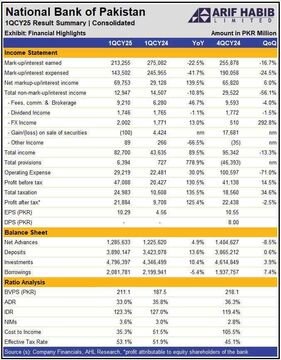

KARACHI: The National Bank of Pakistan (NBP) has posted a 125% year-on-year increase in its profit for CY25, reaching PKR 21.88 billion in Q1. While the headline growth in NBP profit CY25 looks impressive, deeper financial indicators reveal growing vulnerabilities in the bank’s core health.

The surge in profits was largely driven by a 139.5% increase in net interest income, aided by a 41.7% drop in interest expenses. This sharp margin expansion helped push NBP’s net interest margins (NIMs) to 3.6%, signaling strong pricing power and asset-liability management in a high interest rate environment.

Operating expenses saw a rare 71% QoQ drop, pushing the cost-to-income ratio down to 35.3%, which significantly padded the bottom line.

Red Flags: Provisions and Shrinking Non-Interest Income

Despite the stellar profit figure, analysts are wary of the bank’s ballooning provisions, which rose by a jaw-dropping 779% year-on-year. This signals heightened credit risk and the potential buildup of non-performing loans (NPLs). Without detailed disclosure, the sharp increase raises more questions than answers.

Further, non-mark-up income declined 56%, reflecting weak performance in foreign exchange dealings and capital gains on securities. This drop suggests reduced market activity and a lack of confidence in non-core banking operations — both critical for revenue diversification.

NBP’s deposit base expanded by 13.6% YoY, while advances grew by a modest 4.9%. The resulting Advance-to-Deposit Ratio (ADR) sits at 33%, indicating a large cushion of excess liquidity. While safe, it represents a missed opportunity to grow earnings via strategic lending.

While NBP profit CY25 makes headlines for its triple-digit growth, the real story is the pressure building underneath — rising credit risk, shrinking non-interest income, and an under-leveraged balance sheet. Sustaining this performance will depend on how effectively the bank navigates these headwinds in the quarters ahead.

2 min read

2 min read