Remember when Elon Musk dropped his bombshell in 2023, predicting that paid subscriptions would soon dominate social media by weeding out bots and ensuring authentic interactions in an increasingly AI-saturated world?

At the time, it felt like classic Musk bravado, and a prediction that hardly ever comes true. Yet here we are in late January 2026, and the tide has undeniably turned towards a future that is more favorable to paid social media.

Subscriptions have been quietly replacing free access or purchase access for some years now, but they have come out of the niche corners. They’re evolving into legitimate revenue boosters and user upgrades, with platforms layering on verified badges, ad reductions, AI tools, exclusive perks, and creator monetization. In a world of bot fatigue, privacy concerns, and creator economy demands, paying a few bucks a month for a cleaner, more powerful experience is starting to feel less like a tax and more like a smart choice.

Apps Working With A Paid Tier in the Market

X Premium (the rebranded Twitter Blue) has climbed to an estimated 15.3 million subscribers as of early 2026, i.e., up from around 13 million in 2024 and showing steady gains despite early skepticism. Retention hovers around 82%, far higher than free users, thanks to perks like edit buttons, longer posts (up to 25,000 characters), prioritized replies/searches, reduced ads (on higher tiers), undo posts, and creator revenue sharing from ad impressions in replies. Even with controversies over verification losing its prestige, the model has stabilized and grown, especially post-2025 discounts and gifting options that spiked numbers.

Meta is doubling down aggressively. Meta Verified, aimed at creators and businesses on Instagram, Facebook, and Threads, offers blue badges, impersonation protection, priority 24/7 support, search boosts, and more, starting at ~$11.99/month (web) or $14.99 (app), with tiered plans up to $499.99 for Max-level extras. But it is not where the social media giant sees the line. Meta is reportedly working on a separate subscription tier that offers exclusive AI usage for creators across the plethora of apps it owns. These tiers target everyday users with productivity boosts, advanced AI features (like expanded access to Vibes for AI short-form video creation/remixing), better audience insights, anonymous Story viewing, unlimited follower segmentation, and non-reciprocal follow detection. So, it means that all the core feeds stay free, but these add-ons appeal to frustrated power users tired of ads, limited tools, or content overload. It’s a savvy move as ad revenue pressures from privacy changes and competition—building on Verified’s estimated millions of subscribers (around 7 million as of mid-2025) to diversify income.

Snapchat+ quietly proves the model works for younger crowds, surpassing 16 million subscribers by early 2026 (doubling from earlier years). At ~$3.99/month, it delivers exclusive lenses, custom app icons, priority support, and fun extras, proving Gen Z and Millennials will pay for playful, personalized tweaks without feeling nickel-and-dimed.

YouTube Premium remains the heavyweight champion, crossing 125 million subscribers globally (including trials) by March 2025 and holding strong into 2026. Bundling ad-free videos, offline downloads, background play, and YouTube Music, it’s a no-brainer for heavy viewers. YouTube is now testing lighter “Premium Lite” tiers in more markets for budget users who want basics without the full bundle.

TikTok’s approach stays creator-centric: Subscriptions (expanded from LIVE-focused to general in 2024–2025) let eligible creators (18+, 10K followers, 100K views in past year/month) charge monthly for exclusive posts, badges, subscriber-only chats, perks, and community features. Creators earn 70% revenue share (up to 90% with bonuses for high engagement), with options for custom perks like shoutouts or Discord roles. It’s not a broad user subscription yet, but it fuels the creator economy while complementing gifts, Shop, and the improved Creator Rewards Program (better payouts for longer videos and search-based discovery).

