On February 17, 1874, Thomas J. Watson Sr. was born in a modest farmhouse in Campbell, New York. That same year, the world was still decades away from the company that would bear his imprint, i.e. what we know today as IBM.

The actual seeds of what became IBM were planted much later, in 1896, when Herman Hollerith founded the Tabulating Machine Company to process U.S. Census data using punched cards. By 1911, financier Charles Flint merged Hollerith’s firm with the Computing Scale Company and the International Time Recording Company to form the Computing-Tabulating-Recording Company (CTR), a holding company focused on mechanical record-keeping, time clocks, and weighing scales for businesses and governments.

In 1874, there was no IBM. The late 19th century was an era of mechanical innovation: typewriters, cash registers, and early adding machines were transforming office work. CTR’s precursor technologies addressed real industrial needs: accurate payroll, inventory tracking, and census enumeration, but they were purely electromechanical, manual-input devices with no computing power as we know it today.

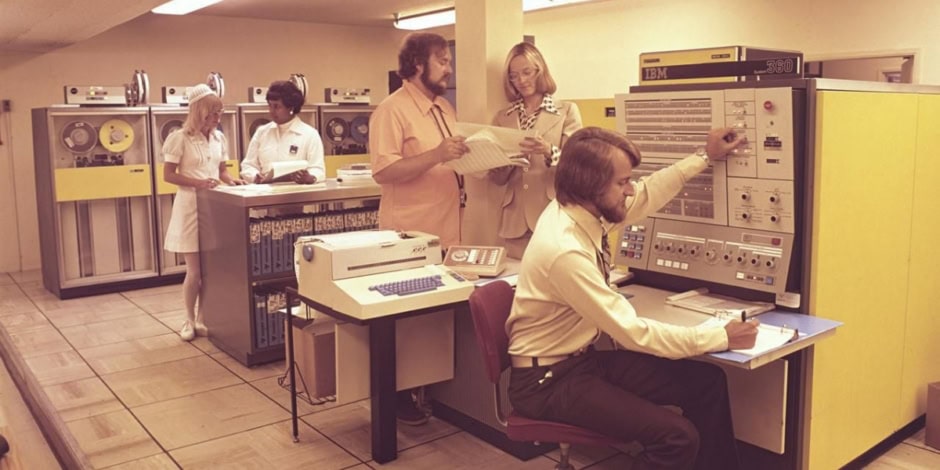

CTR (and its components) employed a few hundred people, generated modest revenues from niche markets, and operated in a pre-digital world where “data processing” meant sorting cards by hand or machine-assisted tabulation. The culture was entrepreneurial yet localized, with limited global reach.

CTR was a small, specialized manufacturer of business machines. Its flagship products included:

- Hollerith’s tabulating machines (punched-card systems for data sorting and summation).

- Time-recording clocks for factories.

- Computing scales for weighing and pricing goods.

Revenue was in the low millions annually, workforce under 1,000, and operations confined mostly to the U.S. The company relied on mechanical precision, human operators, and direct sales to enterprises and governments.

Fast-forward 152 years from Watson’s birth, and IBM has transformed into a $250+ billion market-cap global tech leader (stock price ~$262 as of mid-February 2026). The company reported full-year 2025 revenue of $67.5 billion (up 8% YoY, or 6% constant currency), with Q4 2025 hitting $19.7 billion (up 12%). It employs approximately 288,000 people worldwide (down from peak levels due to strategic restructuring but still massive). Free cash flow reached $14.7 billion in 2025, with guidance for >5% constant-currency revenue growth and ~$1B more FCF in 2026.

IBM’s portfolio is now dominated by high-margin software and services:

- Hybrid cloud (powered by Red Hat OpenShift): the fastest-growing segment, up double-digits in 2025.

- watsonx AI platform: generative AI book of business exceeded $12.5 billion, with watsonx orchestrating models, data governance, and agentic workflows for enterprises.

- Infrastructure including next-gen mainframes (z17) that run AI workloads natively and hybrid setups.

- Consulting, automation, and quantum computing (IBM Quantum remains a leader in useful qubits).

The culture has evolved from Watson’s hierarchical, “THINK”-driven sales machine to agile, open-source-friendly, and AI-focused. Acquisitions like Red Hat (2019) and HashiCorp (2024) fuel multi-cloud openness. IBM positions itself as “Client Zero” for AI, using watsonx internally—and emphasizes ethical, governed innovation for regulated industries.

.png)

In the CTR days, IBM’s ancestors sold mechanical tools for manual data crunching in isolated offices. Today, IBM delivers intelligent, scalable infrastructure that powers global enterprises in real time across clouds, with AI reasoning at the core. From punched cards to watsonx agents, the throughline is enterprise trust: solving mission-critical problems with reliability. Watson Sr. would recognize the customer obsession and long-term thinking, but marvel at how far his “THINK” ethos has scaled in a digital, AI-driven world.

On its founders 152nd birth anniversary, IBM stands as proof that enduring companies adapt boldly while preserving core values, evolving from mechanical tabulators to the backbone of modern hybrid cloud and trusted AI.