The IC industry is currently facing an economic downturn due to dwindling demand. However, it so forecasted that things will get better in the coming months. Nvidia is the only company that has retained its position in Q1.

According to the latest statistics, the revenue for the current quarter has stayed the same compared to Q4 2022 due to the declining demand and the ongoing pre-release period.

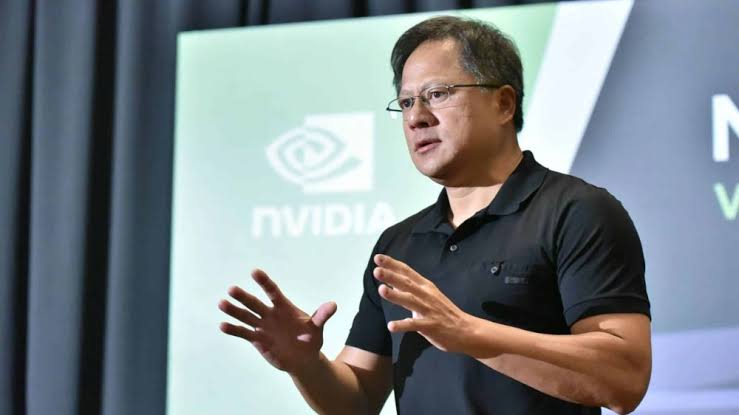

Nvidia is the only company that has reported its first-quarter earnings stronger than expected, which drove its shares up 26% in extended trading. Jensen Huang, CEO of Nvidia, states that “the company was seeing surging demand for its data center products.

Here is how the company did in its first fiscal quarter

- EPS: $1.09, adjusted, versus 92 cents expected

- Revenue: $7.19 billion, versus $6.52 billion expected

According to the company, its expected sales of about $11 billion plus or minus 2% in the current quarter, nearly 59% higher than Wall Street estimates of $7.15 billion. Just before the after-hours move, Nvidia stock was up to 109% last year in 2023, driven mainly by a positive approach from the company’s leading position in the innovation and creation of artificial intelligence chips. Nvidia CEO Jensen Huang said the company saw “surging demand” for its data center products.

According to Nvidia’s data center group, $4.28 billion in sales, versus expectations of $3.9 billion, a 14% annual increase. The company is hopeful and said the performance was driven by cloud vendor demand for its GPU chips. Another critical factor that causes the surplus is the large consumer companies that use Nvidia chips to train and deploy generative AI applications like OpenAI’s chatGPT.

Nvidia is a strong chipmaking company with its market value and firm performance in a data center. This indicates that AI chips are becoming increasingly important for cloud providers and other companies that run many servers.

Nvidia’s gaming division, which includes the company’s graphics cards for PC sales, quoted a 38% drop in revenue to $2.24 billion in sales compared to expectations of $1.98 billion.

Nvidia took responsible for the external factors and the macroeconomic environment, including the ramp-up of the company’s latest GPUs for gaming. Nvidia is constantly working to make its name in almost every new field. The company’s automotive division, including chips and software to develop self-driving cars, grew 114% every year but remains small at under $300 million in sales for the quarter.

Nvidia’s overall financial analysis states that its net quarterly income was $2.04 billion, or 82 cents a share, compared with $1.62 billion, or 64 cents, during the year-earlier period. Nvidia’s overall sales fell 13% from $8.29 billion last year.

The company not only experienced impressive financial growth, but the company’s market share also expanded, potentially positioning Nvidia to dethrone Qualcomm.

On the other hand, AMD and MediaTek faced many challenges due to inventory correction, as they faced an all-time low demand. Both companies faced a significant decline in market share and revenue, indicating a challenging business environment.

Both companies have struggled a lot to attract AI customers efficiently as Nvidia is dealing with its current portfolio.

Read more:

The Next AI Stock Are All Set To Join The $1 Trillion Club :Besides Nvidia

AI Means Everyone Can Now Become a Computer Programmer: Nvidia CEO

Iraq Is Planning To Buy Pakistan’s JF-17 Fighter Or France’s Refale Or Both

Iraq Is Planning To Buy Pakistan’s JF-17 Fighter Or France’s Refale Or Both