We recently reported that Pakistan Telecommunication Authority’s (PTA) Device Identification Registration & Blocking System (DIRBS), which is responsible for verifying IMEI of mobile phones before Federal Board of Revenue (FBR) estimates the custom duty/tax charged on a phone, must be malfunctioning. In some unfavorable scenarios for mobile phone users, FBR is charging custom duty 15 times the cost of the actual phone because PTA’s device identification system probably identified a duplicate or reprogrammed IMEI number of a high-end phone.

Many local media outlets including Pakistan Today and City 42 have reported a shocking turn of events where low-end mobile phone users were charged with up-to PKR 60,000/- custom duty/tax for a phone that costs no more than PKR 4,000.

See Also: PTA barred from blocking unregistered phones for the next three months

In this regard, we have received a clarification from PTA on why people are being charged with enormous custom duties even on their low-end phones. PTA has argued that it is not responsible “for taxes/duties calculation on mobile device registration. PTA is only responsible for checking the IMEI of mobile devices to ensure that it is valid, and not a duplicate or reported stolen. The custom duties/tax calculation of mobile device being registered is determined by the Federal Board of Revenue (FBR).”

This means that FBR has the final authority to estimate custom duty on a mobile phone’s IMEI validated by PTA. The clarification also added that “in certain cases of the high tax on a relatively low-end mobile device, that device had a reprogrammed IMEI belonging to high-end phone. These reprogrammed devices shall be blocked when identified.”

Now you might be thinking that it is the responsibility of PTA to identify whether your phone’s IMEI is duplicated or reprogrammed. PTA explains that it has “developed and established the DIRBS to curtail counterfeit mobile phone usage, discourage mobile phone theft, and protect consumer interest.”

See Also: Check rates of regulatory duty on mobile phones in Pakistan

To avoid any inconvenience of buying a phone with reprogrammed IMEI, the public is advised to check IMEI status of a device prior to buying/obtaining by sending each 15 digit IMEI via SMS to 8484 or visiting this link: https://dirbs.pta.gov.pk.

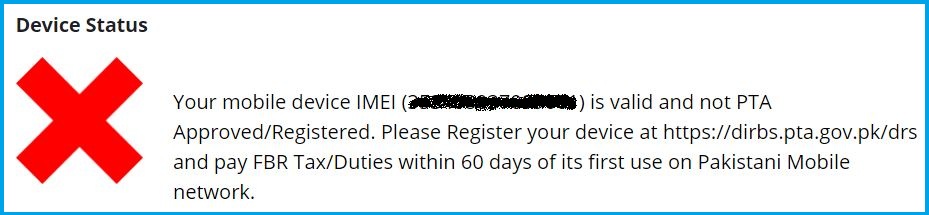

However, in some cases, it’s still quite difficult to decide whether a person with valid IMEI should pay the duty/tax or not when PTA’s website asks users to do so. For instance, look at this message;

At this point, if the PTA-issued invoice tells you to pay a whopping amount of tax/duty to get your phone PTA Approved/Register, what you are going to do?

In such cases, it is likely that mobile phone dealers of the black market may have reprogrammed this phone’s IMEI with a high-end phone or the phone you are trying to buy is GSMA-approved but it came to Pakistan via illegal means.

It must be noted that you must take precautions before buying a phone from a local vendor especially a phone whose packing doesn’t clearly state “PTA Approved”. You must verify the phone’s IMEI by visiting PTA’s website here.

Police to take strict action against hate speech preachers on social media

Police to take strict action against hate speech preachers on social media