Taxation

NBP and Commercial Banks Extend Hours on November 29 for Tax Collections

The government has directed commercial banks to remain open this Saturday, November 29, 2025, to facilitate over-the-counter payment of duties and taxes. All Saturday-opening branches, including NBP branches handling customs collections, will operate from 9:00 A.M. to 5:00 P.M. Designated…

Supreme Court Examines Legality of Super Tax on High Earners

3 min read

3 min read

The Super Tax came under legal scrutiny on Monday as senior counsel Ahmed Jamal Sukhera argued before the Supreme Court’s Constitutional Bench (CB) that the…

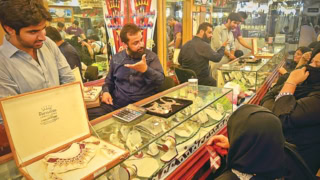

FBR Crackdown on Jewelers as 60,000 Shops Face Tax Investigation

2 min read

2 min read

The Federal Board of Revenue (FBR) has launched a major crackdown on jewelers, compiling data on more than 60,000 businesses across Pakistan to curb widespread…

FBR Goes After 100,000 Influencers Showing Off Wealth Online

2 min read

2 min read

The Federal Board of Revenue (FBR) has launched a crackdown on 100,000 influencers and wealthy individuals who are flaunting their wealth on social media platforms.…

FBR Deploys New IRIS Registry Version for Taxpayers

2 min read

2 min read

The Federal Board of Revenue (FBR) has announced the successful deployment of a new registry version on its IRIS portal, aimed at improving efficiency and…

Govt Weighs New Taxes to Fund Islamabad’s Jinnah Medical Complex

2 min read

2 min read

The federal government is weighing the option of introducing new taxes in Islamabad to meet the operational costs of the upcoming Jinnah Medical Complex and…

Punjab Announces Electricity and Tax Relief for Flood-Affected Families

2 min read

2 min read

Punjab Finance Minister Mujtaba Shuja-ur-Rehman has announced electricity bill and tax relief for flood-affected families, pledging that the provincial government will stand by them with…

FBR Launches Informational Campaign for Taxpayers

2 min read

2 min read

The Federal Board of Revenue (FBR) has announced a new awareness campaign to help taxpayers with the process of filing income tax returns. Under this…

Pakistan Post Mail Suspension Hits US-Bound Deliveries After New Taxes

2 min read

2 min read

Pakistan Post mail suspension to the United States has been confirmed after Washington introduced new taxes and duties on all categories of international shipments. Officials…

Repeat Offenders May Face FBR E-Invoicing Penalty of up to Rs3m

2 min read

2 min read

The Federal Board of Revenue (FBR) has begun enforcing its e-invoicing penalty system from September 1, 2025, with fines starting at Rs500,000 for non-compliance. The…

FBR Revenue Shortfall Hits Rs42bn in First Two Months of FY26

2 min read

2 min read

The Federal Board of Revenue (FBR) has reported a revenue shortfall of nearly Rs42 billion during the first two months of the current fiscal year,…

Govt Unveils Simplified Tax Form for Salaried Class

2 min read

2 min read

Finance Minister Muhammad Aurangzeb has announced a simplified tax form for salaried class, cutting the number of required fields from 800 to just 40 in…

Islamabad Car Token Tax to Rise Following Cabinet Decision

2 min read

2 min read

The Federal Cabinet has approved revisions to token tax rates for vehicles in Islamabad after a gap of six years. The decision is expected to…