A weakening dollar could give BTC price a boost in the coming months and could reach 25,000 Dollars in upcoming March. Federal Reserve will stop raising interest rates over lowering inflation. Some 18% considered a world recession “extremely likely” more than twice as many as in the previous survey conducted in September 2022.

Black History San Antonio – Organizers spent the weekend preparing for San Antonio’s annual Martin Luther King, Jr.Prices are seen rising by about 5% this year, after climbing 11% in 2022, which itself was a slowdown from a 21% increase in 2021, Richard Waind, group managing director of Better homes, told Reuters.

The two assets have moved inversely to each another mostly since March 2020.As of Jan.“The current high inflation, low growth, high debt, and high fragmentation environment reduces incentives for the investments needed to get back to growth and raise living standards for the world’s most vulnerable,” WEF Managing Director Saadia Zahidi said in a statement accompanying the survey results.16, the daily correlation coefficient between Bitcoin and the U. Commission held an in-person march.

The survey comes after the World Bank last week slashed its 2023 growth forecasts to levels close to recession for many countries as the impact of central bank rate hikes intensifies, Russia’s war in Ukraine continues, and the world’s major economic engines sputter. the dollar index (DXY), a barometer to gauge the greenback’s strength versus top rivaling currencies, was -0.S.

83, according to TradingView.On inflation, the WEF survey saw large regional variations: the proportion expecting high inflation in 2023 ranged from just 5% for China to 57% for Europe, where the impact of last year’s rise in energy prices has spread to the wider economy. In September 2022, the San Antonio City Council awarded the MLK commission of $300,000 for related initiatives.

BTC/USD and DXY correlation coefficient.Source: TradingView A traditional technical setup sees more losses for the dollar ahead. Other main findings of the survey included. Nine out of 10 respondents expect both weak demand and high borrowing costs to weigh on firms, with more than 60% also pointing to higher input costs.

Dubbed the ” the setup appears when an asset’s 50-period moving average crosses below its 200-period moving average.” Robinson says “diversity” is the key part that makes San Antonio’s event stand out from others across the country. For the dollar, the death cross shows its weakening momentum, meaning its short-term trend has been underperforming its long-term direction. Reporting by Mark John; Editing by Alexander Smith Our Standards. Buyers from Pakistan were sixth, Lebanon seventh, China eighth, the United States and Canada ninth, and Kyrgyzstan 10th, Betterhomes said in a report.

DXY daily price chart.Source: TradingView “Expecting more downside in the mid to long term,” independent market analyst Crypto Ed said about the dollar, adding: “Risk on assets should bounce more on that. The march will start at the Dr.Or better said: I expect BTC to break its bearish cycle as the big run in DXY is finito.”

Not a long-term Bitcoin price rally Bitcoin has risen 30% above $20,000 in 2023 so far. But on-chain data shows that the buying trend lacks support from institutional investors.m.Concerns of oversupply have long plagued the sector which saw a property bubble burst in 2009-2010, causing prices to plunge by more than half.

Related: For instance, the total amount of Bitcoin held by digital assets holdings such as trusts, ETFs, and funds has been declining during the coin’s price increase in recent months, according to CryptoQuant’s Fund Holdings index. Bitcoin fund holdings.

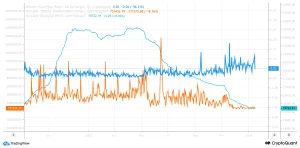

In addition, no unusual transactions occurred on-chain but on crypto exchanges, per the comparisons made between CryptoQuant’s Token Transferred and Fund Flow Ratio metrics. Related Copyright 2023 by KSAT. All rights reserved. BTC/USD versus Token Transferred (orange) and Fund Flow Ratio (blue).Source: CryptoQuant The Token Transferred metric shows the number of coins transferred in a specific timeframe.

While the Fund Flow Ratio represents the ratio of coin transfers involving the exchange to the overall coin transfers network-wide.She previously worked in the Rio Grande Valley at KGBT, KRGV, and Azteca Valle.” Usually at the bottom, institutional investors want to buy quietly through OTC trading,” noted a market analyst.

MAC_D, adding: “This trading was simply actively traded only on the exchange, and no unusual transactions occurred on the on-chain. The current institutional investors have remained calm and just watching OTC trading will be brisk when they expect a full-fledged uptrend turn.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their research when making a decision.

Read More:

5 Easiest Online Businesses To Start In 2023

5 Easiest Online Businesses To Start In 2023