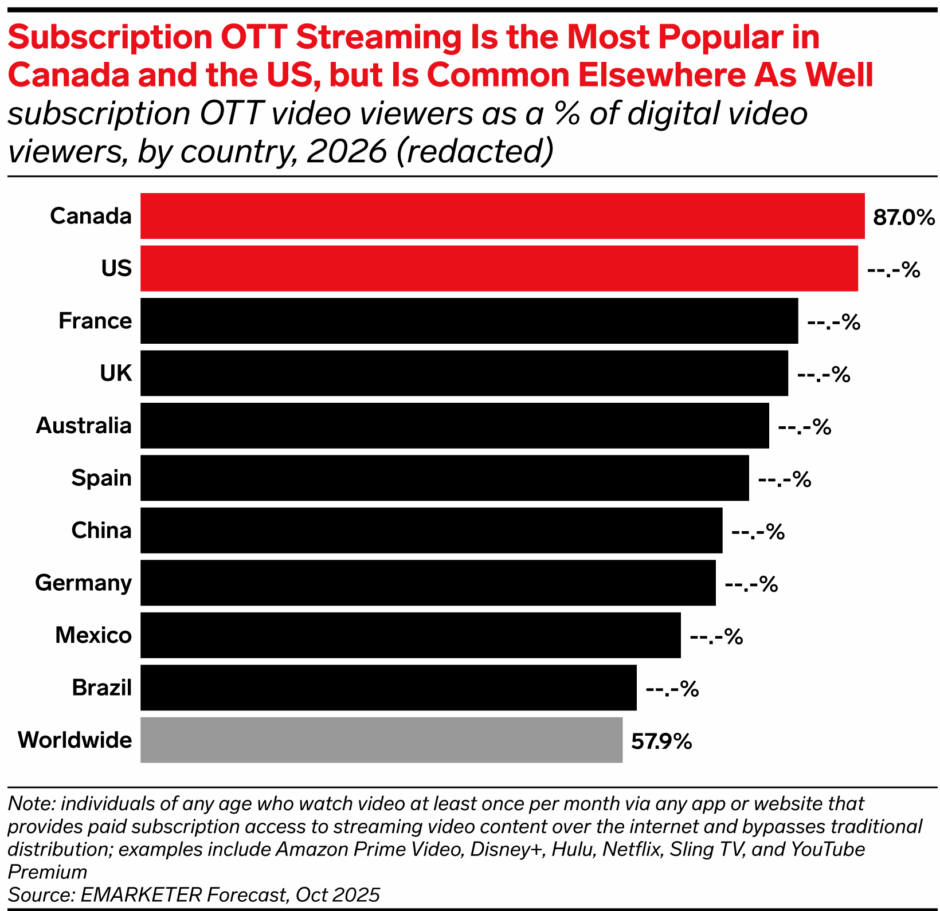

Looking at all this change begs the question why the sudden mainstream vibe shift in 2026? One of the main reason could be bot and spam overload. A paid barrier will appeal for a more “real” engagement experience. The creator economy craves direct support and visibility boosts, and since people are already familiar with paid subscription models such as those offered by Netflix, Spotify, ChatGPT Plus, a paid social media access would not be so foreign an idea to grasp.

In the US alone, social commerce is exploding (sales past $100B), short-form video dominates, and platforms face ad revenue squeezes from privacy regs. Subscriptions supplement ads, not supplant them, gating “nice-to-haves” like AI tools, ad relief, or exclusivity while free tiers drive massive scale.

Do People Want A Paid Internet?

People have pretty mixed feelings about a paid internet, no matter if it’s subscriptions for social media perks, premium app features, or broader paywalls on content. Some users embrace it when the value feels real: Snapchat+ has quietly pulled in over 16 million subscribers who love the exclusive lenses, custom icons, and priority support for just a few bucks a month, seeing it as fun extras worth paying for. In a Harvard Business study in 2023, the respondents answered in significant rank order of likelihood of buying a subscription: with Snapchat receiving the highest score (7.27) followed by Instagram (7.21), Facebook (7.16), and Twitter (7.14).

Meta’s recent tests for premium tiers on Instagram, Facebook, and WhatsApp are getting cautious optimism from power users excited about AI tools, anonymous Story views, and better privacy controls, with Meta promising to tweak based on feedback.

According to the Harvard study:

Instagram is the social media service that has the highest expectations among users for its subscription service, with accompanying high perceived quality and high user satisfaction (Instagram’s customer satisfaction is about the same as it is for Snapchat). Twitter and Snapchat lead in terms of the perceived value that their subscription services offer at this early stage of rolling them out in the marketplace. Snapchat has the most loyal potential pay-for-service users in that they are the most likely to adopt the Snapchat Plus service (which has also been available longer and at a lower price than subscriptions from Twitter, Facebook, and Instagram). Younger social media users (< 35 years), college-educated users, and politically conservative users each have higher expectations; perceive a higher quality, value, and potential satisfaction; and are the most likely to purchase subscription services to Twitter, Facebook, Instagram, and Snapchat.

X Premium (formerly Twitter Blue) has grown steadily into the millions, with creators and businesses appreciating the algorithmic boosts (30–40% higher reply visibility in some reports), edit buttons, and monetization perks that make it feel like a legit tool rather than a vanity buy.

However, pushback is loud and common, especially when it feels forced or unfair. Early Twitter Blue rollouts sparked massive backlash. Celebrities like Stephen King and LeBron James publicly refused to pay for blue checks, calling it extortion or a downgrade of verification’s meaning, while everyday users flooded replies with “this m*f* paid for Twitter” mockery.

Many saw in developing countries such as Pakistan see it as devaluing free expression or amplifying paid voices over organic ones. Broader paywalls on news sites or the web trigger even stronger frustration. Folks complain it locks away information behind money, fueling misinformation as people flock to free (often low-quality) alternatives, widens inequality for lower-income users, and turns the “open” internet into a dysfunctional mess of dead-end links and pop-ups. Critics argue it erodes freedom of information and press access, with some saying it dooms quality content while bad actors thrive unchecked for free.

7 min read

7 min read