Last November, Elon Musk, chief of Tesla and a rocket developer of SpaceX, became the first person in history to obtain a $300billion fortune. Elon Musk leads the product designs, global manufacturing and engineering of electric vehicles. He planned to buy Twitter and wanted to cut off 75% of its workforce.

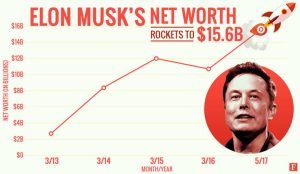

Months back, he had an affair with his employee Nicole Shanahan, Google co-founder Sergey Brin’s soon-to-be ex-wife. However, Musk denied having an affair. On November 4 2021, Musk faced a significant fall of nearly 35% of his net worth. His net worth declined from $320.3 billion to $209.4 billion. The massive decline depicted a sharp drop in the price of Tesla stock. Counting to the current month alone, Musk’s net worth is down by $28 billion.

In a quarterly report presented on Wednesday, the electric vehicle maker’s revenue still fell short of some analysts’ expectations.

Matt Maley, chief market strategist at Miller Tabak + Co.states that “Elon Musk sells high-priced cars, so a recession will not be good for his business.”

As we all are familiar with the name Tesla. Elon Musk is one of the wealthiest people in the world. No matter, his fortune took such a dramatic drive. He is the richest person in the world compared with LVMH chief Bernard Arnault and Amazon founder Jeff Bezos. When he crossed Bezos’s worth last year, he cracked a joke in an email to Forbes that he is willing to send Bezos a giant statue with a digit 2.

Last year Musk sold $31 billion worth of Tesla stock to acquire Twitter and take it private. Since the deal did not get approved. Forbes counts the value from cash obtained from the sales towards his net worth. However, the investors were unhappy and said that Musk had overpaid for the social network.

The problem with the Tesla investors is that Musk is likely to sell more stock to finance the deal, Wedbush described in an email. “One of the worst overpaid M&A deals in the market history. In contrast, other investors are hopeful about Tesla’s prospects. An equity analyst Garrett Nelson, from CFRA research, says Tesla remains one of the market’s most important earnings growth stories. It will stay the same over the intermediate and the long term and will encourage by record vehicle sales.

Read more:

Liz Truss Qualifies For A Taxpayer-Funded Allowance Of $129 K A Year For Life

Liz Truss Qualifies For A Taxpayer-Funded Allowance Of $129 K A Year For Life