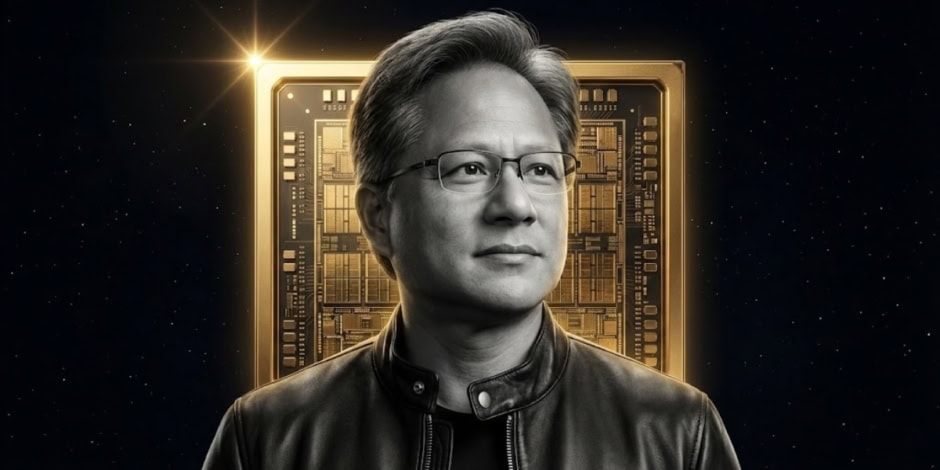

NVIDIA CEO Jensen Huang gave a reality check on the state of artificial intelligence, saying that the so-called “God AI” is a possibility on a “biblical or galactic” timeline. In AI lingo, a “God AI” can be an all-encompassing artificial intelligence capable of mastering language, biology, physics and more. However, he was not hyping up that possibility unlike many other AI moguls.

Huang, who has led NVIDIA since its founding and helped steer the company to become the first to surpass a $5 trillion market valuation, emphasized that current AI systems fall far short of the omnipotent vision many in tech and the media often invoke.

“I don’t see any researchers having any reasonable ability to create God AI,” he said, noting that while someday such a system might exist, it is not imminent and likely not on any near-term roadmap. ” And I don’t think any company practically believes they’re anywhere near God AI. And nor do I see any researchers having any reasonable ability to create God AI… I guess someday we will have God AI… We need to be super careful with AI. Potentially more dangerous than nukes…”

NVIDIA has long been at the heart of the AI boom due to its dominance in GPUs and data center infrastructure, but Huang’s remarks stand out amid a broader industry narrative that sometimes borders on hype. Rather than focusing on distant, speculative milestones, he urged attention on practical applications of AI today that create demonstrable value for businesses and society now.

Huang’s remarks also pushed back against what he described elsewhere as harmful “doomer narratives,” predictions of catastrophic outcomes driven by apocalyptic visions of AI gone wrong. He suggested that overly negative portrayals can damage public understanding, hinder constructive regulation, and dissuade meaningful innovation, even as legitimate concerns around safety and governance remain part of the conversation. These remarks may come as a shock to many as Musk and Altman have always been vocal on the singularity. Even NVIDIA has always been hyping up the “point of no return,” until recently. This shift in stance might come as a result of share price fluctuations.

To give you some context, NVIDIA’s valuation skyrocketed past the $4 trillion mark in early July last year, and by the end of October, it even reached the impressive $5 trillion milestone during an incredible rally.

However, in the last three months, the stock has dipped by 1%, wrapping up the year with a solid 40% increase in value.

Huang’s remarks may also be a result of a period of intense public debate over the trajectory of AI. As companies expand investment in machine learning, autonomous systems, and intelligent automation, investors and regulators alike are grappling with how to balance innovation with safeguards.

Despite the stock market hype, a fully mobilized, all-knowing AI is not an imminent threat, however, it is unlikely to go anywhere anytime soon.