Payment systems in Pakistan have shown significant growth in 2016 by using digital transaction channels, State Bank of Pakistan (SBP) has stated in a Press Release.

SBP listed the facts and figures of Financial Year 2016 in the latest press release. SBP also mentioned that Real-time Gross settlement (RTGS) has increased to 29% in value from Financial Year 2015. The use of electronic and digital technology in making transactions is in line with SBP’s mission of promoting digital payments in Pakistan.

The volume of paper-based transactions has decreased significantly and e-banking is slowly replacing it. E-banking transactions have increased by 16% in volume and 4% in value, as compared to FY15. E-banking is an electronic payment system in which customers can make transactions like withdrawals, transfer of funds, bill payments etc., using mobile and the internet.

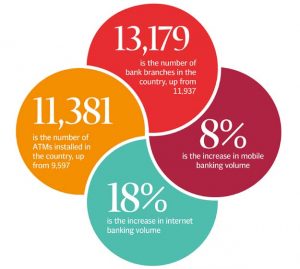

The use of Alternate Delivery Channels (ADCs) like ATMs, Point of Sale (POS) terminals, internet and mobile banking also showed rising trends. The internet and mobile banking increased by 18% and 8% in value respectively, as compared to 2015. It states

“Payment System infrastructure also showed phenomenal growth during the period under review. The number of branches increased from 11,937 to 13,179 whereas total number of ATMs installed in the country increased from 9,597 to 11,381 during the year.”

SBP functions as the central bank of Pakistan and it regulates the monetary and credit system. It works on the expansion of financial infrastructure by incorporating digital technology like cards, wallets, ATMs, POS, gateways, mobile and internet. It also ensures the security of the payments and transactions.

The Internet of Things could revitalize Pakistan’s IT Industry

The Internet of Things could revitalize Pakistan’s IT Industry