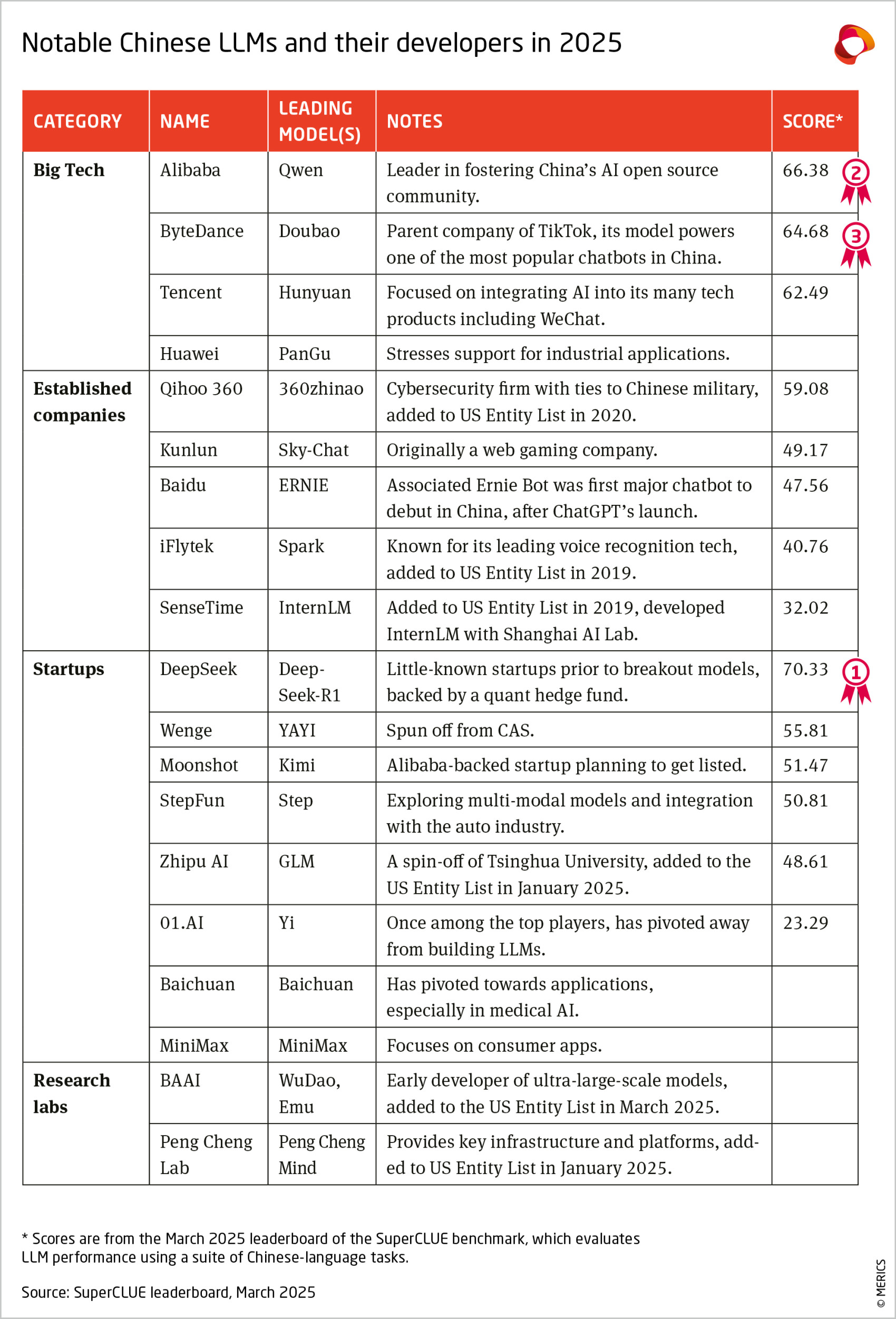

The shockwave began in 2024 when DeepSeek, a relatively unknown Chinese AI team, launched a competitive large language model at far lower apparent training cost than Western peers.

The splash helped puncture the notion that state of the art AI was solely a Silicon Valley preserve and briefly knocked market value off NVIDIA, triggering new urgency in both private and public circles.

Independent reporting showed DeepSeek’s arrival created immediate market ripples and a fresh sense that alternative development pathways were feasible.

Since then, Chinese tech titans have publicly escalated plans to domesticize the compute stack. Alibaba and Huawei have unveiled new AI chips and roadmaps explicitly framed as steps toward independence from Western suppliers. State press and corporate briefings have touted chips that claim parity with scaled-down versions of Western accelerators while promising better energy efficiency for local workloads.

Startups and specialized firms such as Cambricon, MetaX and others have seen investor interest surge on the back of domestic procurement wins and government encouragement, underlining a fast-moving industrial strategy to localize critical components.

Strategic Support, Hardware Reality

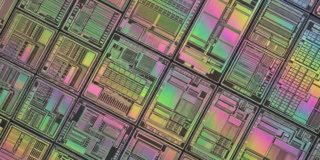

Beijing’s strategy blends direct funding, preferential procurement, and a domestic cluster effect: research labs, foundries, system integrators and cloud operators co-locate to push commercial scale. Yet there are hard, capital-intensive bottlenecks. Sophisticated fabs, EUV lithography and mature process nodes remain a hurdle; advanced tools and certain materials are still controlled by Western allies.

The US has tightened export controls on cutting edge semiconductor equipment and design IP to slow technology transfer, creating a two-front race for China, i.e., bootstrap domestic capability while circumventing limits imposed by export policy.

Market Dynamics and Continuing Ties To NVIDIA

Despite nationalism in procurement and proud local claims, many Chinese cloud and AI customers still prefer NVIDIA GPUs where available.

Reuters reporting shows that major Chinese internet firms remain eager for NVIDIA silicon even as domestic alternatives improve, illustrating that pragmatic performance needs coexist with political objectives.

NVIDIA CEO Jensen Huang said losing China’s artificial intelligence (AI) market would be a huge loss, with the market poised for significant growth in the coming years. He also talked about how the company is handling tightening export restrictions from Washington.

Chinese Tech: Where it Leads, Where it Lags

China’s strengths lie in vast markets for training data, an enormous engineering workforce, and the ability to field coordinated national programs that subsidize scale. That converts into rapid product cycles, plentiful real-world testbeds, and large domestic deployments.

On the other side, independent benchmarking is often sparse, design toolchains and IP ecosystems are still maturing, and complex workloads used in advanced analytics or unusual model architectures can reveal performance differentials versus the most advanced Western accelerators.

Geopolitics as Technology Policy

Western export controls aim to slow the transfer of the most sensitive equipment and know-how. China’s policy response has combined subsidies, talent programs, and an embrace of open other toolchains to lessen reliance on specific foreign vendors.

The result is a bifurcated global landscape where parallel ecosystems can emerge, each optimized for different regulatory regimes and market constraints. We already saw a sneak-peak of it when China came out with DeepSeek at the start of this year, leading to Trump administration banning the model.

Chinese Tech Momentum and the World in the Future

China’s momentum is real and multifaceted: government strategy, local demand, and entrepreneurial energy are all aligning toward technological self reliance. But material constraints in lithography, complex chip manufacturing, and software ecosystems remain.

The race is evolving with advance engineering and policy challenges going side-by-side. The next phase will be defined by which side converts their resources into reproducible, scalable deployments and transparent benchmarks that stand up to global scrutiny.

4 min read

4 min read